Yields on U.S. Treasury bonds across multiple maturities rose further to their highest levels in more than two months on Monday, after most global government bond markets fell, as investors prepared for three U.S. bond auctions and the Federal Reserve's interest rate decision this week.

Market data shows that yields on U.S. Treasury bonds across all maturities rose across the board on Monday, with medium-term bonds performing the weakest. As a key indicator of mortgage and corporate financing costs, the benchmark 10-year Treasury yield rose 2.92 basis points to 4.164% on Monday, approaching the 4.2% mark for the first time since September—the bottom of the trading range for 10-year Treasury yields before the Federal Reserve resumed rate cuts in September…

The yield on the 30-year U.S. Treasury note also rose 1.11 basis points to 4.802% on Monday, a new high since September. The yield on the two-year Treasury note, which typically moves in tandem with the Federal Reserve's interest rate expectations, climbed 1.7 basis points to 3.581%, having touched 3.61% during the session, its highest level since November 20.

Market participants are currently focusing closely on the Federal Reserve's policy decision to be announced on Wednesday. Traders believe there is approximately a 90% probability that the Fed will cut interest rates by 25 basis points for the third consecutive time in December. With inflation remaining stubbornly high, market participants will interpret the officials' outlook for 2026 through the dot plot.

John Canavan, chief analyst at Oxford Economics, said he expects the Federal Reserve's rate cut this week to be accompanied by a hawkish tone, potentially extending the period of no change in rates next year. Investors may be disappointed if the Fed strongly hints this week that it will keep rates unchanged for an even longer period – as the market is currently betting on a greater than 90% probability of another rate cut before April.

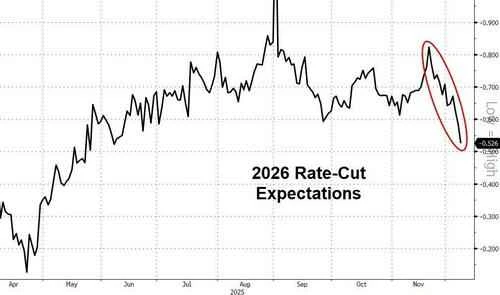

As shown in the chart below, compared to last week, interest rate swap traders lowered their expectations for a Fed rate cut in 2026 on Monday.

Assuming the Federal Reserve cuts rates by 25 basis points as expected this Wednesday, traders currently anticipate only two more rate cuts of 25 basis points each before the end of next year, a decrease of about 5 basis points from the rate cuts expected last Friday. It's worth noting that a month ago, the market had anticipated more than three rate cuts next year.

Roger Hallam, global head of interest rates at Vanguard, said the Federal Reserve will cut rates this week and will describe the rate cut as part of ongoing risk management, but may eventually stop easing at a level closer to 3.5% rather than 3%.

The agency expects the macroeconomic environment to remain positive next year, with inflation likely to stay above target. "Therefore, we are unlikely to see interest rates move further toward 3%."

On Monday, Richard Hassett, the leading candidate to become the next Federal Reserve chairman and director of the White House National Economic Council, delivered his latest remarks, which were not particularly dovish and to some extent dampened expectations for interest rate cuts next year. Hassett stated that it would be irresponsible for the Fed to formulate a plan for interest rate direction over the next six months at this time, and emphasized the importance of paying close attention to economic data.

Hassett said in a television interview on Monday, "The Fed chair's job is to look at the data, make adjustments, and explain why they do it. So it's irresponsible to say, 'I will do this over the next six months.'"

When asked how many more interest rate cuts he thought would be needed by 2026, he said, "I don't want to disappoint people on the issue of the number of rate cuts, but I can say that what we need to focus on is the data."

The well-known financial blog Zerohedge stated that Hassett's latest remarks were not as dovish as people had expected, leading to a decline in market expectations for further easing by the Federal Reserve next year… The world is currently awaiting Wednesday's Fed meeting, anticipating a hawkish rate cut. However, due to internal disagreements within the Fed, the credibility of any statement will be far lower than usual!

Regarding the U.S. Treasury auction, the Treasury Department had previously adjusted its auction schedule for this week to align with the Federal Reserve's two-day policy meeting. Monday's auction results showed that the yield on the $58 billion in 3-year Treasury notes issued by the U.S. Treasury was 3.614%, 0.8 basis points lower than the pre-auction trading level at the bid deadline. The bid-to-cover ratio was 2.64 times, compared to an average of 2.63 times for the previous six auctions, indicating a relatively stable overall auction performance.

On Tuesday and Thursday, the U.S. Treasury will also auction $39 billion in 10-year Treasury notes and $22 billion in 30-year Treasury notes, respectively.

(Article source: CLS)