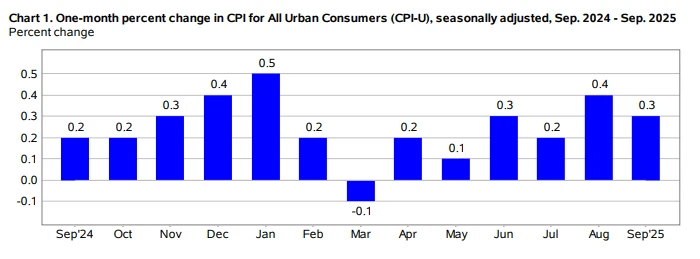

The runaway US stock market has finally come to a halt, as escalating US-China trade tensions and the impact of regional US banks... The "explosive financial news" has become one of the two major obstacles hindering the continued rise of US stocks, and the effect of OpenAI's numerous large cooperation deals is gradually diminishing. However, judging from last week's market performance, investors' willingness to go long remains relatively strong. Before the Fed's interest rate decision at the end of this month, as long as US President Trump does not take too aggressive and risky actions on trade issues, US stocks are unlikely to experience a major correction.

However, in our view, US stock valuations were already at a relatively high level, and with a series of risks gradually emerging, investors are proceeding with greater caution. Although financial stocks got off to a good start in the recent earnings season, for tech giants, the previous market enthusiasm may have already priced in their positive earnings, and the upside potential after the earnings reports may be relatively limited.

This edition of "Top 50 US Stocks" features Alibaba , a leading Chinese technology company. BABA Group. From its earliest days as a foreign trade website to its current presence encompassing e-commerce and cloud computing. As a comprehensive platform integrating local services and global business, Alibaba has become deeply embedded in the daily lives of Chinese people and a key player in the global digital economy. A key player in the industry. Taobao and Tmall make consumption more convenient, Alibaba Cloud supports the digital transformation of countless enterprises, and businesses such as Cainiao, Ele.me, and Gaode Maps are constantly enriching the entire ecosystem.

Against the backdrop of a global AI boom and a consumer recovery, Alibaba is entering a new phase of growth. Its core e-commerce business is steadily recovering, while cloud computing and artificial intelligence are also driving growth. With continued business expansion and gradual opening up of international markets, the company's ample cash reserves, stable profitability, and ongoing share buyback program provide it with a solid foundation amidst market uncertainties. For long-term investors, this company, which once reshaped China's business landscape, is embarking on a new journey.

[Company Profile]

Alibaba Group Holding Limited (US stock code: BABA), founded in June 1999 and headquartered in Hangzhou, Zhejiang Province, China, is one of China's leading technology and business groups, both domestically and globally. It began as a B2B export platform, expanding through e-commerce platforms such as Taobao and Tmall, developing cloud computing and technology services, and entering the new retail sector. Its expansion from local life services and digital media has gradually developed into a comprehensive platform group covering retail, technology infrastructure, content and services.

Alibaba's vision emphasizes making it easy to do business anywhere, and it has always positioned itself as a technology-driven, ecosystem-based enterprise. In terms of corporate governance, its board of directors and management structure are mature, and in recent years it has frequently taken action in strategic transformation and organizational restructuring to cope with changes in domestic and international markets and regulatory environments. Its business layout has a deep penetration in both China and international markets, while it invests heavily in AI, cloud computing, and infrastructure, attempting to seek new growth drivers within a platform + technology + ecosystem model.

According to the latest disclosure, Alibaba has tens of thousands of employees worldwide (including the entire group and its subsidiaries), and its customers range from individual users, e-commerce merchants, and SMEs to large companies and governments/institutions. It is one of the important pillar enterprises of China's digital and internet economy.

【Scope of Services】

Alibaba's business structure is quite diversified and can be roughly divided into the following main segments, which work together and support each other:

1. China's commerce/core e-commerce

This is Alibaba's most traditional, and still largest, business segment, which mainly includes:

Taobao/Tmall/Juhuasuan/Alimama (Advertising/Customer Management/Marketing Services): Provides C2C/B2C retail platforms, merchant back-end systems, advertising placement, content promotion, and other services.

China Commercial Wholesale/Supply Chain Services: Providing wholesale/procurement/distribution support and supply chain services for businesses.

This segment boasts relatively high profit margins and stable cash flow, making it the main driver of the group's revenue. It exhibits a strong profit leverage effect, particularly in advertising, customer management, and platform service fees.

2. International Business/ Cross-border E-commerce

Alibaba competes in the global market through multiple international platforms, including:

AliExpress: A retail platform targeting overseas consumers.

Lazada, TrendYol, and others: Regional e-commerce platforms with operations in Southeast Asia, Türkiye, and other regions.

Alibaba.com: Cross-border/B2B wholesale trading platform

This sector faces challenges such as logistics, tariffs, localization, and foreign exchange fluctuations. In recent years, Alibaba has invested significant resources in these countries and regions, hoping to achieve new economies of scale through global expansion.

3. Cloud/Technology Infrastructure/AI

Centered around Alibaba Cloud/Cloud Intelligence Group, this is a key business that Alibaba has been focusing on in recent years. The products/services offered include:

Public cloud/hybrid cloud/private cloud infrastructure services

Database/ Big Data /Storage/Computing/ Network Security /CDN /AI Platform and Model Services

AI-related capabilities (training, inference, model management, etc.) can be integrated into other businesses as value-added services.

Alibaba views cloud computing and AI as the levers for future profit growth and drivers of valuation reassessment.

4. Local services/ New retail /Instant services

This section includes:

Hema/ New Retail Project: An integrated online + offline shopping experience

Ele.me/Local Instant Delivery/Community Commerce: Providing users with faster local delivery services.

Gaode Maps/Local Services Platform: Location/Navigation/Life Services Portal

Local services require high capital and efficiency, but if the scale and operational efficiency are sufficient, it can become a promising growth point.

5. Digital Media/Content/Entertainment/Advertising

The company operates film and television, video platforms (such as Youku), music/content platforms, and advertising/traffic monetization businesses through subsidiaries/business lines. This segment accounts for a small percentage of overall revenue, but its synergy with e-commerce/ecosystem entry points can enhance user stickiness and content -driven growth. .

6. Innovation/Other Businesses/Investment Segments

Alibaba also maintains a presence and investment in areas such as health technology, digital finance (although Alipay belongs to the Ant Group system, Alibaba and Ant are closely related), new business incubation, overseas investment, and logistics/smart supply chain.

Summary of revenue structure:

Alibaba's revenue still primarily comes from its e-commerce business (platform transactions + customer management/advertising/platform service fees), but the proportion is gradually shifting towards cloud/international business/local services/new retail and other businesses . Cloud/AI is seen as a high-yield strategic lever that can boost valuation in the future.

Note: Selected financial data from the first fiscal quarter report of fiscal year 2025.

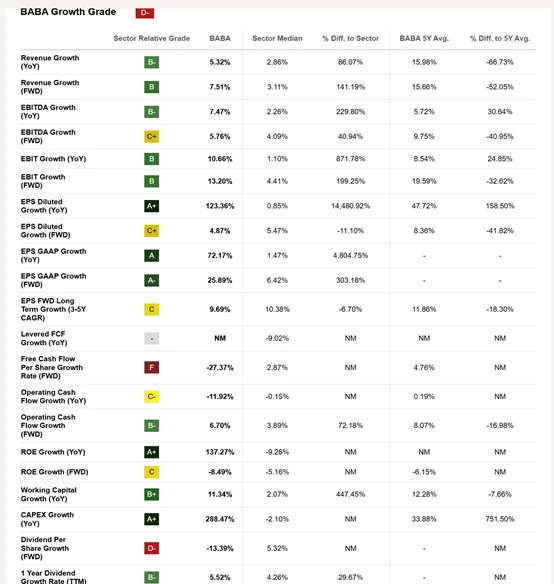

Financial Status

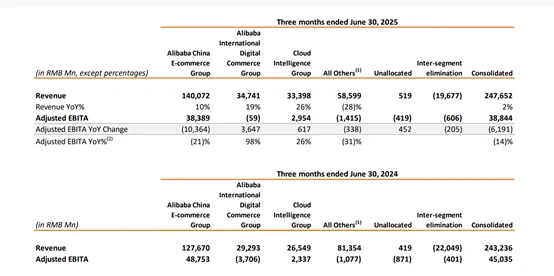

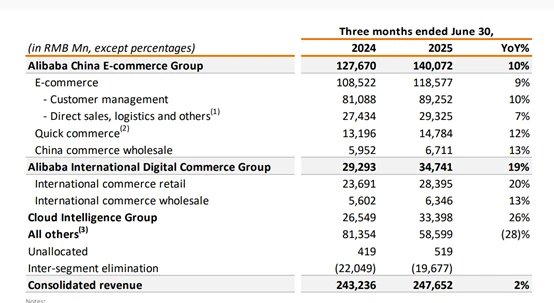

In the first quarter of fiscal year 2025 (ending June 30, 2024), Alibaba Group achieved revenue of RMB 248.42 billion, a year-on-year increase of 4%, slightly below market expectations; adjusted net profit was RMB 46.08 billion, a year-on-year increase of 10%. Core e-commerce business remained the main driver, with Taobao and Tmall Group revenue reaching RMB 114.5 billion, a year-on-year increase of 4%, benefiting from increased user activity and a steady recovery in advertising spending. Alibaba Cloud Intelligence Group's revenue reached RMB 27.7 billion, a year-on-year increase of 3%. Although the growth rate slowed, it benefited from increased demand for AI training and inference, and its public cloud and enterprise solutions business continued to grow. The International Digital Commerce Group (including Lazada, AliExpress, Trendyol, etc.) achieved revenue of RMB 28.6 billion, a year-on-year increase of 36%, becoming the Group's fastest-growing segment, reflecting Alibaba's expansion momentum in the global e-commerce market. Cainiao Logistics' revenue reached RMB 26.1 billion, a year-on-year increase of 8%, driven by a recovery in demand for international logistics services. Overall, although the recovery in domestic consumption was limited, the robust performance of international business and cloud computing enabled Alibaba to maintain profit growth in a complex macroeconomic environment.

Note: Revenue data for each business segment in the first fiscal quarter report.

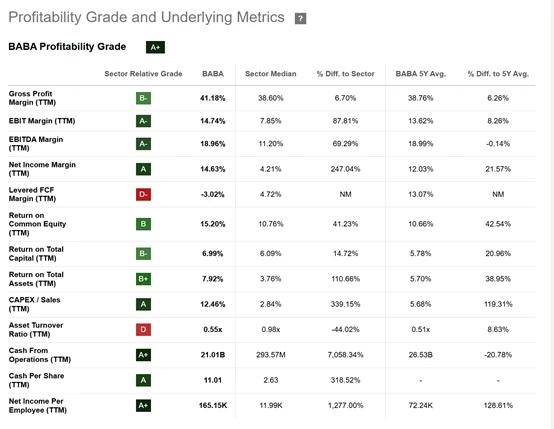

From a profit structure perspective, adjusted EBITDA for this quarter was RMB 45.7 billion, a year-on-year increase of 5%, with profit margins remaining at a high level. Operating cash flow was RMB 49.5 billion, a year-on-year increase of 14%, reflecting the company's continued strong cash generation capabilities. The Group continued to promote its shareholder reward policy, having repurchased approximately US$3.8 billion worth of shares by the end of the quarter. Notably, following its independence restructuring, Alibaba Cloud has begun to focus on high-value customers and AI infrastructure development, becoming a potential growth driver for the future.

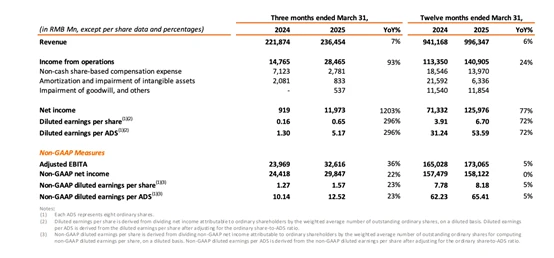

In fiscal year 2024, ending March 31, 2024, Alibaba Group achieved annual revenue of RMB 940.24 billion, a year-on-year increase of 8%; adjusted net profit was RMB 161.1 billion, a year-on-year increase of 10%. Taobao and Tmall remained the core revenue generator, accounting for over 45%, with revenue increasing by 5% year-on-year, demonstrating a recovery driven by a rebound in consumption. Alibaba International Digital Commerce Group (AIG) saw a 46% year-on-year revenue increase, becoming a new growth engine for the company; Alibaba Cloud's annual revenue reached RMB 82.1 billion, a year-on-year increase of 3%, gradually recovering momentum after restructuring its large customer base. Cainiao's annual revenue reached RMB 111.3 billion, a year-on-year increase of 13%, with its international expansion driving the continued expansion of its cross-border logistics business.

In fiscal year 2024, Alibaba's operating cash flow reached RMB 183.4 billion, and free cash flow reached RMB 148.1 billion, demonstrating a sound financial structure and net cash reserves exceeding RMB 500 billion. Over the past year, the company continued organizational restructuring and asset streamlining, promoting the independence of its six major business groups to enhance operational flexibility and market valuation. Overall, after undergoing strategic restructuring, Alibaba has entered a phase of steady recovery, with international business and cloud computing becoming the dual growth engines for the future, while its core e-commerce business remains the cornerstone of profits.

[Strong Reasons]

1. Cloud computing and AI form a structural moat, driving Alibaba to become a superpower in China's AI field.

Alibaba is undergoing a fundamental transformation from an e-commerce platform to an AI infrastructure company. It is one of the very few companies in China that possesses a complete technology stack encompassing chips, cloud computing power, large-scale models, and industry applications. This transformation begins with its self-developed AI chips . From providing cloud computing power to training and open-sourcing its own large-scale model Qwen3-Omni, Alibaba has covered almost all key levels of the artificial intelligence industry. This vertical integration capability gives it extremely strong ecosystem control in the future AI wave.

It's worth noting that Alibaba not only boasts a deep technological foundation but also understands how to monetize through openness. Its open-source strategy has successfully attracted hundreds of thousands of developers to the Model Studio and PAI ecosystem, achieving a commercial cycle through the synergy of computing, tools, and vertical industry solutions. Even with restrictions on GPU exports, Alibaba maintains high performance and high profit margins thanks to its self-developed chips and optimized software stack. This hardware-software synergy is becoming a long-term technological moat for the company.

with Nvidia The collaboration between Omniverse and Isaac Robotics further injects new momentum into the cloud business. The integration of simulation tools into Alibaba Cloud gives the company a key voice in the multi-billion dollar markets of future humanoid robots , autonomous driving, and industrial simulation. By entering the industrial training sector through a "shovel-selling" model, Alibaba can continuously benefit from the entire Chinese AI manufacturing ecosystem.

2. The core e-commerce business has recovered, and user stickiness and monetization capabilities have significantly improved.

After two years of restructuring, Alibaba's core e-commerce business has returned to a growth trajectory. In fiscal year 2025, revenue increased by 6% year-on-year, operating profit increased by 24%, and Taobao customer management revenue increased by 12%. Instant retail, with its "Taobao Instant Deals" feature, increased transaction frequency, while the synergy between Gaode Maps and Ele.me significantly improved the revenue quality of local services and advertising businesses.

This recovery is not simply a rebound in GMV, but rather an optimization of the profit structure. The expansion of the membership system, the linkage of points and benefits, and AI-driven personalized recommendations are all increasing repurchase rates and customer value. Alibaba is refocusing on user lifetime value rather than short-term transaction volume, making its consumer ecosystem more sticky and profitable. As Chinese consumer confidence recovers and the e-commerce industry returns to a healthy competitive environment, Alibaba is poised to solidify its dominant position in this reshuffling.

3. Financial soundness and shareholder returns form a solid safety net.

Financial data demonstrates Alibaba's strong safety margin: As of June 2025, the company held approximately RMB 586 billion in cash and cash equivalents, with low leverage and controllable capital expenditures. The company is implementing a three-year AI and cloud capital plan totaling RMB 380 billion, while continuing to conduct share buybacks and has clearly expressed its intention to resume annual dividends.

This strategy of pursuing both growth and returns provides strong support for valuation recovery. Management's disciplined fund allocation has regained market trust, implying higher future earnings potential. With the ramp-up of AI business, consumption recovery, and improved profit margins, shareholders will simultaneously enjoy the dual benefits of EPS growth and exponential expansion.

4. The closed-loop effect of full-stack AI + e-commerce collaboration in the industry

Alibaba hasn't limited AI to mere technology demonstrations; instead, it has directly embedded AI into its e-commerce, logistics, and advertising operational systems. For example, AI algorithms have optimized search ranking, supply chain forecasting, and content distribution, significantly improving traffic efficiency and inventory turnover. In advertising recommendations and live-streaming e-commerce, Alibaba's generative models have increased conversion rates, delivering quantifiable commercial returns. This AI-driven business flywheel gives Alibaba a unique advantage in the competitive landscape.

AI not only improves the efficiency of core businesses but also feeds back into cloud computing and data intelligence services. Enterprise customers, after using Alibaba's AI tools, often further purchase cloud computing power or API services, creating natural cross-selling. This internal, self-generating synergy gives Alibaba's AI ecosystem the potential for self-sustaining growth and is a key source of continued future profit margin increases.

5. Internationalization and vertical industrial expansion bring compound growth potential.

While domestic consumption is recovering, Alibaba's international business has become a new profit lever. International retail revenue grew by 19% year-on-year in fiscal year 2025, nearing break-even. This inflection point signifies that its globalization strategy is beginning to reap the rewards. Southeast Asia, the Middle East, and Europe are becoming important sources of growth, while the cross-border expansion of AI and cloud services is bringing even higher profit margins.

The deeper potential lies in cross-industry penetration. Leveraging its cloud and AI capabilities, Alibaba is gradually entering high-barrier sectors such as intelligent manufacturing, fintech, and urban transportation, forming a vertical extension from the consumer internet to the industrial internet. Compared to peers that rely on only a single business, this multi-dimensional growth model can smooth out cyclical fluctuations, improve overall resilience, and provide a stronger foundation for long-term valuation.

Valuation

From a multi-dimensional perspective, Alibaba's current valuation is in a typical bottom repricing range. Although its stock price has rebounded significantly in the past few months, its market capitalization still falls far short of reflecting the qualitative changes in its business structure. Whether measured by traditional price-to-earnings ratio (P/E), comparable company analysis, or the discounted cash flow (FCF) model, BABA's valuation is significantly lower than it should be and has room for further expansion.

Alibaba's current forward P/E ratio is approximately 21-22 times, roughly equivalent to its median valuation over the past five years. However, over the past five years, the company has faced multiple pressures, including regulatory scrutiny, uncertainty surrounding its spin-off, and a weak macroeconomy. Now, its fundamentals have reached a turning point—cloud computing has returned to double-digit growth (+26% YoY), AI products have maintained triple-digit growth for eight consecutive quarters, and international retail is nearing breakeven. Given the significant improvement in performance quality and the optimization of its profit structure, maintaining the median multiple is clearly conservative.

Historically, Alibaba maintained a forward P/E ratio of 25-28 times during its pre-pandemic period of profit growth. Assuming a compound annual growth rate of approximately 10-12% in earnings per share (EPS) over the next two years, and that the market is willing to reassess it with a reasonable valuation multiple of 25, its market capitalization would rise to approximately $500-560 billion. This aligns with multiple reports predicting a market capitalization target exceeding $500 billion within 12 months.

In a horizontal comparison, Alibaba's current valuation still lags significantly behind that of similar global technology platforms. This is true even for companies like Microsoft, which is driven by AI and cloud computing. (MSFT), Amazon Both AMZN (Alibaba's parent company) and MercadoLibre (MELI), primarily an e-commerce company, have average forward P/E ratios in the 2025 fiscal year range of 28–35. Even considering the macroeconomic discount in China and regulatory risks, Alibaba's current valuation discount of approximately 50–70% still appears excessive.

With continued fundamental recovery and a rebound in international investment sentiment, the market is expected to gradually repric these Chinese technology assets that demonstrate proven profitability, strong cash flow, and technological drive. If the discount range narrows from the current 70% to 40%, the corresponding fair value multiple will rise to 28–30 times P/E, implying a market capitalization of approximately $520 billion–600 billion. This means that Alibaba's share price still has approximately 25–35% upside potential.

From a cash flow perspective, Alibaba boasts RMB 586 billion in cash and cash equivalents, while maintaining a healthy free cash flow generation capability. According to research reports, the substantial investment in AI and cloud capital expenditures has not eroded cash reserves but rather laid the foundation for high ROIC growth over the next few years. Assuming a neutral assumption of 8-10% CAGR in free cash flow over the next three years, and using an FCF discount rate of 6-8% (aligning with the average risk premium of leading Chinese technology companies), its reasonable market capitalization range is approximately US$450-550 billion.

This range aligns closely with the conclusions reached using the price-to-earnings ratio and the comparable company approach, indicating that Alibaba's valuation is primarily supported by its ability to generate continuous cash flow, rather than by one-off policy changes or sentiment-driven factors. With the accelerated commercialization of its AI cloud services, the growth rate of its cash flow (FCF) may even further increase, providing a significant safety margin for the current valuation.

Combining these three valuation perspectives, a relatively consistent conclusion can be drawn: Alibaba is currently in the middle of its revaluation cycle. A market capitalization in the range of $450 billion to $600 billion is reasonable, driven by three core factors: optimized profit structure and exponential growth from cloud and AI businesses; robust cash flow from e-commerce and international businesses; and the amplifying effect of share earnings per share on share through share buybacks and dividend mechanisms.

In other words, BABA's investment logic is shifting from discount repair to a revaluation driven by earnings growth. With the realization of AI cloud industrialization, stable growth in consumer business, and enhanced capital returns, the valuation increase is supported by fundamentals rather than a speculative bubble. This kind of valuation expansion, centered on earnings quality and cash generation, is often more sustainable and achievable.

Brant, Chief Analyst at Chinese Investment Network, shares his views.

The correction in US stocks came somewhat hesitantly, but the overall trend is unstoppable. Recently, several US financial institutions have experienced defaults, including JPMorgan Chase. Jamie Dimon, CEO of [Company Name], stated that when you see one cockroach, there are likely many more lurking. Everyone should be vigilant about this. Therefore, our outlook for the market is bearish.

Alibaba is an undervalued Chinese AI giant with a world-class big data model. Considering factors such as Jack Ma's return to China and the bottoming out of the Chinese economy, Alibaba is our most favored Chinese concept stock. The stock has undergone a relatively sufficient short-term correction, and technically, it remains a good buy on dips.

The recent correction in US stocks is already a sign of impending doom, and investors should reduce their positions to mitigate the impact of a market downturn. Even for sectors they are optimistic about, it's not advisable to allocate too much capital, as market corrections often involve a general sell-off, potentially creating opportunities to buy at lower prices.

(Article source: CLS)