Warren Buffett, the head of Berkshire Hathaway and known as the "Oracle of Omaha," bought Apple shares between 2016 and 2018. He bought the company's stock, which was arguably one of the wisest investment decisions of his career.

However, his sale of a large amount of Apple stock in 2024 and further reductions this year may now appear to be a regrettable mistake.

According to estimates, Berkshire Hathaway missed out on approximately $50 billion in potential gains due to Warren Buffett's decision to sell two-thirds of his Apple holdings as Apple's stock price surged on Monday .

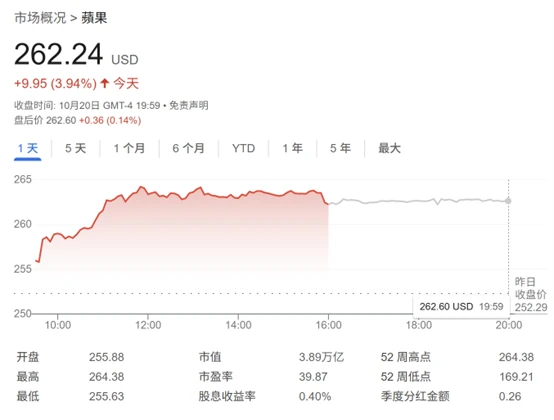

Apple shares surged on Monday as renewed optimism about iPhone sales pushed the stock to a new intraday high of $264.38. It closed up 3.94% at a record $262.24.

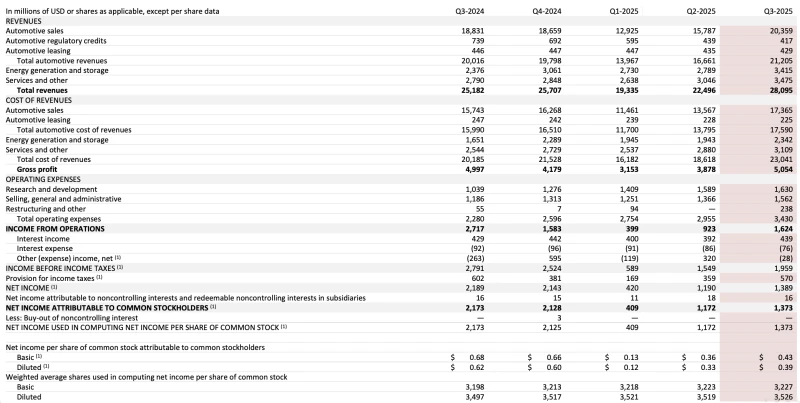

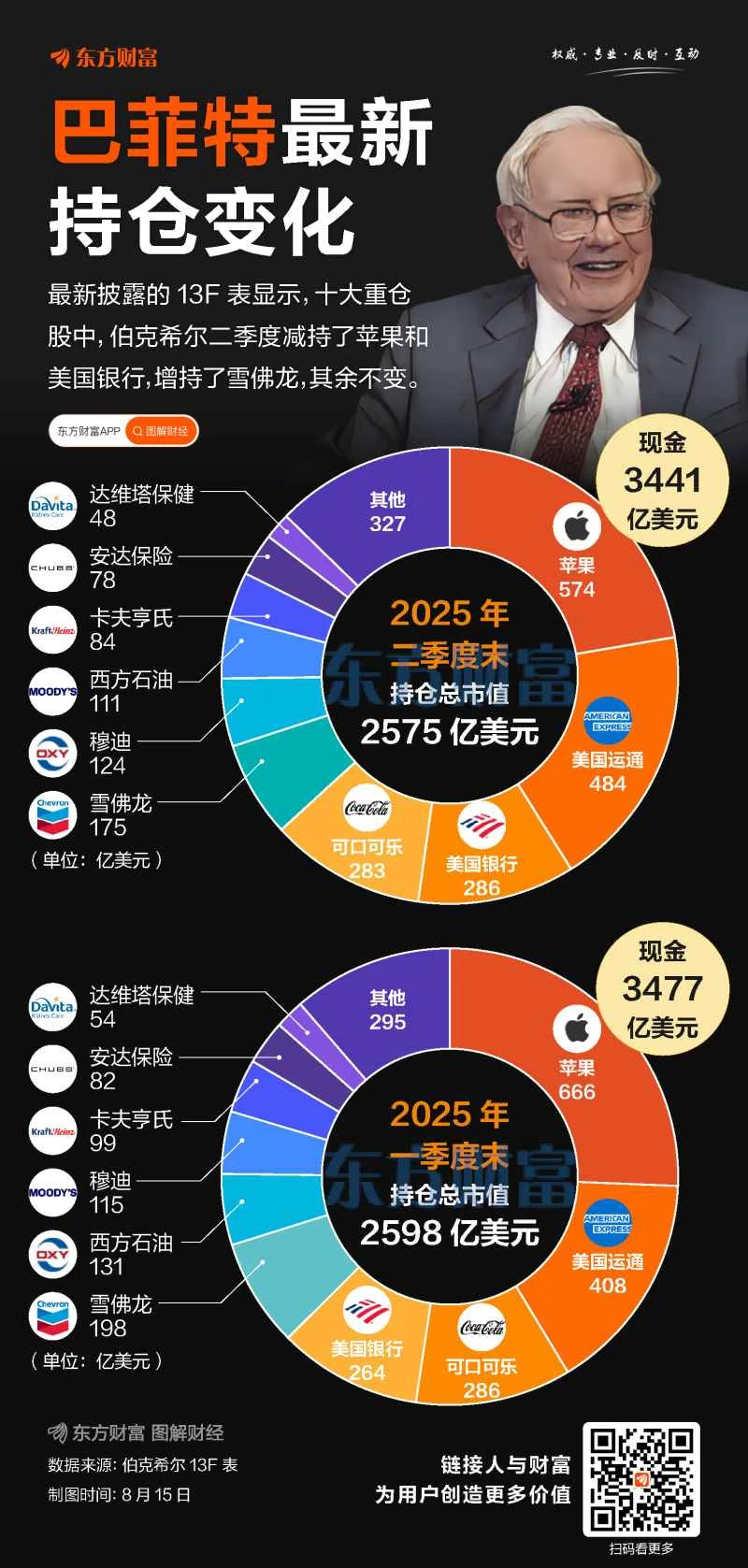

According to disclosures, as of June 30th this year, Berkshire Hathaway held 280 million shares of Apple stock, significantly lower than the 906 million shares held at the end of 2023. The majority of these sales occurred in the second quarter of 2024, with nearly 400 million shares sold during that quarter.

According to information disclosed by Buffett in his 2021 letter to shareholders, Berkshire Hathaway initially purchased a total of approximately 1 billion shares of Apple stock, primarily between 2016 and 2018, at an average purchase price of $35 per share.

It is estimated that Berkshire Hathaway sold Apple stock at an average price of about $185 per share. This transaction brought in more than $90 billion in pre-tax profits last year and about $6 billion so far in 2025.

However, Apple's current share price of around $262 (nearly $80 higher than the estimated average selling price) means that Berkshire Hathaway missed out on approximately $50 billion in gains by selling too early .

To make matters worse, Berkshire Hathaway will also have to pay corporate income tax on the sale of Apple stock, which is expected to be close to $20 billion, or about $30 per share.

Why did Buffett sell his Apple shares?

There is much speculation in the market about the reasons behind Buffett's reduction of his Apple stock holdings.

Warren Buffett himself hinted at the Berkshire Hathaway annual shareholders meeting last May that a possible increase in corporate income tax was a problem.

Some Berkshire Hathaway observers believe that Buffett reduced his Apple holdings because Apple's position was too large, accounting for more than 40% of Berkshire's total holdings. Currently, Apple's share in Berkshire's approximately $300 billion stock portfolio has decreased to nearly 25%.

There is also speculation that Buffett hopes to raise cash before stepping down as Berkshire Hathaway CEO at the end of 2025 to bolster the company's already massive balance sheet. As of June 30, Berkshire Hathaway held more than $330 billion in cash.

Given the strong performance of Apple's stock price, Buffett may further reduce his Apple stock holdings in the third quarter, and the relevant data will be presented in detail in the 13F report to be released in mid-November.

In any case, Berkshire Hathaway's move to reduce its Apple stock holdings was unexpected, because Buffett stated in his 2021 letter to shareholders that Apple stock was one of the four pillars of Berkshire Hathaway's value, the other three being insurance. Business, Utilities Business and railroad company BNSF. This statement previously suggested that Apple might follow in the footsteps of American Express. and Coca-Cola In that way, it becomes a "permanent holding" of Berkshire Hathaway.

Berkshire Hathaway Class A shares closed at $740,600 on Monday, up about 9% year-to-date, lagging behind the S&P 500's 16% gain over the same period. Analysts believe that declining Apple holdings may be one of the factors dragging down Berkshire's share price.

Further Reading

(Article source: CLS)