U.S. stock index futures traded in a narrow range in pre-market trading on Tuesday, while major European indices generally rose. As of press time, the Nasdaq... The S&P 500 futures index rose 0.01%, the Dow Jones futures index fell 0.03%, and the S&P 500 futures index fell 0.01%.

In terms of individual stocks, prominent tech stocks showed mixed performance in pre-market trading, with ASML... Tesla rose more than 1%. Micron Technology It rose by nearly 1%.

Most popular Chinese concept stocks rose in pre-market trading, with Baidu among them. Baidu Group-SW Hong Kong-listed shares rose nearly 9%, up nearly 5%, as the company deploys autonomous vehicles in the UK and develops its own AI chips. Kunlun Chip is expected to enter a period of rapid production; NIO XPeng Motors It rose by more than 3%.

Silver rebounded more than 5%, recovering some lost ground, while gold rose back above $4,400/ounce. Gold, silver, and copper stocks generally rose in pre-market trading. AngloGold Ashanti and Jintian... Harmony Gold surges over 4% Pan American Silver , Dolly Varden Silver rose more than 3%.

Goldman Sachs A recent research report indicates that the strong growth resilience of the US economy in 2025 is expected to continue beyond 2026. As the tax cuts in the Trump administration's "Big and Beautiful" bill and more favorable loose monetary conditions begin to work together, coupled with a significant easing of headwinds from tariffs and inflation, the macroeconomic narrative of a "soft landing" for the US economy is expected to gain significant traction in 2026—meaning that the US economy is projected to grow faster than the market anticipates in 2026.

Goldman Sachs' economists emphasized that despite the recent stagnation in the weak non-farm payrolls market, AI data centers ... The vigorous construction progress, the significant reduction in the drag from tariffs and the over $100 billion in tax rebates, and the Federal Reserve's interest rate cut path will all contribute to boosting economic growth momentum.

Hot News

Bank of America CEO: Trump's tariff war may ease next year, but small businesses will still face many challenges.

On Sunday, Eastern Time, Bank of America In an interview, CEO Brian Moynihan predicted that tensions related to Trump's tariffs would ease next year.

Moynihan stated that he believes the Trump administration will focus on "de-escalating rather than escalating" the situation next year and will set average tariffs on other countries around 15%. However, he anticipates raising tariffs on countries that disagree with purchasing from the United States or are unwilling to lower non-tariff barriers.

“The impact of reducing the tariff from 10% across the board to 15% for most countries will not be too great,” Moynihan said. “That’s where our team thinks the situation is starting to ease.”

Moynihan's Bank of America is the largest small business lender in the United States. Moynihan stated that even if tariffs ease, the problems faced by American small business clients extend far beyond tariffs, including issues such as labor shortages caused by immigration policies.

Are funds chasing silver and avoiding Bitcoin? Volatility data provides the answer.

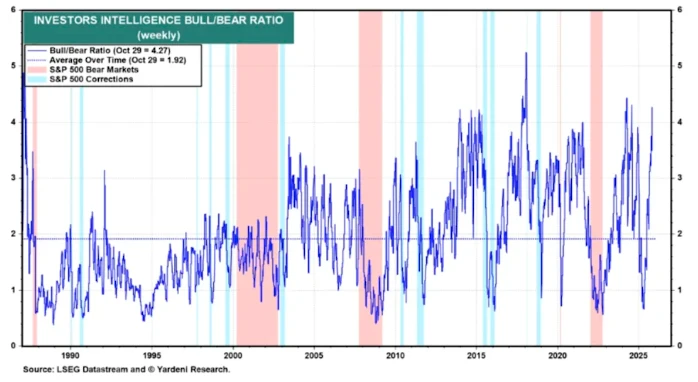

As the year draws to a close, market trading is becoming increasingly thin, with Bitcoin and silver sending drastically different signals. Volatility data shows that traders are actively repricing silver, while Bitcoin is almost at a standstill.

Over the past month, Bitcoin's 30-day annualized volatility has continued to converge to around 45%, reflecting that the market remains range-bound and lacks a clear direction. According to TradingView data, this level is significantly lower than its 365-day average of 48%.

This volatility level might be considered high among blue-chip stocks, but compared to silver, which is a precious metal... It still pales in comparison to assets in the industrial metals sector.

Realized volatility for silver has jumped to around 55%, driven by factors including a sharp price increase, widening physical premiums, and multiple pressures on the global gold and silver markets.

This volatility divergence is highly consistent with the price performance of the two assets. Year-to-date, silver prices have risen by over 151%, while Bitcoin has fallen by nearly 7%.

The surge in silver prices is primarily due to a supply-demand imbalance. (Solar energy) Boards, electric vehicles, electronic products and batteries The demand for technology has surged, but supply has failed to keep pace.

Major institutions' outlook for 2026: The US economy may experience moderate growth, but uncertainty remains high.

From major banks Economic forecasts for 2026 from financial institutions are being released one after another. The mainstream consensus among these institutions is that the US economy will grow moderately next year, but there are also some uncertainties.

Bank of America Global Research projects that the U.S. economy will maintain a mid-2% growth rate until the end of 2026. This relatively optimistic forecast is based on tax reforms aimed at boosting investment, as well as consumer spending and artificial intelligence. Investment in AI-related companies remains strong.

Goldman Sachs ' research team also believes that the US economy will outperform most other major economies, although the widespread adoption of AI may put some pressure on job growth. Goldman Sachs projects global GDP growth of approximately 2.8% in 2026, slightly higher than the overall market expectation, and notes that the end of the US federal government shutdown could trigger a rebound early next year.

Regarding interest rate trends, S&P Global S&P Global projects that the Federal Reserve will implement two 25-basis-point rate cuts in the second half of 2026. Lower interest rates may provide some support for lending and investment, but most forecasters remain cautious about when financial conditions (i.e., high borrowing costs) will ease.

US Stocks Focus

Morgan Stanley is bullish on China's emerging electric vehicle manufacturers: New product launches in Q2 next year may bring investment opportunities.

Morgan Stanley Analysts released a report recommending that investors closely monitor NIO and BYD in the second quarter of next year. And Li Auto The release of new models may present investment opportunities, especially given the current relatively low market expectations.

BYD will launch the new generation Seal 08 sedan and Sealion 08 SUV in the first half of next year, while Li Auto is conducting road tests on its 2026 extended-range flagship SUV L9.

NIO will launch three new SUVs next year, including the L80, a large five-seater SUV under the Onvo sub-brand, the new flagship SUV ES9, and a new five-seater SUV under the main brand.

For the first half of next year, Morgan Stanley will focus on XPeng, Geely Automobile Holdings and SAIC Motor. Listed as a top pick among Chinese automakers.

Morgan Stanley projects that plug-in hybrid electric vehicle (PHEV) sales in China will grow by 14% in 2026, exceeding the 9% growth rate of battery electric vehicles (BEVs). Chinese electric vehicle exports are expected to remain strong, growing by 16% year-on-year, with sales to Europe, ASEAN, and Latin America each growing by 20-25%.

TSMC 2nm has quietly entered mass production.

TSMC has quietly announced that it has begun mass production of chips using its N2 (2nm-class) process. The company did not issue a formal press release announcing the start of mass production, but had previously stated on several occasions that the N2 process was expected to achieve mass production in the fourth quarter, thus confirming that the plan has been achieved.

TSMC stated on its 2nm technology website: "TSMC's 2nm (N2) technology is scheduled to begin mass production in the fourth quarter of 2025."

The N2 process utilizes first-generation nanosheet transistor technology, achieving full-node improvements in both performance and power consumption. TSMC has also developed a low-resistance redistribution layer (RDL) and ultra-high-performance metal-insulator-metal (MiM) capacitors to further enhance performance.

TSMC's N2 technology will become a leader in semiconductors in terms of both density and energy efficiency. Industry-leading technology. Leveraging its advanced nanosheet transistor structure, N2 technology will deliver full-node performance and power efficiency advantages to meet the growing demand for energy-efficient computing. Through our continuous improvement strategy, N2 and its derivative technologies will further solidify TSMC's technological leadership and ensure its continued dominance for a long time to come.

Tesla has unprecedentedly released a forecast on its official website: Q4 deliveries may see a "sharp drop".

Tesla (TSLA.US) recently published a compilation of analyst vehicle delivery forecasts on its website, with the average expectation for the current quarter being more pessimistic than the market-compiled data. According to Tesla... According to their own statistics, analysts on average expect the company to deliver 422,850 vehicles in the fourth quarter, a 15% decrease compared to the same period last year. In comparison, the market-compiled average estimate is 445,061 vehicles, a 10% year-over-year decrease.

Although Tesla's investor relations team has been compiling average delivery estimates for years, these figures have never been publicly released on the company's website. The automaker is facing its second consecutive year of declining sales, with its compiled average annual delivery estimate at 1.6 million vehicles, down more than 8% from the same period last year.

Tesla's sales plummeted earlier this year as all its assembly plants were repurposed for the updated Model Y (the company's best-selling vehicle). Meanwhile, CEO Elon Musk's divisive role in the Trump administration also impacted the brand.

Tesla's third-quarter deliveries surged to record levels as U.S. consumers rushed to buy electric vehicles before the $7,500 federal tax credit expired at the end of September. Earlier in the quarter, Tesla partially offset the impact of the credit's expiration by introducing a simplified version of the Model Y SUV and Model 3 Sedan, both priced under $40,000.

Despite declining vehicle sales, Tesla's stock price is still on track for a year-to-date gain. As of Monday's close, the stock was up 14%, slightly less than the S&P 500's 17% increase.

(Article source: Hafu Securities) )