US tech stocks plunged this week, and cryptocurrencies also wiped out their gains from the previous 10 months within a month. What exactly happened?

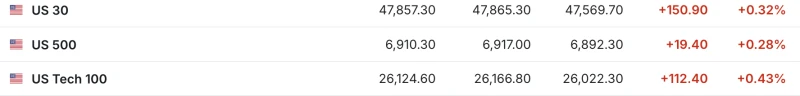

As of November 7, the Nasdaq, dominated by technology stocks... The index fell more than 3% in a single week, marking its worst weekly performance since April; the S&P 500 fell 1.6% during the week, ending a three-week winning streak.

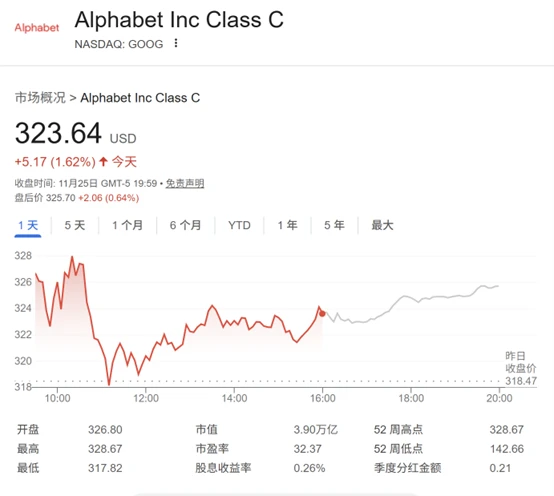

The combined market capitalization of the eight leading companies most closely associated with AI evaporated by approximately $800 billion (about 5.698 trillion yuan) , related to artificial intelligence . Nearly $1 trillion in market value has been wiped out by U.S. companies closely associated with the boom.

Among them, Nvidia, which had just become the world's most valuable company a little over a week ago. This week, it fell by more than 7%, and its market value shrank by about $350 billion;

Microsoft The stock price fell by more than 4%, wiping out over $150 billion in market value.

Oracle bone script It fell nearly 8%, resulting in a market capitalization loss of over $66 billion.

Regarding other AI concept stocks, Duolingo Palantir fell more than 11%, and Broadcom fell more than 24%. It fell by more than 5%, and Meta fell by more than 4%...

In terms of news, AI-generated scams have recently attracted widespread attention again.

According to CCTV News, Meta has been exposed for making huge profits from a massive amount of fraudulent advertising. A May 2025 report by Meta's security department estimated that approximately one-third of successful fraud cases in the United States are linked to Meta.

How long can the US stock market's AI "myth" last?

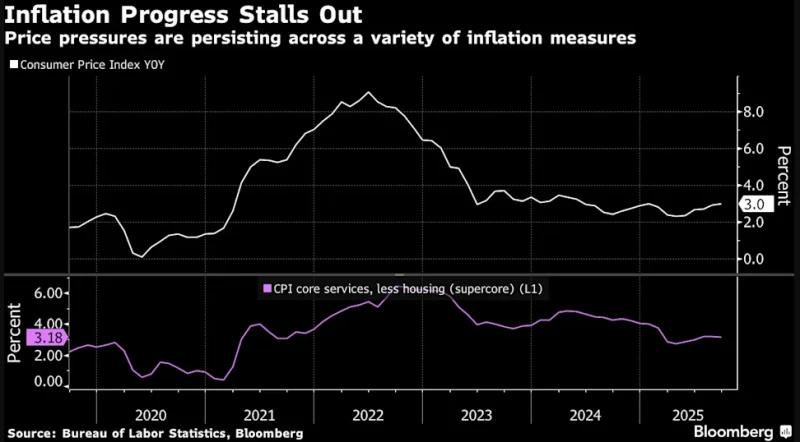

After a strong rally in global stock markets driven by the artificial intelligence boom and expectations of interest rate cuts, investor concerns about high valuations are rapidly intensifying, triggering a general market correction, with technology stocks bearing the brunt of the sell-off.

Currently, a consensus is emerging in the US regarding the risks: the AI myth in the US capital markets is unsustainable . First, the market recognizes that the US AI myth is built on "uncertainty," meaning that all US companies are betting on building artificial general intelligence (AGI), a costly approach with no definite development path. A survey indicates that 95% of US companies using generative AI have not profited from the technology. A narrative-driven bubble has formed. Data shows that AI-related spending in the US has contributed more to US GDP growth than the total of all consumer spending.

Market concerns are growing that a bubble could burst at any moment. Michael Burry, the "big short" who accurately shorted the US housing market before the subprime crisis, is now positioning himself to short the US AI bubble. He suggests that current overspending and low returns will ultimately cause many leading companies in the AI boom to collapse.

Another factor undermining US investor confidence is competition from China. The US industry has recognized that nearly half of the world's AI talent comes from China, and therefore, China will leverage its talent advantage to win the long-term competition with the US. Furthermore, unlike the US investment in uncertain AGI (Artificial Intelligence of Things), China's AI has taken a pragmatic "industry application-driven" approach, giving it a cost-effectiveness and application advantage when competing in other global markets.

Recently, Goldman Sachs With Morgan Stanley They believe that global (US) stock markets may experience a 10% to 20% correction in the next 1-2 years due to the tech stock bubble , but they are optimistic about the Chinese stock market, especially in areas such as artificial intelligence, electric vehicles, and biotechnology.

Furthermore, Goldman Sachs Chairman and CEO David Solomon stated that even market pullbacks of 10% to 15% are quite common in market cycles. Investors should not easily shake their long-term capital allocation mindset due to short-term fluctuations.

Cryptocurrencies have erased 10 months of gains in the past month.

It's worth noting that on November 7th, the cryptocurrency market experienced a sharp decline, with Bitcoin briefly falling below the $100,000 mark again. In just over a month, the cryptocurrency market has almost wiped out all the gains accumulated in the first 10 months of the year.

As of 16:39 on November 9, major cryptocurrencies such as Bitcoin and Ethereum continued to fall, with trading volume plummeting by 40% to 50% in the past 24 hours, and more than 130,000 people across the market being liquidated .

This large-scale liquidation event caused many investors to lose both their profits and principal overnight. With liquidity and confidence collapsing, buying became noticeably more cautious.

Charles Edwards, founder of digital asset hedge fund Capriole Investments, noted that for the first time in nearly seven months, institutional demand for Bitcoin has fallen below the rate of new coin mining. This suggests that large buyers may be backing down, and other activities as a whole show a clear risk-averse sentiment.

(Article source: 21st Century Business Herald)