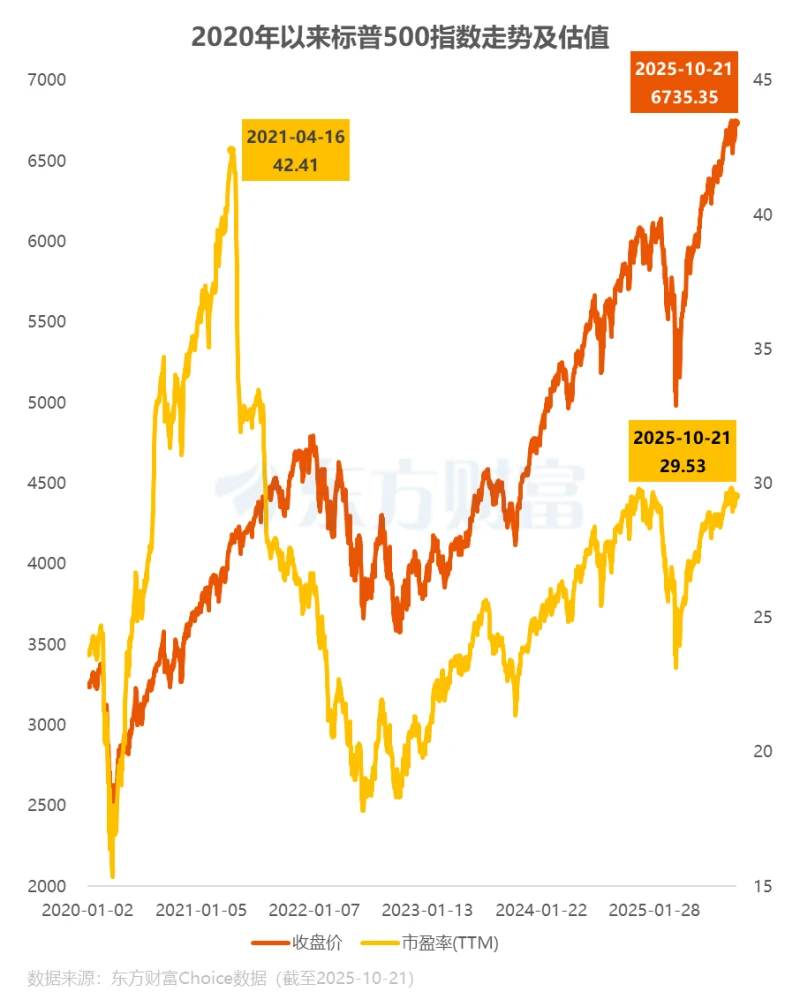

In the blink of an eye, the US stock market bull run is nearing its second year, and the S&P 500... The CSI 500 index is poised for another double-digit gain. Artificial intelligence. AI appears to be an unstoppable driving force in this, but Bank of America... Bank of America warns that unique risks are emerging.

Since the lows of October 2022, most of the market’s gains have been driven by an unbridled enthusiasm for artificial intelligence , with companies pledging to implement massive capital expenditure plans, supporting investors’ bullish views.

Bank of America analysts also acknowledge that the risk of an artificial intelligence bubble has increased, but the obstacles to the continued rise of the US stock market seem to go far beyond that, and they have listed five major risks.

Five major risks

A team of Bank of America analysts, led by Savita Subramanian, points out that the S&P 500 appears somewhat expensive by historical standards, with valuations even higher than during the tech boom of the 1990s. While they acknowledge that the companies driving this index's growth appear to have stronger financials and less debt, they still see some risks that investors should not overlook.

First, the team believes that signs of a bear market are emerging, despite the seemingly strong market growth.

Subramanian states that historically, when 70% of the warning signals appear, the market tends to peak, leading investors into a bear market. So far, 60% of the signals the bank tracks have already materialized.

“Indicators that have underperformed in the past few months include high price-to-earnings ratios and credit metrics,” they added.

Secondly, analysts say the boom in artificial intelligence is not keeping pace with consumer adaptability.

In their view, the rise of artificial intelligence could force companies to lay off more white-collar workers who have helped drive strong consumer spending. To account for this risk, they recently downgraded their rating on the consumer discretionary sector in the stock market.

Third, the “Gordion knot” between mega-cap stocks, private companies, and the U.S. government is brewing risks.

Gordis was the king of Phrygia in Asia Minor during the Greek mythological period, famous for the legend of creating the "Gordian Knot." He tied an intricate knot on his oxcart, its beginning and end indistinguishable, and placed it in the Temple of Zeus, prophesying that whoever untied it would rule Asia. Centuries later, Alexander the Great... In 334 BC, the Great Emperor cut the knot with his sword, solving the problem in an unconventional way. This story gave rise to the idiom "cutting the Gordian Knot," which became a symbol of solving complex problems with decisive means.

“Uncle Sam buying stocks is nothing new, but more often it’s for bailouts than strategic investments. Similarly, there’s no inherent risk, and it could be a net bullish move—a new, potentially long-term, U.S. stock buyer—but that adds complexity,” Bank of America noted.

Fourth, analysts point out that macroeconomic uncertainty poses significant risks. The "macroeconomic fog" surrounding the impact of tariffs, coupled with the lack of new data during the government shutdown, has led investors to make blind investments.

“In October, trade tensions escalated again, the US government shut down, and economic data was affected. Limited visibility may have caused economic activity to stagnate, which is precisely what hindered the recovery of economic activity in the second/third quarter,” they added.

Fifth, and finally, the bank commented on recent concerns in the private lending sector, calling them "canaries and cockroaches," referring to comments made last week by JPMorgan CEO Jamie Dimon regarding several high-profile bankruptcy cases.

Last week, two regional banks The report highlighted borrower problems, exacerbating concerns about credit.

Bank of America analysts wrote: “ The banking sector is performing well, and we are cautiously optimistic, but recent credit events suggest that ‘more’ cockroaches may be on the horizon. In our view, regulated banks are better capitalized and therefore more vulnerable to the credit cycle, but the S&P 500 may be vulnerable for a strange reason: liquidity.”

Further Reading

(Article source: CLS)