After the US stock market closed on November 19, chip giant Nvidia... Once again, they shocked Wall Street with a "shocking" financial report.

In the third quarter of fiscal year 2026 (ending October 26, 2025), Nvidia's revenue surged 62.5% year-over-year, and net profit increased by 65% year-over-year. (Data Center) Nvidia's quarterly revenue surpassed $50 billion for the first time. Its stock price surged 5% in after-hours trading that day.

Wedbush Securities Analyst Dan Ives told the Daily Economic News reporter that this is a "champagne-popping moment." He believes this earnings report will fuel a bullish outlook on artificial intelligence. The argument for revolution provides a "major positive catalyst".

However, beneath this impressive performance, some potential risks have begun to emerge.

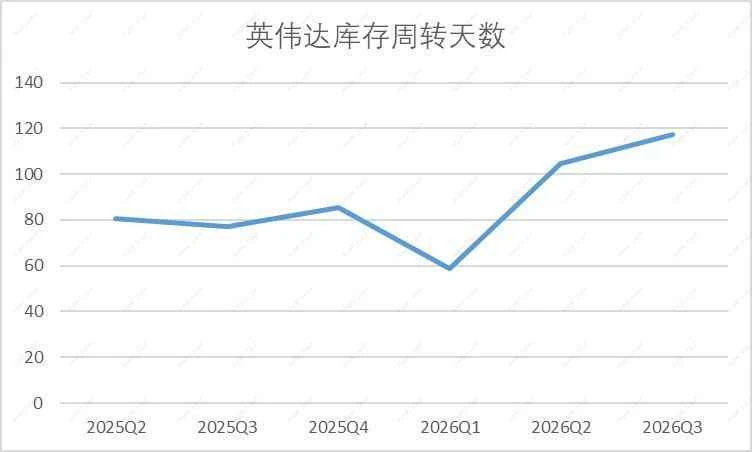

A review of Nvidia's financial reports over the past seven quarters by NBD reporters reveals a consistent increase in accounts receivable and an excessively high customer concentration. Furthermore, according to data platform Discounting Cash Flows, Nvidia's Days Inventory Outstanding (DIO) has been steadily climbing over the past few quarters, currently standing at 117.5 days, higher than the five-year average.

As the only analyst to publicly give Nvidia a "sell" rating, Seaport Global Securities analyst Jay Goldberg told the NBD reporter that the stock's "downside risks far outweigh its upside potential."

Revenue and profit both increased by more than 60% year-on-year; Huang Renxun: We have entered a virtuous cycle in AI.

In the third quarter of fiscal year 2026, Nvidia's revenue reached $57.01 billion, a year-on-year increase of 62.5%, significantly higher than the market expectation of $55.1 billion to $55.45 billion; net profit was approximately $31.9 billion, a year-on-year increase of 65%.

The strong revenue growth was primarily driven by the explosive growth of its data center business. In the quarter, Nvidia's data center revenue reached a record high of $51.2 billion, representing a 66% year-over-year increase and a 25% quarter-over-quarter increase.

In addition to its data center business, Nvidia's gaming... The business also performed well, with revenue of $4.26 billion in the quarter, up 30% year-over-year, benefiting from strong market demand for the RTX 50 series products.

In the earnings report, Nvidia founder and CEO Jensen Huang stated, "Blackwell chip sales far exceeded expectations, and cloud GPUs are sold out. Demand for training and inference computing continues to grow exponentially. We have entered a virtuous cycle in artificial intelligence . "

During the earnings call, Jensen Huang also directly refuted the AI "bubble" theory. He stated that there has been a lot of discussion about an AI bubble recently, but Nvidia sees something very different . Nvidia's products, unlike other accelerators, are suitable for use at every stage of artificial intelligence , including pre-training and post-training.

This earnings report is undoubtedly a shot in the arm for investors who are optimistic about the prospects of AI. Wedbush Securities analyst Dan Ives told the National Business Daily reporter, "As market concerns about an AI bubble intensified and put pressure on tech stocks, tonight was a moment of champagne for both the market and tech stocks." He believes that Nvidia's solid earnings and guidance are "another validation of the AI revolution" and asserts that "concerns about an AI bubble have been greatly exaggerated."

For the next fiscal quarter, Nvidia gave a revenue guidance of $65 billion, which far exceeded the general analyst expectation of $61.7 billion and even exceeded the upper limit of some optimistic investors' expectations.

Dan Ives described the upward revision of the guidance as "astounding." In his view, this report will have a significant impact on Microsoft . Google, Amazon Oracle bone script This is beneficial for large-scale cloud service providers and software companies such as Palantir, and will drive the entire semiconductor industry. The sector is trending upward.

Accounts receivable have risen for seven consecutive quarters; analysts say Nvidia's downside risks outweigh its upside potential.

However, a review of Nvidia's financial reports over the past seven quarters by NBD reporters revealed that Nvidia's accounts receivable have been steadily increasing, and its customer concentration is excessively high.

Data shows that Nvidia's accounts receivable reached $33.391 billion in the third fiscal quarter, with accounts receivable from its four largest direct customers accounting for 65% of the total. In the fourth fiscal quarter of 2025, the top two direct customers will account for 33% of accounts receivable.

This deep reliance on a small number of customers means that if these major customers change their capital expenditure (Capex) plans, Nvidia's future order and revenue stability will be directly impacted.

A deeper concern is the actual market demand for Nvidia's products. Recently, Nvidia's "circular transaction" model—investing in customer companies and then having those companies purchase its chips—has sparked widespread discussion.

For example, Nvidia announced a $10 billion investment in Anthropic, which will in turn purchase $30 billion worth of AI computing power services powered by Nvidia chips. Goldman Sachs It was estimated that 15% of Nvidia's sales next year could come from such transactions.

In an interview with NBD, Seaport Global Securities analyst Jay Goldberg pointed out: "I am increasingly worried about end-user demand because many of their customers are borrowing more and more money through increasingly complex financing methods."

Goldberg believes the market has reason to worry whether Nvidia is artificially "creating demand" through indirect subsidies or complex debt structures, rather than responding to genuine market demand.

He revealed a key detail to the reporter from National Business Daily: "Many 'neoclouds' claim that their computing power is sold out, but I know some smaller cloud service providers are not achieving 100% utilization. If the utilization is really 100%, why do they need 'backstops' in their sales agreements with Nvidia ?" The so-called "backstops" are Nvidia's commitment to purchase a certain amount of computing power capacity when selling products to new cloud customers.

Jay Goldberg, the only analyst to publicly give Nvidia a "sell" rating, said: "I believe that the downside risk for Nvidia stock outweighs the upside potential."

Inventory turnover days are higher than the 5-year average.

Another warning sign is inventory data.

Financial reports show that as of the end of the third fiscal quarter, Nvidia's total inventory rose to $19.784 billion. According to data platform Discounting Cash Flows, Nvidia's inventory turnover days (DIO) has now reached 117.5 days, compared to 58.64 days in the first quarter of fiscal year 2026.

This level is not only 13 days higher than the company's average over the past five years , but also highly unusual for a company that claims its high-end products are in "short supply." In the semiconductor industry, a steady increase in inventory days is generally seen as a leading indicator of potentially slowing demand or a shift in the supply-demand relationship.

External supply chain bottlenecks could also constrain Nvidia's growth.

Jay Goldberg told the reporter from National Business Daily that despite CoWoS's advanced packaging and high-bandwidth memory... Supply chain constraints such as (HBM) are easing, but remain a constraint on delivery.

More importantly, Goldberg stated, "In the US and Europe, electricity is a major issue that could potentially cause delays in future data center construction." This means that even if Nvidia can produce enough chips, it remains uncertain whether downstream customers can build enough data centers to accommodate them.

Several institutions have already "withdrew".

Before Nvidia released its earnings report, some of the world's top investors had already "withdrew".

According to a 13F filing with the U.S. Securities and Exchange Commission (SEC), Thiel Macro Fund, the fund managed by "Silicon Valley venture capital godfather" Peter Thiel, sold off all of its Nvidia shares in the third quarter. Thiel had previously warned on multiple occasions that the hype surrounding artificial intelligence far exceeded its actual economic viability, comparing it to the dot-com bubble of 2000.

Coincidentally, Bridgewater Associates, one of Wall Street's largest hedge funds, also significantly reduced its Nvidia holdings by nearly two-thirds during the same period.

In addition, SoftBank Group sold all of its Nvidia shares in October.

The coordinated actions of these institutional investors indicate that beneath the surface of the AI boom, a "risk-averse portfolio rebalancing" is underway.

Bank of America The latest monthly Fund Manager Survey (FMS) report shows that over 50% of fund managers surveyed by Bank of America believe that "artificial intelligence stocks are already in a bubble." Meanwhile, about 45% believe that the "AI bubble" poses the biggest tail risk to the market and the global economy, up from 33% last month.

(Source: Daily Economic News)