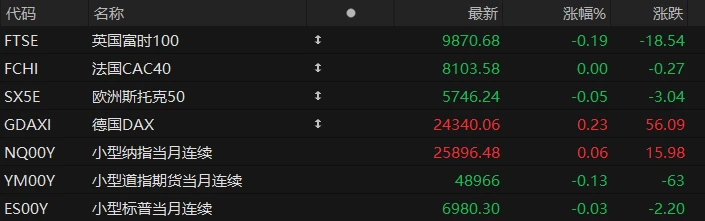

U.S. stock index futures were mixed in pre-market trading on Friday, while most major European indices declined. As of press time, the Nasdaq... S&P 500 futures rose 0.06%, S&P 500 futures fell 0.03%, and Dow Jones futures fell 0.13%.

In terms of individual stocks, most prominent tech stocks rose pre-market; storage concept stocks also rose pre-market, with SanDisk leading the gains. Micron Technology Western Digital rose about 2%. The stock rose over 1%. On the news front, international market research firm Omdia pointed out that the storage product market is experiencing an unprecedented upward cycle. Popular Chinese concept stocks showed mixed performance in pre-market trading . Li Auto shares fell more than 9% in pre-market trading. XPeng Motors It rose by more than 1%.

After a brief day of adjustment yesterday, global precious metals... The market quickly regained its upward momentum and saw a collective surge. Spot silver recorded its fifth consecutive day of gains on Friday, rising 5% intraday to $75.39 per ounce, setting a new record high. Meanwhile, spot gold touched a high of $4,530, and other metals generally rose sharply. Mining stocks rose across the board in pre-market trading, with Cordell Mining leading the gains. First Majestic Silver rose 2.67%, up 2.72 %. Hekla Mining rose 2.73%. Up 2.57%, Kinross Gold Newman Mining rose 1.64%, while Newman Mining rose 0.74%.

U.S. stocks were closed Thursday for Christmas, and trading was light on Wednesday after an early close. Trading volume is expected to remain subdued ahead of the shortened New Year holiday week. Earlier this week, the S&P 500 rose 0.3% to a record high of 6932.05 on Wednesday, boosted by stronger-than-expected third-quarter U.S. economic growth; the Dow Jones Industrial Average rose 0.6% to 48731.16, also a record high for the blue-chip index; and the Nasdaq Composite rose 0.2% to 23613.31, primarily driven by artificial intelligence. Strong performance of leading enterprises.

After markets resume normal trading on Friday, investors will focus on economic data for further guidance. Trading may remain quiet on thin volumes, but the market is watching to see if the "Santa Claus rally" can continue.

Hot News

Silver prices surged during Christmas: London physical silver experienced a historic run?

Amidst subdued trading during the Christmas holidays in Europe and the US, the surge in silver prices is accelerating. Market data shows that during Asian trading hours on Friday (December 26), spot silver prices reached a high of $75.14 per ounce, extending this month's gains to an astonishing 33%.

As silver prices continue to soar and even become increasingly out of control, Dutch precious metals trading expert Karel Mercx has also noticed a phenomenon indicating that the physical shortage of silver in the London market may have reached an extreme level.

In the London spot silver market, most investors do not hold silver bars stored in vaults with their names on them, but rather "unallocated ownership certificates." Currently, almost all holders of unallocated silver ownership certificates and delivery promissory notes are demanding physical metal delivery.

In other words, the London silver market is now like a reservoir with only 10 buckets of water but 1,000 water-drawing tickets issued—the huge leverage effect of "paper silver" relative to deliverable physical silver poses a potential risk of a complete and rapid collapse of the London silver market's operating system.

Growth is decoupling from employment, and the US economy is showing signs of an "unemployment-driven boom."

The US economy continues to grow faster than expected, with the exception of the job market. Strong economic growth is usually accompanied by more active hiring and higher personal incomes, which in turn supports continued consumer spending. However, this year the situation in the US economy is exactly the opposite: spending is driving the economy, but the job market has fallen into a "full freeze".

"Economic growth has become decoupled from labor market performance," KPMG chief economist Diane Swonk wrote in a report on Tuesday. This is gradually becoming a central narrative for 2026. The United States is in what some call an "unemployment boom": money is flowing healthily through the economic system but not translating into new jobs.

The market's focus has shifted to artificial intelligence (AI). This year's economic growth has been largely driven by AI investment, while consumer spending has remained resilient. Major investors in AI are large corporations, including those leading the wave of white-collar layoffs. In some cases, these companies have seen their profits soar, and "doing more with fewer people" has become the operating mantra this year.

If tech companies begin to reap the rewards of AI, the "unemployment boom" could only be exacerbated. Businesses hoping to boost productivity with AI without hiring more workers will only worsen an already sluggish job market.

Wall Street is unanimously bullish on US stocks in 2026! A combination of AI and interest rate cuts could propel a four-year winning streak, but this strong consensus may be a hidden concern.

As the year draws to a close, most institutions have released their forecasts for the US stock market in 2026. Wall Street's target price for the S&P 500 in 2026 is concentrated in the range of 7100-8100 points, with an average target price of 7490 points, representing an upside of about 8% from Wednesday's closing price.

With US stocks likely to close higher this year, if the 2026 performance aligns with these predictions, it will mark the fourth consecutive year of gains for US stocks. Wall Street generally expects the artificial intelligence (AI) boom and Federal Reserve interest rate cuts to drive the S&P 500's upward trend, while corporate earnings growth will also support higher US stocks. However, it also warns that inflation, high valuations, and tariff tensions could still trigger market corrections.

Furthermore, Wall Street also expects global economic growth to be resilient in 2026.

US Stocks Focus

Nvidia Will Google still be the leading stock in the US stock market in 2026?

As of the most recent trading day (December 24), the two best-performing "Big Seven" stocks in 2025 are Nvidia and Google's parent company, Alphabet. Nvidia's stock price rose approximately 36% to $188, while Alphabet's rose approximately 65% to $315.

Bulls believe that there will be no bubble in US tech stocks in 2026, and expect an overall increase of more than 20%. Due to their respective advantages, the two companies mentioned above are particularly anticipated, with expected price-to-earnings ratios of 23 and 27 times, respectively.

Let's look at Nvidia first. Its stock price has been under pressure recently, mainly due to slowing AI spending and threats to its dominance from new competitors. While these challenges will continue into the new year, overall, Wall Street sentiment suggests the market remains highly confident in the company. As one of the major computing power providers, Nvidia is prepared for a tighter memory market, reflected in its November guidance of a 70% gross margin.

Google's recently released Gemini 3.0 model is based on Broadcom's... AVGO's custom chip training has attracted investor attention. However, bullish investors believe the market reaction is more focused on the competition between Google and OpenAI models than on the direct threat AVGO's dedicated chips pose to Nvidia GPUs. Due to the high development difficulty and low versatility of custom chip projects, they are unlikely to pose a substantial challenge to Nvidia, and Nvidia's commercial solutions remain the preferred choice for most customers.

XPeng Motors officially enters the Mauritius market.

On December 26, XPeng Motors announced its progress in the Middle East and Africa market.

Following its official entry into the Qatari market, XPeng Motors reached a strategic cooperation agreement with its Mauritian partner in December, officially entering the Mauritian market. In December, XPeng opened its flagship showroom in Abu Dhabi, UAE, and at the same time opened its largest exclusive service center in the region, covering an area of 2,000 square meters, in New Cairo, Egypt, integrating showroom and service.

As of press time, XPeng Motors shares were up over 1% in pre-market trading.

apple Branded mobile phones saw sales in China double year-on-year in November.

According to the latest data released by the China Academy of Information and Communications Technology (CAICT), sales of smartphones from foreign brands such as Apple in China surged by 128.4% year-on-year in November. During the same period, overall smartphone shipments in China increased by less than 2% year-on-year.

Apple expects its revenue to grow by 10% during this year's holiday season. Counterpoint Research also predicts that Apple is likely to remain the world's number one smartphone vendor in 2026.

(Article source: Hafu Securities) )