①TSMC ① 2nm technology began mass production in the fourth quarter of 2025; ② Lululemon's founder launched a proxy fight to reorganize the board of directors; ③ Intel Complete the transfer to Nvidia Sell $5 billion worth of common stock.

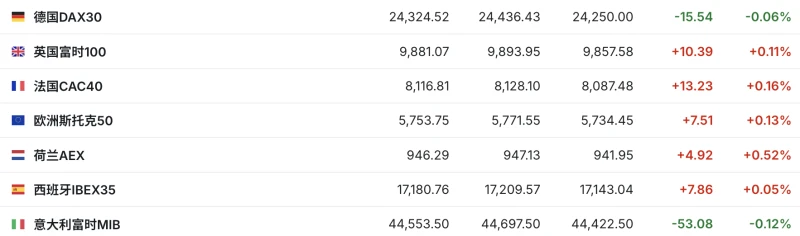

On Monday, futures for the three major U.S. stock indexes all fell, while most major European indices rose.

(Source: Investing.com)

The S&P 500 hit a record high in the previous trading session, as traders prepare to cap off a strong 2025.

2025 is poised to be a banner year for Wall Street, with the S&P 500 rising nearly 18% year-to-date. The Dow Jones Industrial Average is up 14.5%, on track for its best annual performance since 2021. The Nasdaq Composite is the standout performer, with a year-to-date gain of over 22%.

Currently, Wall Street is in the traditional "Santa Claus rally" phase, a period in which the stock market has historically performed strongly.

Artificial intelligence in pre-market trading AI concept stocks came under pressure, with Nvidia's stock price falling by more than 1% and Micron Technology's stock price also declining. and oracle bone script Similar declines were also observed. Over the past week, Nvidia has risen by more than 5%, while Micron and Oracle have risen by approximately 7% and 3%, respectively.

Gold and silver futures both retreated after hitting record highs on Friday. The CME Group has raised margin requirements for gold, silver, platinum, and palladium futures due to increased recent volatility, meaning traders will need to deposit more cash for trading these metals.

London copper prices continued to rise, nearing new highs and extending recent gains. The London Metal Exchange's three-month benchmark copper contract is poised to settle at a record price.

This week sees a limited release of corporate earnings reports and economic data. Investors will focus on Tuesday's release of the Federal Reserve's December meeting minutes to understand the disagreements among policymakers and how those disagreements might affect interest rate trends next year.

Company News

TSMC's 2nm technology began mass production in the fourth quarter of 2025.

On December 29, it was announced that TSMC's 2-nanometer (N2) technology will begin mass production as scheduled in the fourth quarter of 2025. The N2 technology utilizes first-generation nanosheet transistor technology, providing performance and power efficiency improvements across all process nodes.

Amazon Suspension of drone operations in Italy Delivery Plan

Amazon announced on December 28th (local time) that it has decided to abandon its plans to launch drone delivery services in Italy. Amazon stated that while it has made good progress in aviation regulations, broader business regulatory issues have hindered the project's progress.

Lululemon founder launches proxy battle to reorganize board of directors

On December 29, it was reported that, days after CEO Calvin McDonald resigned, lululemon founder Chip Wilson launched a proxy fight aimed at pushing for changes to the company's board of directors.

Intel completes $5 billion sale of common stock to Nvidia.

Intel announced on December 29 that on December 26, it issued and sold 214,776,632 shares of its common stock to Nvidia for a total cash purchase price of $5 billion, equivalent to $23.28 per share.

Samsung accelerates P4 factory construction in Pyeongtaek, HBM4 mass production may be ahead of schedule.

According to reports, the construction project of Samsung Electronics' P4 factory in Pyeongtaek is progressing rapidly, with the installation and testing of equipment already completed 2-3 months ahead of schedule. This factory will become the core of Samsung's 10nm sixth-generation (1c) DRAM production, and Samsung will be the first to use 1c DRAM in its sixth-generation HBM (HBM4) chips.

SoftBank is reportedly in advanced talks to acquire a data center. DigitalBridge, an investment company

According to reports, SoftBank is in advanced talks to acquire private equity firm DigitalBridge, which primarily invests in assets such as data centers .

Woodside Energy and Türkiye's Botash sign long-term LNG supply agreement

According to a statement released on December 28, Woodside Energy has signed a long-term liquefied natural gas (LNG) contract with Turkish state-owned energy company Botash. Supply and purchase agreements.

Under the agreement, Woodside Energy will supply Botash with a total of approximately 5.8 billion cubic meters of natural gas equivalent (equivalent to 500,000 tons of liquefied natural gas per year) for up to nine years, starting in 2030. This liquefied natural gas will primarily come from Woodside Energy's Louisiana project currently under construction in the United States.

Key events to watch in the US stock market (Beijing time)

December 29

23:00 US November Pending Home Sales Index (MoM)

23:30 US EIA Crude Oil Inventories for the week ending December 19

(Article source: CLS)