A sudden negative news report.

On October 21, Texas Instruments , the world's largest analog chip manufacturer, TXN.US released its third-quarter earnings report and made a pessimistic forecast for the fourth quarter. In pre-market trading today, the company's stock price fell by more than 9%, and as of press time, the decline was still over 8%.

It's worth mentioning that Lam Research and Intel will also be participating this week. Two chip companies, AMD and Nvidia, released their quarterly reports. The quarterly report will not be released until November. Regarding semiconductors... Regarding the future prospects, analysts believe that the industry will become more differentiated, while the prospects of leading companies are more certain.

Texas Instruments' earnings exceeded expectations, but its outlook remains pessimistic.

According to the company's third-quarter report, the performance exceeded market expectations. The company achieved revenue of $4.742 billion in the quarter, a year-on-year increase of 14% and a quarter-on-quarter increase of 7%, higher than the market expectation of $4.65 billion; operating profit increased by 7% year-on-year to $1.663 billion; earnings per share increased by 1% year-on-year to $1.48, slightly lower than the market expectation of $1.49.

By category, the company's revenue from analog chips increased by 16% year-on-year to US$3.729 billion, and operating profit increased by 13% year-on-year to US$1.486 billion; revenue from embedded processing chips increased by 9% year-on-year to US$709 million, and operating profit decreased by 1% year-on-year to US$108 million.

However, in a recent earnings statement, Texas Instruments management indicated that it expects total revenue for the fourth quarter to be between $4.22 billion and $4.58 billion, with the midpoint of the range falling short of the average Wall Street analyst estimate of approximately $4.5 billion. Furthermore, the company projects a median earnings per share of approximately $1.26 for the fourth quarter (estimated to be between $1.13 and $1.39), compared to the Wall Street average estimate of $1.39.

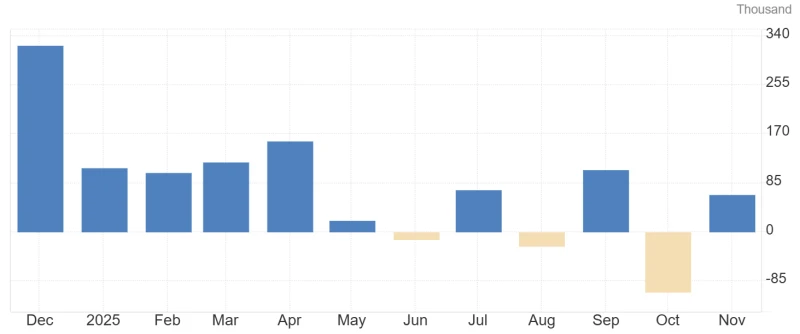

Following the pessimistic earnings guidance, the company's stock price plummeted by more than 8% in after-hours trading. Three months ago, Texas Instruments' stock price also experienced its worst single-day drop in 17 years, falling 13%, after releasing a similarly pessimistic earnings forecast.

"The recovery across the semiconductor market continues, but at a slower pace than in previous phases—this is likely related to the broader macroeconomic environment and overall uncertainty," said CEO Haviv Ilan in a conference call with analysts. He noted that industrial customers are taking a "wait-and-see" approach to scaling up their plants due to the uncertainty surrounding potential tariffs imposed by the U.S. government.

Nvidia and others focus on artificial intelligence Unlike other chips, Texas Instruments is the world's largest analog chip company and a crucial MCU chip manufacturer, whose products are widely used in automotive, industrial, communications, and consumer electronics. Industries such as healthcare.

Following the release of the financial report, Morgan Stanley Barclays lowered its price target for Texas Instruments from $192 to $175. This comes just before the earnings release. bank A report maintains its "underweight" rating on Texas Instruments stock. The report notes the continued weakness in the industrial and automotive market recovery and the risk of further significant downgrades. The Barclays report also suggests that the analog chip industry may face not only cyclical adjustments but also a structural contraction in the total addressable market (TAM).

Bank of America Downgrade ratings of several chip stocks

Texas Instruments' pessimistic outlook has also fueled investor skepticism about the chip sector's prospects. Bank of America recently downgraded several chip stocks. Among them, Bank of America lowered its rating on Intel from "neutral" to "underperform," while maintaining its target price of $34. Analysts point out that Intel's recent $80 billion market capitalization increase has fully reflected expectations of improved balance sheets and external foundry potential. However, analysts also emphasize that Intel's competitive outlook remains challenging, including a lack of a clear artificial intelligence (AI) product portfolio or strategy, insufficient competitiveness of its server CPUs, and reduced flexibility in divesting loss-making manufacturing businesses compared to the past.

Bank of America also downgraded Texas Instruments' rating from "neutral" to "underperform," lowering its price target from $208 to $190. Analysts pointed out that despite the company's high asset quality and stable execution, global tariff volatility could dampen demand recovery in the industrial sector in the short to medium term. Furthermore, unlike some of its peers, Texas Instruments has benefited only to a limited extent from the current AI capital expenditure cycle.

Bank of America downgraded GlobalFoundries (GFS.O) from "Neutral" to "Underperform," with a price target of $35. Analysts stated that the downgrade reflects their assessment of short-term macroeconomic headwinds for GlobalFoundries, while also adjusting earnings forecasts that were slightly below market consensus. Analysts believe the $35 price target implies limited upside potential from current share price levels. While no specific trigger for an immediate price drop is currently apparent, analysts point out that the company needs to demonstrate faster gross margin improvements and stronger pricing power than it has over the past two years to change the market's wait-and-see attitude.

At the same time, Bank of America also raised its application materials. (AMAT.O), KANT Technology The rating of (CAMT.O) was revised upwards, and target prices for several other companies were also raised.

Barclays ' report maintains that the AI investment cycle is still in its early stages, but the bank is adopting a more selective strategy towards companies directly exposed to AI. The report recommends that investors concentrate their AI exposure on large, leading companies such as Nvidia and Broadcom. On Broadcom and AMD.

(Source: Securities Times) (Times)