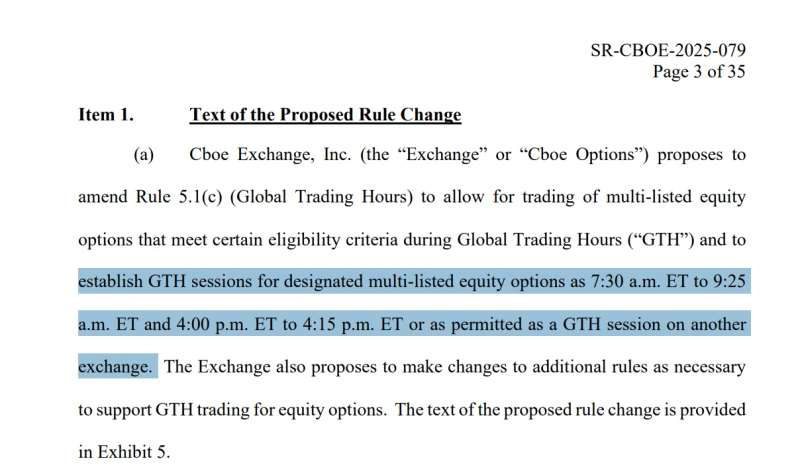

① In response to the rapid trend of the US stock market moving towards "24-hour trading," Cboe plans to advance the trading hours for US stock options to 7:30 a.m. and postpone them to 4:15 p.m. New York time; ② This marks the first step towards 24-hour trading in the US derivatives market.

In response to the trend of increasingly longer trading hours on global stock trading platforms, Cboe ( Chicago Board Options Exchange) , the largest options exchange in the United States, has... There are also new developments: extending the trading hours for US stock options.

According to Cboe's report to the U.S. Securities and Exchange Commission According to the filings with the SEC, the company is applying to add a pre-market session from 7:30 a.m. to 9:25 a.m. New York time, and a post-market session from 4:00 p.m. to 4:15 p.m., in addition to the regular trading session for U.S. stock options (9:30 a.m. to 4:00 p.m. New York time ).

This proposal aims to respond to the overall trend in the US stock market—as stock trading operators continue to extend trading hours, well-known US stocks are now able to trade 24/7. Cboe has therefore proposed expanding the trading hours for individual stock options to match the trading hours of the underlying stocks.

In recent years, US stock options trading volume has surged as retail traders have become increasingly active and the so-called "zero-day options" high-risk gambling craze continues to grow. According to data from an options clearing company, options trading volume in September of this year climbed to 1.29 billion contracts from 763 million contracts two years ago, an increase of 68% .

It's worth noting that Cboe only plans to offer extended trading services for a subset of options. The filing indicates that the exchange will select specific categories of stock options based on factors such as trading volume, market capitalization, and stock activity.

In a statement, the company said, "Offering options trading on select stocks during these extended trading hours will bring the options market more in sync with the underlying stock market, providing investors with greater flexibility to manage risk and adjust positions outside of traditional trading hours. Given that the market is evolving towards 24/7 trading, we believe this is a significant and crucial step. "

It is worth mentioning that Cboe proposed earlier this year to extend the trading hours of its stock exchange to Sunday evening through Friday evening, closing only on weekends .

In recent years, due to the increasing number of unexpected events affecting capital markets (or social media statements by certain political figures), investors' demand for "ready-to-trade" has grown significantly. Major exchanges and brokerages have responded to this trend by providing continuously extended trading hours for large public markets.

For example, brokerages such as Robinhood, the "home base" for US stock retail investors, are now able to conduct overnight trading through alternative trading systems such as Blue Ocean, which objectively enables uninterrupted buying and selling of US stocks "5 days a week, 24 hours a day".

To expand 24-hour trading to the New York Stock Exchange and Nasdaq Exchanges and other platforms need to update the systems of the Securities Depository and Clearing Corporation (DTCC) and the Securities Information Processor Operating Committees (SIPs).

The DTCC has announced that it will extend clearing hours for stock trading starting in the second quarter of next year. SIPs also plan to extend their trading hours to five days a week, nearly 24 hours a day.

(Article source: CLS)