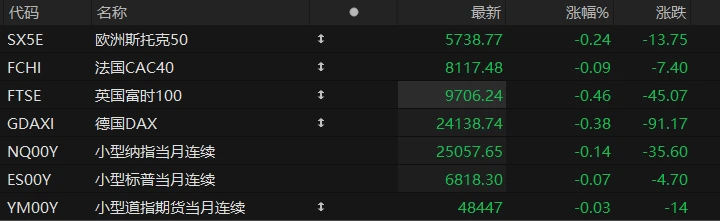

U.S. stock index futures traded in a narrow range in pre-market trading on Tuesday, while major European indices generally declined. As of press time, the Nasdaq... S&P 500 futures fell 0.14%, S&P 500 futures fell 0.07%, and Dow Jones futures fell 0.03%.

In terms of individual stocks, star tech stocks fluctuated slightly in pre-market trading, with Tesla... Micron Technology Advanced Micro Devices (AMD) shares fell nearly 1%.

Most popular Chinese concept stocks fell in pre-market trading, with Alibaba among them. JD.com NIO Hesai It fell by more than 1%.

Cryptocurrency stocks rebounded in pre-market trading, with Circle up over 3%, Bitmine Immersion Technologies up over 2%, Strategy up nearly 2%, and Coinbase and MARA Holdings up over 1%.

The non-farm payrolls report to be released tonight will be the focus of investors' attention. According to the median forecast of a survey of economists, non-farm payrolls are expected to increase by 50,000 in November; the unemployment rate is likely to reach 4.5%, continuing its upward trend in recent months and rising to its highest level since 2021.

This report not only allows people to examine the long-awaited true state of the US labor market, but will also set the tone for next year's interest rate path. However, due to the impact of the government shutdown, the uncertainty and anomalies in the data are more pronounced than usual.

In addition, the U.S. Commerce Department will also release October retail sales data at the same time. Excluding automobile and gasoline sales, economists expect consumer spending to accelerate, indicating robust consumer demand at the start of the fourth quarter; while overall retail sales, unadjusted for inflation, are expected to show only a modest 0.1% growth.

Hot News

Nasdaq applies for 23-hour trading, potentially ushering in a sleepless era for US stocks.

Nasdaq has filed an application seeking regulatory approval to extend its stock exchange's trading hours to 23 hours per day during weekdays. According to a filing on Monday (December 15), Nasdaq has submitted the application to the U.S. Securities and Exchange Commission . The Securities and Exchange Commission (SEC) has applied to add a new trading session—from 9 p.m. Eastern Time to 4 a.m. the following day.

Currently, Nasdaq offers three trading sessions each weekday: the pre-market session (4:00 AM to 9:30 AM), the regular session (9:30 AM to 4:00 PM), and the after-market session (4:00 PM to 8:00 PM). If finalized, Nasdaq's trading hours will evolve into a "23/5" model—five days a week, 23 hours a day.

However, there is disagreement on Wall Street regarding allowing extended stock trading hours. Supporters argue that both domestic and international investors want to be able to enter and react to the market outside of regular trading hours; opponents warn that lower trading volumes could impair trading quality and make price discovery less accurate. Currently, most trading activity in the US stock market remains concentrated within the "regular trading hours." With extended trading hours, an unresolved question arises: will institutional investors begin to actively trade during these less-volume periods?

Bitcoin is sliding toward its lowest point of the year! The crypto market is facing more sustained selling pressure.

Bitcoin prices fell below $86,000 for the first time in two weeks, dampening investor sentiment. The largest cryptocurrency is further venturing into bear market territory. Analysts say Bitcoin prices are approaching the lower end of their recent trading range, and they expect another wave of selling should prices rebound, as investors who bought at the all-time high in early October may recoup some of their losses.

In recent weeks, Bitcoin has continued to decline along with other risk assets, but it has failed to follow suit when other assets rebounded, breaking its usual correlation with market movements. This decline also demonstrates that even after the Federal Reserve cut interest rates last week, the crypto market remains squeezed due to insufficient liquidity and weakened risk appetite.

Chris Newhouse, head of research at decentralized finance firm Ergonia, said the decline in Bitcoin was primarily driven by spot and derivatives positioning strategies, rather than forced liquidations. Newhouse stated that the relatively stable liquidation data suggests that over-leveraged positions have been cleared, leaving behind a more natural but potentially more sustained selling pressure.

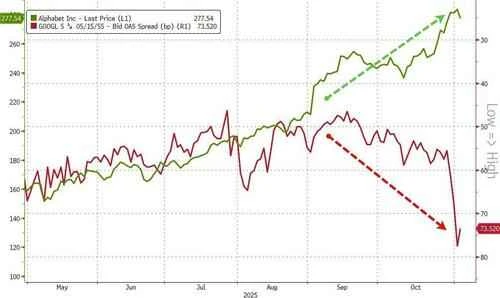

Wall Street is issuing a warning: the AI boom will "decline" next year, and the S&P 500 is expected to fall by more than 20%!

As the year draws to a close, investors are increasingly focusing on the outlook for next year, and most Wall Street analysts hold a very optimistic base of expectations. Statistics show that by the end of 2026, Wall Street's valuation of the S&P 500... The median forecast for the CSI 500 index target price is 7,500 points.

Peter Berezin, chief global strategist at BCA Research and one of Wall Street's most prominent short sellers, recently warned that artificial intelligence , which has driven the US stock market bull run for the past two years , is at risk. The AI craze will "fade" in 2026, and large tech companies in the Nasdaq will drag down the entire US stock market.

Berezin's team's baseline expectation is that the AI boom will turn into a recession, with economic activity slowing down sharply.

The team believes that in early 2026, as investors shift from tech stocks to non-tech stocks and from growth stocks to value stocks, the stock market decline may be minimal. However, by the second half of 2026, "almost all sectors of the stock market will crash," as capital spending on artificial intelligence declines sharply and unemployment begins to rise rapidly.

"The final result is that the S&P 500 will close at 5280 points by the end of 2026, a decline of about 23% for the year," the report said.

US Stocks Focus

Google and Total have reached another 21-year green electricity supply agreement.

French energy giant Total announced on Tuesday (December 16) that it has signed a 21-year power supply agreement with Alphabet's Google, committing to supplying electricity to Google's data centers in Malaysia. It will provide 1 terawatt-hour (TWh) of renewable energy. The power supply contract is expected to take effect in the first quarter of next year.

Total stated that this electricity will be generated by its Citra Energies solar power plant in northern Kedah, Malaysia. The power plant is provided. Construction of the power plant is scheduled to begin in early 2026. In August 2023, the Malaysian Energy Commission awarded the project to Total Energy (49% stake) and its local partner MK Land (51% stake) for joint operation.

It's worth noting that Total and Google also signed another agreement in November of this year, under which Total agreed to provide power to Google's U.S. data center in Ohio.

The power purchase agreement at the time was for 15 years and would acquire a total of 1.5 terawatt-hours of renewable energy from Total’s solar power plant in Montpellier, Ohio.

Who will be the biggest IPO of 2025? The answer will be revealed tonight.

As 2025 draws to a close, it is an undeniable fact that the Hong Kong Stock Exchange has crushed the New York Stock Exchange and Nasdaq to become the top IPO in terms of fundraising this year. However, there is still one question to be answered: Which company will have the largest IPO fundraising in 2025?

As background, as part of this year's "A+H" listing wave, the world's largest electric vehicle battery Manufacturer CATL It listed on the Hong Kong Stock Exchange in May, raising HK$41 billion (approximately US$5.27 billion), making it the largest IPO in 2025 to date.

CATL 's challenger is Medline , an American medical supplies manufacturer. The company is scheduled to decide its IPO pricing on Tuesday evening and list on the Nasdaq Global Select Market on Wednesday.

According to Medline's prospectus filed with the U.S. Securities and Exchange Commission, the company plans to issue 179 million shares, priced between $26 and $30. If priced at the upper end of the range, Medline will raise $5.37 billion, slightly surpassing CATL .

Tuesday's latest news also indicates that this is not yet a done deal. According to sources, Medline is guiding potential investors to estimate that its IPO will be priced in the " upper half of the offering price range ." Simple calculations show that as long as Medline's IPO price is below $30, it will not surpass CATL's . The sources also revealed that Medline's IPO attracted orders approximately 10 times the number of shares available for subscription.

Nvidia Acquiring SchedMD to strengthen its AI ecosystem moat through an open-source strategy.

SchedMD's core business is providing software for scheduling large-scale computing tasks, which often consume massive amounts of data center server resources. The company's open-source technology, Slurm, allows developers and enterprises to use its underlying software free of charge, and the company's main revenue comes from engineering implementation and maintenance support services. The financial terms of this transaction have not been disclosed, but NVIDIA has committed to continuing to distribute SchedMD's software products as open source.

NVIDIA stated, "The Slurm system, which supports the latest NVIDIA hardware, has become a crucial component of the critical infrastructure for generative AI, and is widely used by foundational model developers and AI builders to manage model training and inference needs." The chip giant is responding to increasingly fierce industry competition by increasing investment in open-source technologies and strengthening its AI ecosystem.

Is Amazon reallocating resources to adjust its AI strategy? Luxembourg headquarters lays off record number of employees

Amazon 's decision earlier this year to lay off 14,000 employees globally is now sending ripples through its European headquarters in Luxembourg. Amazon expects to lay off another 370 employees there in the coming weeks, representing approximately 8.5% of its 4,370 workforce.

This round of layoffs is the largest in the small country in at least two decades, and it has become a slowdown in the mutually beneficial relationship between Amazon and Luxembourg. In October, Amazon stated that its global layoffs were aimed at "reducing bureaucracy, optimizing organizational structure, and adjusting resource allocation to ensure investments focus on the most important strategic areas," including artificial intelligence. The company revealed plans for further layoffs in 2026 and expects hiring to be limited to key growth areas.

(Article source: Hafu Securities )