Ed Yardeni, a senior Wall Street researcher, pointed out this week that falling oil prices could push the benchmark 10-year Treasury yield back to levels seen more than a year ago.

The founder of Yardeni Research stated that if oil prices continue to fall and the Federal Reserve cuts interest rates next week, the 10-year US Treasury yield could drop to 3.75%. His argument is based on the long-standing correlation between these two asset classes—the two asset classes can be linked through the impact of oil on inflation.

A report released by Yardeni Research on October 20th pointed out that the worsening oversupply of crude oil and concerns about a global economic slowdown have pushed the price of West Texas Intermediate crude oil to near its lowest point since the COVID-19 pandemic. This will help lower the CPI and boost consumer purchasing power.

This could further fuel the recent rally in US Treasury bonds – since the beginning of this month, market bets on a Federal Reserve rate cut and the performance of regional US banks have been increasing. The crisis has pushed up US Treasury prices, with the 10-year Treasury yield falling by about 18 basis points so far this month. Bond yields move inversely to prices.

Regarding oil prices, US WTI crude oil prices have fallen from a high of $80 per barrel in January to below $58 on Tuesday. Lower energy costs are expected to further ease inflationary pressures in the US and strengthen the case for further interest rate cuts by the Federal Reserve, which could provide more room for the current "Goldilocks"-like market to rise.

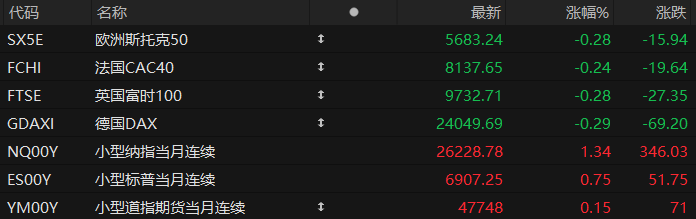

In fact, the rise in the US Treasury market this year can be said to have occurred during an unusual period in the market: US Treasury bonds and US stocks rose at the same time. This rare synchronization stemmed from traders betting that the economic slowdown would just be enough to curb inflation and prevent a recession.

U.S. Treasury prices rose for the second straight session on Tuesday, pushing yields lower, as investors continued to position themselves for the remainder of 2025 and the potential for multiple Federal Reserve rate cuts next year, despite a lack of clear market drivers. Officials are currently in a "blackout" period—temporarily prohibited from making public comments or speeches on monetary policy—ahead of the Fed's policy meeting next week.

Bond investors are also looking to Friday's U.S. September Consumer Price Index (CPI) report for clues as to whether inflation remains under control. According to the consensus forecast of economists surveyed by the media, the core CPI, excluding volatile food and energy items, is expected to rise 0.3% month-over-month, unchanged from August.

Vinny Bleau, Director of Fixed Income Capital Markets at Raymond James, said, “I still believe there is room for the bond market to rise, even if the economy is expected to continue growing in the near term.”

He added that the 3.85% low in April may be the lowest point for the 10-year Treasury yield this year. Looking ahead to next year, I think if the Fed continues to ease policy, the job market weakens further, or a combination of factors, the 10-year Treasury yield could fall to around 3.60% to 3.70%—the low reached in late September/early October last year.

(Article source: CLS)