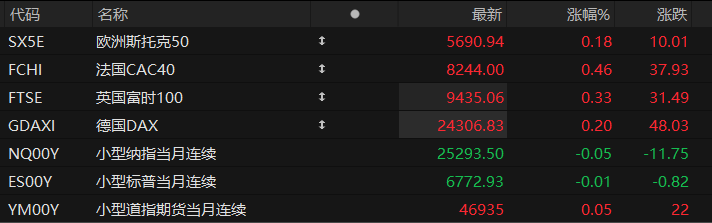

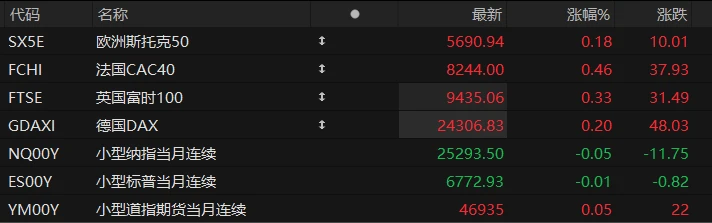

U.S. stock index futures were mixed in pre-market trading on Tuesday, while major European indices generally rose. As of press time, the Nasdaq... S&P 500 futures fell 0.05%, S&P 500 futures fell 0.01%, and Dow Jones futures rose 0.05%.

In terms of individual stocks, popular Chinese concept stocks generally fell, with Bilibili among them. Jike rose more than 6% in pre-market trading. XPeng Motors rose more than 2%. NetEase TSMC rose more than 1%. Tencent Music rose nearly 1%; Alibaba fell more than 2%. Hesai JD.com Kingsoft Cloud fell more than 1%. NIO Baidu It fell by nearly 1%.

In terms of earnings stocks, General Motors Coca-Cola shares surged over 10% pre-market after the company projected adjusted earnings per share of $9.75 to $10.50 for the current fiscal year, up from its previous forecast of $8.25 to $10. The stock rose nearly 3% in pre-market trading after third-quarter net revenue and earnings per share both exceeded expectations.

GE Aerospace The stock rose nearly 2% in pre-market trading; the company's third-quarter revenue is estimated at $11.31 billion, down from $10.4 billion; adjusted earnings per share are estimated at $1.66, down from $1.47.

Tobacco company Philip Morris shares rose more than 2% in pre-market trading. Third-quarter adjusted earnings per share were $2.24, below the estimated $2.11; third-quarter net revenue was $10.85 billion, below the estimated $10.66 billion.

Spot gold experienced a significant drop starting at 3 PM Beijing time on Tuesday, falling from a record high of $4,381 per ounce to below $4,200 as of press time. While there was no clear driving event, profit-taking at record highs , signs of easing geopolitical tensions, the end of seasonal buying in India, and a stronger US dollar all weighed on gold prices.

Regarding the future trend of gold, analysts say the key is to see if there are signs of waiting buyers entering the market. UBS commodities analyst Giovanni Staunovo explained, " In my view, many market participants have not yet participated in this rally; they are waiting for prices to fall before entering, which will limit the downside potential of gold prices. "

Spot silver fell more than 5%. Traders and analysts said that liquidity pressures in the London spot silver market have eased as overseas silver inflows have increased.

Hot News

What's driving this rebound in US stocks: short covering igniting the market rally?

The recent rebound in US stocks amid continued uncertainty reveals a force that cannot be ignored: it is not a recovery in market confidence, but a "short squeeze" triggered by short covering, which may be sending a false optimistic signal to the market.

The most direct evidence comes from Goldman Sachs. The group tracks a basket of the most heavily shorted U.S. stocks. The index has surged 16% this month, far exceeding the S&P 500's 0.7% gain over the same period, and is on track for its best October performance since records began in 2008.

This rebound, driven by short covering, is pushing the market higher, but its true nature may mask the market's real sentiment. With the Federal Reserve's interest rate decision scheduled for October 29th and the outlook for the Trump administration's trade agenda uncertain, the reliability of this technical rally is highly questionable. It may not be a true reflection of investor confidence in the stock market, but rather a reluctant surrender.

Will the Fed's decision next week contain a "policy bombshell"? Wall Street warns: QT may be urgently suspended!

Some Wall Street analysts now believe that the Federal Reserve will end its long-running quantitative easing (QT) balance sheet reduction program at the end of this month. These central bank watchers point out that the foundation for quantitative tightening has been shaken as increased friction in the money market could threaten the Fed's ability to control interest rates to achieve its inflation and employment goals.

Analysts believe that halting the withdrawal of liquidity through QT at the Federal Open Market Committee (FOMC) meeting on October 28-29 will help ensure the smooth operation of monetary policy from a technical perspective.

We expect the FOMC to conclude securities lending at its meeting this month. “Reduce holdings,” analysts at Wright-ICAP said in a report released last weekend. While they remain skeptical about whether there is a genuine liquidity crunch in the money market, recent volatility in some short-term lending markets “clearly serves as a sufficient warning sign to justify moving to the next phase of the Fed’s policy normalization.”

Jefferies analysts told clients, "We expect the Fed to completely halt QT at its meeting at the end of this month," but also noted that the Fed may allow such assets to continue maturing naturally at the current pace due to the slow pace of mortgage-backed securities sales caused by the severe housing market conditions.

This shift in expectations stemmed from market anomalies last week—key short-term lending rates rose as some financial institutions unexpectedly activated the Federal Reserve's Standing Repurchase Facility (SRFF), a facility designed to provide rapid cash loans secured by bonds.

Bank of America warns: If the credit crisis escalates, pension funds... Forced liquidation of index funds could become the next ticking time bomb in the US stock market.

Bank of America Strategists noted that signs of further tightening in the credit market could trigger a new round of sharp declines in U.S. stocks, as bullish investors such as pension funds may be forced to sell assets.

Savita Subramaniam, head of U.S. equity and quantitative strategy at Bank of America Securities , pointed out that if private lending remains sluggish, institutions such as pension funds may be forced to sell index funds to avoid punitive losses from downgrades in private asset valuations and to meet ongoing funding obligations. She emphasized that passive investing has "dominated the S&P 500 benchmark index," so an economic downturn will force funds tracking that index to collectively sell stocks.

US Stocks Focus

Pop Mart's overall revenue in Q3 increased by 245%-250% year-on-year, with overseas revenue increasing by 365%-370%.

With the global popularity of the Labubu series, Pop Mart achieved strong revenue growth in both mainland China and overseas markets in the third quarter. The Americas market performed particularly well, achieving explosive growth of over 12 times. On the 21st, Pop Mart announced that its overall revenue for the third quarter of 2025 increased by 245%-250% compared to the same period in 2024. Specifically, revenue in China increased by 185%-190% year-on-year, and overseas revenue increased by 365%-370% year-on-year.

In terms of channels, the growth rate of online channels in China (300%-305%) far exceeded that of offline channels (130%-135%), demonstrating the significant effectiveness of digital transformation. Looking at overseas markets, the Americas market experienced explosive growth of 1265%-1270%, Europe and other regions grew by 735%-740%, and the Asia-Pacific market grew by 170%-175%.

Even the "Oracle of Omaha" missed out on profits? Apple. Buffett missed out on $50 billion in gains as stock price hit a new high.

Warren Buffett, the head of Berkshire Hathaway and known as the "Oracle of Omaha," bought Apple stock between 2016 and 2018, which is considered one of the wisest investment decisions of his career.

However, his sale of a significant portion of his Apple stock in 2024, followed by further reductions this year, now appears to be a regrettable mistake. According to estimates, Berkshire Hathaway missed out on approximately $50 billion in potential gains due to Buffett's decision to sell two-thirds of his Apple holdings as Apple's stock price surged on Monday.

Apple shares surged on Monday as renewed optimism about iPhone sales pushed the stock to a new intraday high of $264.38. It closed up 3.94% at a record $262.24.

General Motors' Q3 results exceeded expectations, prompting the company to raise its full-year profit guidance.

General Motors reported Q3 revenue of $48.59 billion, exceeding market expectations of $45.26 billion; adjusted earnings per share were $2.80, exceeding market expectations of $2.27. The company projects full-year 2025 adjusted earnings per share of $9.75-$10.50, up from the previous forecast of $8.25-$10.00; and full-year adjusted EBIT is projected at $12-13 billion, up from the previous forecast of $10-12.5 billion.

General Motors' optimistic outlook reflects a surge in sales of its high-margin gasoline-powered SUVs and trucks, a trend partly driven by adjustments to U.S. federal emissions policies. The company stated that the mitigation measures are expected to offset approximately 35% of the tariff impact by 2025 due to the lower tariff base. The company also indicated that it is in a very favorable position as it increases its investment in domestic sourcing and manufacturing. As of press time, GM shares were up nearly 10% in pre-market trading on Tuesday.

Coca-Cola's Q3 results exceeded expectations; the company reiterated its 2025 guidance.

Financial reports show that Coca-Cola's Q3 revenue was $12.46 billion, better than the market expectation of $12.41 billion; adjusted earnings per share were $0.82, better than the market expectation of $0.78.

"We are confident in achieving our 2025 guidance while working toward our long-term goals," said CEO James Quincey. The company stated that it still expects to achieve 5% to 6% adjusted organic revenue growth in 2025, and 3% adjusted earnings growth from $2.88 per share in 2024. As of press time, Coca-Cola's shares were up nearly 3% in pre-market trading on Tuesday.

(Article source: Hafu Securities )