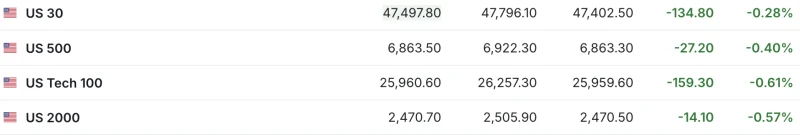

On January 2, the first trading day of 2026, the three major U.S. stock indexes closed mixed, with the Dow Jones Industrial Average up 0.66%, the S&P 500 up 0.19%, and the Nasdaq Composite down 0.03%.

In terms of sectors, large-cap tech stocks mostly declined, with Tesla among them. Tesla's stock price has fallen for seven consecutive trading days. In terms of news, according to CCTV News, on January 2nd local time, Tesla released data showing that it plans to deliver 1.636 million vehicles globally in 2025, a year-on-year decrease of approximately 8.6%. This marks the first time in Tesla's history that it has been surpassed by Chinese automaker BYD in annual electric vehicle sales. Surpass .

Chip stocks performed strongly, with the Philadelphia Semiconductor Index leading the way. The index rose 4.01%, Micron Technology ASML rose more than 10%. Intel shares rose more than 8%. TSMC rose more than 6%. The stock rose more than 5%, and AMD rose more than 4%.

Chinese concept stocks generally rose, Nasdaq The China Golden Dragon Index rose 4.38%, achieving a "good start." Among popular stocks, Baidu... The group rose more than 15%, Pony.ai GDS Holdings surged over 10%. Tiger Brokers rose nearly 10%. Jinko Solar surged over 9% Bilibili rose more than 8%. NetEase Alibaba rose more than 7%. Canadian Solar It rose by more than 6%.

precious metals In terms of commodities, spot gold rose 0.33% to $4,332.5 per ounce, while COMEX gold futures rose 0.02% to $4,341.90 per ounce. Spot silver rose 1.74% to $72.8 per ounce, while COMEX silver futures rose 2.35% to $72.27 per ounce.

In the international oil market, WTI crude oil futures for February delivery closed down 0.17% at $57.32 per barrel. Brent crude oil futures for March delivery closed down 0.16% at $60.75 per barrel.

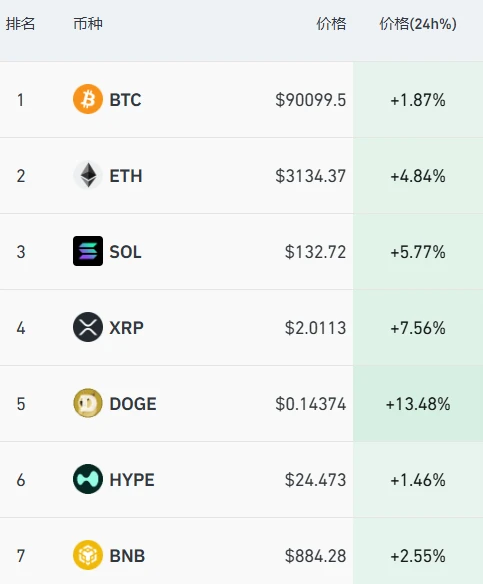

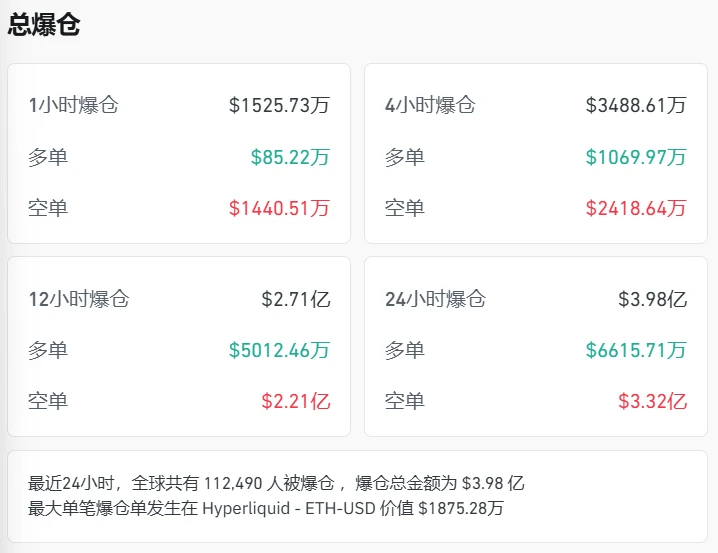

In the cryptocurrency market, several major currencies rose collectively, with Bitcoin regaining the $90,000 mark. In the past 24 hours, more than 110,000 people across the market were liquidated.

Foreign investors remain optimistic about Chinese assets. Goldman Sachs projected that by the end of 2025... JPMorgan Chase Morgan Stanley Several leading foreign investment institutions, including UBS, HSBC, and Deloitte, have released their 2026 market outlooks, all expressing positive expectations for the Chinese stock market. On December 22, Liu Jinjin, Chief China Equity Strategist at Goldman Sachs Research, and his team released a new report predicting that the Chinese stock market could achieve a 38% increase by the end of 2027.

Beyond an overall bullish outlook, foreign institutions have clearly outlined highly structured investment opportunities, with technological innovation being a core focus. BNP Paribas Asset Management emphasizes that China's technology sector has the greatest potential for profit growth, with its revenue largely derived from the service sector and less affected by trade policies.

In its outlook, UBS points out that opportunities in 2026 will be highly structured. The institution is particularly optimistic about three areas aligned with China's long-term development strategy: artificial intelligence... "Hard technologies" such as semiconductors and high-end manufacturing; green energy transformation industrial chain; and high-quality brands that benefit from the recovery of consumption.

"Judging from the inflow of foreign capital, the main destinations are high-quality Chinese assets, including some leading technology companies and dividend-paying stocks with high dividend yields. Overall, foreign investors are more focused on value investing," noted Yang Delong, chief economist at Qianhai Open Source Fund.

(Article source: 21st Century Business Herald)