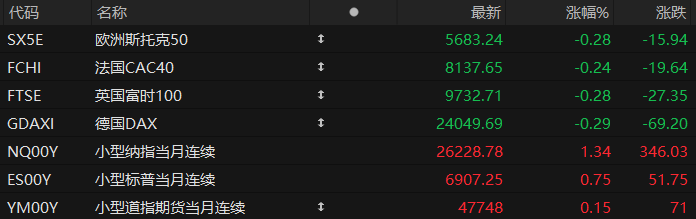

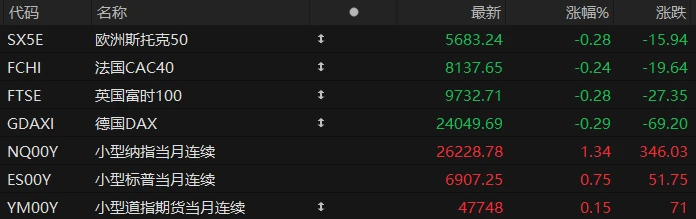

U.S. stock index futures rose across the board in pre-market trading on Friday, while major European indices generally fell. As of press time, the Nasdaq... S&P 500 futures rose 1.34%, S&P 500 futures rose 0.75%, and Dow Jones futures rose 0.15%.

In terms of individual stocks, large-cap tech stocks collectively strengthened, with Amazon leading the gains. Apple shares surged over 13% in pre-market trading after the company released its third-quarter results. Nvidia Up over 2%, Meta, Google, and Tesla Netflix rose more than 1%. The stock rose more than 3% in pre-market trading after the company announced a 1-for-10 stock split plan.

Two cryptocurrency-related stocks surged after earnings reports, with Strategy jumping nearly 6% and Coinbase gaining nearly 5%. Data storage stocks also strengthened in pre-market trading, with Western Digital leading the gains. Sandisk Corporation shares rose more than 3% at one point, with the stock price surging over 12%.

Popular Chinese concept stocks generally fell in pre-market trading, with Alibaba among them. JD.com fell nearly 2% Baidu Bilibili Li Auto It fell by more than 1%.

Starting November 3rd (next Monday), due to the US entering winter time, US stock trading hours will be delayed by one hour, with the intraday trading session changing to 22:30 to 05:00 Beijing time. Furthermore, starting next week, the release times of important US economic data such as CPI and non-farm payrolls will be delayed by one hour compared to daylight saving time. The adjusted US stock trading hours are as follows: pre-market trading is 17:00-22:30 (Beijing time), and intraday trading is 22:30-05:00 (Beijing time).

Hot News

Goldman Sachs CEO: If economic growth fails to improve, the US will face a round of debt liquidation.

Goldman Sachs CEO David Solomon said that if the U.S. economy fails to grow, rising debt levels will pose a risk of "liquidation" to the economy.

In an interview on Thursday (October 30), Solomon said, "If we continue on the current path without increasing economic growth, we will face a reckoning. The way out is to achieve economic growth." However, he believes the possibility of a recession in the short term is "very low."

Solomon's views align with widespread concerns on Wall Street that the U.S. and other Western economies are "addicted" to debt-driven stimulus measures, a situation that has worsened since measures implemented during the COVID-19 pandemic fueled a surge in consumer spending.

The US national debt has now surpassed $38 trillion, marking the fastest accumulation rate outside of the pandemic. Since the 2008 financial crisis, the national debt has increased by more than $7 trillion, and the pandemic has further accelerated government borrowing. Although Solomon warned of the risks of US debt, he reassured the public that the US economy is in "generally good shape" and believes that the possibility of a recession is small.

US Vice President Vance: If the government shutdown continues, American Airlines Traffic will face a "disaster".

U.S. Vice President Vance warned on Thursday that the U.S. airline industry could face widespread chaos if the government shutdown continues into the Thanksgiving holiday travel peak. He called on Democrats to provide the necessary votes to pass a temporary funding bill and restart government operations.

Vance met with executives from airlines such as American Airlines and United Airlines, union representatives, and other industry figures at the White House. He stated that if the government shutdown extends to the end of November, it could lead to more employee absenteeism, significantly increasing security check lines and flight delays.

Vance warned, "This could be a disaster, it really could. By then, people will have missed three paychecks. Just imagine how many people will simply stop coming to work?"

Delta Air Lines United Airlines, Southwest Airlines Several airlines, including American Airlines, are urging Congress to pass an unconditional continuing resolution (CR) as soon as possible to get the government running again before slowly negotiating on issues such as healthcare.

Jensen Huang: The AI industry has entered a "virtuous cycle," and the global trillion-level computing power infrastructure is just beginning.

Nvidia CEO Jensen Huang said on Friday that artificial intelligence The AI industry has entered a virtuous cycle, driving the entire industry to achieve sustained growth.

At the APEC CEO Summit held in South Korea that day, Huang Renxun pointed out that the rapid progress of AI models is attracting more capital investment, and these investments are further promoting the iterative optimization of models, forming a mutually reinforcing growth cycle.

"We have now achieved what is known as a virtuous cycle. AI is becoming more and more powerful, and there are more and more users. The more users, the higher the profits; the higher the profits, the more factories will be built, thereby producing more advanced AI; better AI will attract more users, which is the virtuous cycle of AI. This is also why you are seeing accelerated growth in global capital expenditure."

Huang's remarks come at a time when global tech giants are racing to increase investment in AI infrastructure to meet the needs of end users.

This year was originally considered a big year for AI investment. Meta, Amazon , Google, Microsoft... The four giants combined this year in AI and data centers Investment has already exceeded $350 billion, and this spending momentum is expected to continue until 2026. Goldman Sachs' latest estimates suggest that global AI infrastructure investment will reach a cumulative $3 to $4 trillion by 2030.

US Stocks Focus

Nvidia announced "big news": it will supply more than 260,000 AI chips to South Korea. !

US Semiconductor Nvidia announced on Friday that it will supply more than 260,000 of its most advanced artificial intelligence (AI) chips to the South Korean government and several major South Korean companies, including Samsung Electronics . This represents Nvidia's latest expansion in South Korea.

The South Korean government plans to invest in artificial intelligence infrastructure using more than 50,000 of Nvidia's latest chips, while Samsung Electronics, SK Group, and Hyundai Motor Group will each deploy up to 50,000 AI chips in smart factories in the semiconductor and automobile manufacturing sectors.

memory chip Samsung Electronics will build an "AI factory" housing over 50,000 Nvidia chips. Meanwhile, Hyundai Motor has pledged to use a similar number of processors based on Nvidia's Blackwell architecture. These chips will be used to develop Hyundai's AI models and help advance manufacturing and autonomous driving technologies.

Previously, Nvidia had reached a series of high-profile AI chip deals globally, including in countries such as the UAE and Saudi Arabia, which helped it become the first company in history to surpass a market capitalization of $5 trillion on Wednesday.

Jensen Huang had twice previewed his visit to South Korea on Tuesday and Thursday, stating that he would announce some major news with South Korean companies during his visit. Previous speculation suggested it would be related to the semiconductor industry, so the market wasn't surprised. However, boosted by the news, Nvidia's stock price still rose by about 2% in pre-market trading on Friday .

Bank of America analysts: Amazon 's new AI chip is expected to unlock billions of dollars in revenue.

Amazon has made significant progress in its major foray into artificial intelligence with the official launch of its Rainier supercomputer, powered by nearly 500,000 Trainium 2 chips.

The new Rainier system marks a significant turning point for Amazon Web Services, enabling the company to better meet the growing demand for artificial intelligence training and inference. Analysts predict that this growth in demand will generate billions of dollars in revenue for the company by 2026.

Bank of America Securities The company's analyst, Justin Post, maintained a "buy" rating on Amazon and predicted that its stock price would reach $272.

As of the close of trading on Thursday (October 30), Amazon's stock price closed at $222.86 per share. However, after the close of trading, thanks to Amazon's strong earnings report, its stock price rose by more than 13%.

Full transcript of Apple's earnings call: Is the Chinese market poised for a recovery, and is a "double strongest" quarter in history on the horizon?

After the market closed on Thursday Eastern Time, Apple held its earnings call for the fourth quarter of fiscal year 2025 (ending September 27), where CEO Tim Cook and CFO Kevin Parrek jointly disclosed the company's latest performance.

Overall, Apple performed strongly across multiple key metrics this quarter, with continued efforts in new product iterations and technological innovation, while also providing a clear plan for future development, injecting confidence into the market.

Cook is optimistic about Apple's performance in the current quarter (ending December), expecting total revenue to grow by 10%-12% year-over-year, with iPhone revenue expected to achieve double-digit growth, both of which are expected to be the best quarter in history.

In the long term, Apple plans to invest $600 billion in the United States over the next four years, focusing on areas such as advanced manufacturing, chip engineering, and AI.

In the Chinese market, although revenue in Greater China declined by 4% year-on-year in the fourth fiscal quarter, this was mainly due to iPhone supply constraints, and actual store traffic has rebounded significantly. Cook stated that the iPhone 17 series has received a positive market response, and the company expects the Chinese market to resume growth in the next quarter.

The landscape of the "AI battle" has changed dramatically: Alphabet is highly praised while Meta is relegated to the sidelines. Why?

This week, the four largest U.S. tech companies—Alphabet (Google's parent company), Microsoft , Meta, and Amazon—all announced plans to accelerate capital spending in the field of artificial intelligence (AI). However, investors reacted differently, cheering for Alphabet while leaving Meta and Microsoft "on the sidelines."

By the close of trading on Thursday, Meta's stock price had fallen more than 11%, and Microsoft's stock price had also fallen by about 3%, as investors remained concerned about the time it would take to recoup their massive investments. Meanwhile, Alphabet's stock price dramatically surged 2.45%.

Some analysts point out that a key reason for this "divergence" is that Alphabet is able to balance its soaring spending with its strong cash flow.

"I think reducing the proportion of capital expenditures in revenue and cash flow will play a role," said Dave Heger, senior equity analyst at Edward Jones. "This might reassure investors. All companies are increasing spending significantly, and people are very worried about the pressure on free cash flow."

In the quarter ending September, Alphabet's capital expenditures totaled $23.95 billion, representing 49% of its operating cash. However, Meta's figure was 64.6%, and Microsoft's was even higher at 77.5%.

Synovus Trust portfolio manager Dan Morgan said that companies with strong cash flow are able to invest more aggressively in AI infrastructure because they can afford the lower returns on these expenditures.

(Article source: Hafu Securities )