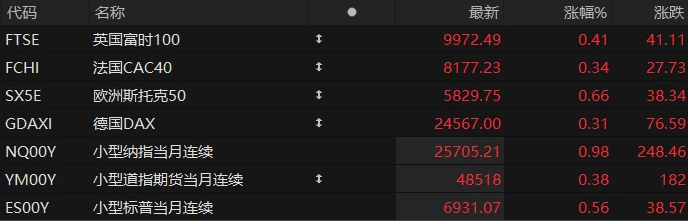

On the first trading day of 2026, US stock index futures rose across the board, and major European indices generally increased. As of press time, Nasdaq... S&P 500 futures rose 0.98%, Dow Jones futures rose 0.38%, and S&P 500 futures rose 0.56%.

In terms of individual stocks, leading tech stocks collectively rose in pre-market trading, with ASML among them. Micron Technology rose more than 5%. TSMC Intel rose nearly 3%. Tesla rose 2%. Advanced Micro Devices (AMD) rose nearly 2%, while Nvidia... It rose by more than 1%.

Popular Chinese concept stocks performed strongly in pre-market trading, with Baidu leading the way. Bilibili surged over 11% Alibaba rose more than 5%. NIO rose more than 4%. JD.com rose nearly 4% Li Auto Pinduoduo rose nearly 3%. It rose by more than 2%.

Space-related stocks rose in pre-market trading, with Sidus Space up nearly 16%, Redwire up over 4%, AST SpaceMobile up nearly 3%, and Rocket Lab up nearly 2%.

precious metals The market continued its strong momentum from 2025, with silver/dollar jumping nearly 4% in a single day, gold/dollar reaching $4,390, and platinum futures approaching $2,170/ounce, up more than 6% intraday; aluminum futures broke through the $3,000 mark, reaching a new high since 2022.

Barclays In a report, US economists stated that the bank maintains its forecast of two Federal Reserve rate cuts in 2026, each by 25 basis points in March and June. They believe the risks surrounding this baseline forecast lean towards a delay in rate cuts.

These economists said the minutes of the Fed’s December policy meeting (in which the Fed cut rates by 25 basis points) were consistent with Barclays ’ expectation that rates would remain unchanged at the January meeting, “because the Federal Open Market Committee needs time to assess the impact of the recent rate cuts.”

Hot News

Musk says brain-computer interface devices will begin "mass production" this year, and there have been key advancements in implantation methods.

Elon Musk, the world's richest man, revealed that his brain-computer interface company Neuralink plans to significantly increase the production of brain-computer devices by 2026 and will also innovate in brain-computer implantation methods.

In a social media post this week, Musk stated that Neuralink will begin high-volume production of its brain-computer interface device in 2026 and will advance a highly streamlined, almost fully automated surgical procedure.

Musk also revealed that the electrode wires in the device will now pass directly through the dura mater without having to remove it—a very significant breakthrough.

Neuralink, co-founded by Elon Musk in 2016, is a cutting-edge technology company that aims to enable humans to control computers with their thoughts through implanted brain-computer interfaces. Its initial goal is to help patients with severe neurological disorders (Parkinson's, Alzheimer's, paralysis, or visual impairment) regain communication and independence. In its long-term vision, healthy humans could also gain some form of artificial intelligence through brain-computer interfaces. Empower.

What remains unknown is whether Musk's mention of large-scale production means a rapid increase in the number of volunteers undergoing brain-computer interface (BCI) implantation experiments. Neuralink did not complete the implantation of its "first subject" until January 2024. In a post in early September last year, Neuralink revealed that 12 people worldwide had received BCI implants, an increase from 7 in June.

Goldman Sachs Hedge fund manager: 2025 will be "very good" for US stocks; 2026 will be even "wildering".

In his annual review, Goldman Sachs' global head of hedge funds, Tony Pasquariello, said that after much deliberation, he chose to describe the past year as "Very Good." Pasquariello believes the market will become even "Wilder" in 2026: "I don't think next year will be uneventful. While the overall trend is positive, my gut feeling is that next year will be wilder."

On paper, the Nasdaq 100 (NDX) surged 21% for the year, the S&P 500 recorded an 18% total return (including dividends), and the Dow Jones Industrial Average and Russell 2000 rose 15% and 13%, respectively. The S&P 500 even finished the year with an unprecedented eight-month winning streak, a strong performance not seen since 2017. However, this return came at the cost of significantly increased market volatility. Pasquariello points out that the market in 2025 will be characterized by "high returns and high volatility."

Standing on the threshold of 2026, the market faces even higher stakes: historically high price-to-earnings ratios (rising from 21.5 to 22.0), extremely narrow corporate credit spreads, ever-expanding sovereign debt, and astronomical AI capital expenditures.

Pasquariello predicts that 2026 will be anything but uneventful. While the baseline expectation remains net positive, the market will become much more "wild." In an era of high valuations and rapid technological change, a simple "buy and hold" strategy may face challenges, and tactical flexibility will become crucial.

Continuing its best performance in 46 years! Goldman Sachs kicks off a dominant 26-year run, proclaiming a record $4,900 price target.

Gold and silver prices both rose at the start of trading in 2026, extending their best annual performance since 1979. Gold prices approached $4,400 per ounce, while silver rebounded above $74. Although traders noted that precious metals could perform well in 2026, boosted by further US interest rate cuts and a weaker dollar, recent market concerns about widespread index rebalancing could put pressure on prices. Given the previous surge in precious metals , passively tracking funds may sell some contracts to accommodate the confirmed new weightings.

Tim Waterer, Chief Market Analyst at KCM Trade, stated, "Precious metals are likely to follow a similar trajectory in 2026 as in 2025, meaning there's upward momentum. Precious metals appear to be recovering from the year-end sell-off, which had troubled them earlier this week. Year-end liquidation pressures have eased, and fundamentals are now back in focus. Gold is poised to start 2026 on an upward trajectory."

Nevertheless, TD Securities "We expect up to 13% of total open interest to be sold off in the Comex silver market over the next two weeks, which will lead to a significant price revaluation and a decline," wrote senior commodities strategist Daniel Ghali in a report. He added that lower liquidity after the holiday could amplify price volatility.

In major banks In the Chinese market, bullish sentiment towards gold prices this year remains dominant , especially given the Federal Reserve's anticipated further interest rate cuts and President Trump's efforts to reshape the Fed's leadership. Goldman Sachs stated last month that its baseline forecast for gold is $4,900 per ounce, with risks skewed to the upside.

US Stocks Focus

Baidu surged over 11% in pre-market trading.

Baidu announced that on January 1st, Kunlun Core, through its joint sponsors, confidentially submitted a listing application to the Hong Kong Stock Exchange, seeking approval for the listing and trading of Kunlun Core shares on the Main Board of the Hong Kong Stock Exchange. The announcement indicates that after the spin-off, Kunlun Core is expected to remain a subsidiary of Baidu. The size and structure of the global offering, and the extent of the reduction in Baidu's percentage of shareholding in Kunlun Core, are yet to be finalized.

Tesla's Q4 deliveries may plummet by 15%, and Wall Street has significantly lowered its 2026 sales forecast to 1.8 million vehicles.

Tesla is set to release its fourth-quarter delivery figures on Friday. According to Bloomberg data, Tesla is expected to... The company delivered approximately 440,900 vehicles in the fourth quarter, a decrease of 11% year-on-year, which means that the company's sales in the second half of the year will be lower than the same period last year.

Tesla released a summary of analyst forecasts this week, which was even more pessimistic, predicting that Tesla's fourth-quarter deliveries would be 422,850 vehicles, a 15% year-over-year decrease. Furthermore, according to data compiled by Bloomberg, Wall Street's delivery expectations for Tesla in 2026 have been significantly lowered from over 3 million vehicles to approximately 1.8 million.

Although the company's stock price surged in the second half of 2025, the main driver was... Artificial intelligence and robotics touted by CEO Elon Musk Technological advancements, not electric vehicle sales figures.

Analysts point out that investors are currently focusing on Tesla's growth potential over the next 5 to 15 years, while ignoring its short-term financial performance. However, this strategy faces challenges as adverse factors such as the elimination of the US federal electric vehicle tax credit, intensified global market competition, and regulatory obstacles in Europe become apparent.

Apple's fourth-quarter shipments are projected to plummet to 45,000 units. Proposed reduction in Vision Pro production scale

Reports from two market intelligence firms indicate that Apple has scaled back production and marketing of its Vision Pro headset due to weak consumer demand.

According to data from International Data Corporation (IDC), Luxshare Precision, Apple 's Chinese manufacturing partner Apple ceased production of the Vision Pro early last year. In 2024 (the year the device was released), it shipped 390,000 units. IDC predicts that Apple will only ship 45,000 new units in the fourth quarter of 2025 (including the busy holiday shopping season).

According to Sensor Tower, the tech giant has also significantly cut digital advertising spending on the Vision Pro in markets such as the US and UK. Apple sells the headset directly in 13 countries but has not expanded it to other markets by 2025. With a starting price of $3,499, the Vision Pro is considered too expensive by many. Critics have also pointed to the headset's weight, discomfort, and battery issues . The battery life is relatively short, and the number of available applications is limited.

According to data from Counterpoint Research, virtual reality Headsets are generally struggling to attract consumer interest, with the overall market size for the device shrinking by 14% year-on-year.

(Article source: Hafu Securities )