As the year draws to a close, Wall Street is filled with a joyful atmosphere: U.S. stocks have experienced another year of strong gains, and analysts generally expect U.S. stocks to see even more gains next year.

Morgan Stanley Similarly, they predict that the S&P 500 will rise another 13% in 2026, benefiting from strong corporate profits and a further expansion of the U.S. economic recovery.

However, anything can encounter unexpected situations and risks, and the US stock market is no exception. Morgan Stanley strategists point out that three significant unexpected events may occur next year, impacting the performance of the US stock market.

"It would be surprising if nothing unexpected happened in a year," wrote a team led by Morgan Stanley analyst Matthew Hornbach in a report, outlining three major surprises they anticipate next year.

I. "Unemployment-Driven Productivity Boost"

Morgan Stanley analysts believe that the U.S. economy may see a so-called "unemployment-driven productivity boost" next year, which is an enhanced version of the so-called "unemployment-driven economic recovery."

The term "unemployment-driven productivity gains" is easily understood literally; it refers to an increase in productivity in the US economy despite persistently low employment. This situation can curb inflation and open the door for further interest rate cuts by the Federal Reserve.

In his report, Hornbach wrote that in this scenario, a weak U.S. job market would help curb wage growth and inflation, while increased productivity would help maintain stable economic growth.

In this scenario, the US could potentially reduce its core inflation rate to below 2% without its economic growth stalling.

"This supply-driven deflation provides the Federal Reserve with significant room to cut interest rates. Investors do not need to worry that the Fed's policies may trigger a renewed acceleration of inflation, and the Fed also has room to lower policy rates into the accommodative range."

He added that this situation could also alleviate investors' concerns about the widening U.S. fiscal deficit.

Currently, the trend of increased labor productivity in the United States appears to be emerging. Data from the U.S. Department of Labor shows that hourly output of all non-agricultural employees increased by 3.3% year-on-year in the second quarter, a significant reversal from the 1.8% year-on-year decline in the previous quarter.

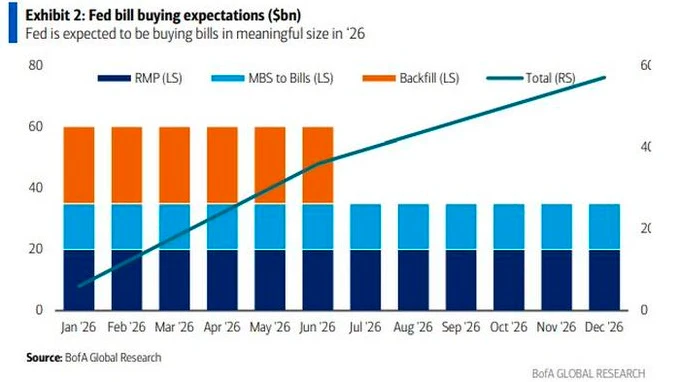

Against this backdrop, the Federal Reserve's rate cuts next year will be larger than those projected in its official dot plot. Fed officials currently expect only one rate cut in 2026, but according to the CME FedWatch tool, investors expect a 72% probability of a larger rate cut next year.

II. Regression of the inverse relationship between stocks and bonds?

Generally speaking, stock prices and bond prices move inversely; that is, when the prices of risky assets fall, investors seek bonds for safety.

However, in 2025, this pattern reversed: both US stock and bond prices continued to rise throughout the year.

Morgan Stanley believes this is mainly because the US stock market has recently been in a " bad news is good news " pattern, meaning that weak economic data has had a positive effect on the US stock market because it has fueled investors' optimistic expectations for a Federal Reserve rate cut.

However, they pointed out that this pattern could reverse again if U.S. inflation falls back to the Fed's target level next year.

“When inflation expectations are at or even below the target level, the ‘ bad news is bad news ’ pattern for risk assets will return, which will allow US Treasuries to regain their role as a portfolio stabilizer for investors during the low-inflation periods of the two decades before the pandemic,” said Martin Tobias and Eli Carter, two strategists at Morgan Stanley. (Eli Carter) wrote.

III. Sharp rise in commodity and energy prices

In 2025, prices of various commodities, including energy, surged, and Morgan Stanley believes that this trend may repeat itself in 2026.

Morgan Stanley strategists speculate that this is primarily due to a series of events that could cause commodity prices to "surge":

1. The Federal Reserve continues to lower interest rates, while other central banks raise them. This reduces the attractiveness of the dollar relative to other global currencies, thus lowering its value.

2. A weaker dollar and stimulus measures will help stimulate a rebound in the Chinese economy, and China is the world's largest producer of rare earth and precious metals. As one of the world's leading producers and consumers of energy, and also one of the world's largest energy consumers, China's economic growth helps boost commodity consumption.

Morgan Stanley stated, "A weaker dollar and strong Chinese consumption will drive up energy prices—including gasoline prices, which are currently at their lowest level in five years—and could reach new highs."

Currently, most commodity market analysts believe that 2026 will be a good year for energy prices and various commodities, due to factors including tight supply and artificial intelligence. Increased demand due to trade and higher demand for safe-haven assets, among other factors.

Meanwhile, gold, a safe-haven asset, broke through $4,500 for the first time this week, hitting a new high. The metal has risen nearly 70% this year and is on track for its best annual performance since 1979. Silver and copper, closely linked to artificial intelligence trade, also hit record highs this week.

(Article source: CLS)