In recent weeks, as gold prices have repeatedly hit new highs, many investment gurus have stated that the rapid rise in gold prices is out of control. Even though gold prices have fallen sharply in the past two days, they still believe that the long-term bull market for gold is not yet over.

Kevin Smith, who manages the $420 million Crescat Capital hedge fund, has been bullish on gold since 2019, when prices were below $1,500 an ounce. He noted that gold prices have fallen 6.5% in the past two days, briefly approaching the $4,000 an ounce mark, "but it's still worth buying. " enter".

The driving force behind the price surge

Investors' concerns about the ever-expanding budget deficit are just the latest driving force pushing them into gold, a traditional safe haven. With gold prices repeatedly hitting new highs, it has recently attracted more speculative demand from retail investors. However, long-term investors like Smith see this week's pullback as a healthy correction, saying that many of the factors driving prices higher remain intact.

“There is no doubt that it has surpassed itself. Given that the United States and most developed countries still have unsustainable debt and deficit imbalances, this remains a very favorable fundamental backdrop,” he said.

One factor supporting the sustained rise in gold prices has long been the large-scale gold purchases by central banks around the world. Most believe this was the reason gold prices broke through $3,500 last month. It is also widely believed in the industry that central bank gold purchases will prevent prices from falling too quickly as short-term investors withdraw from the market.

“Weaker investors—institutional and retail investors—have actually only been in the market for about six weeks. This rally is largely thanks to strong investors,” said Ross Norman, an industry veteran who runs the pricing and analysis website Metals Daily. “I think some of the weaker investors have definitely been weeded out by now.”

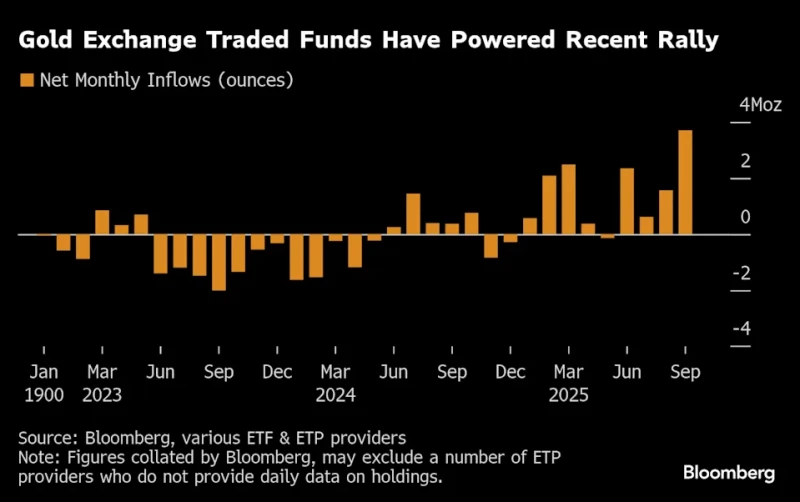

According to data compiled by the media, gold holdings in exchange-traded funds (ETFs) increased by 4.2 million ounces over the past five weeks, reaching nearly 100 million ounces, continuing the growth momentum since the end of May. However, since the financial crisis, global central banks have been steadily increasing their gold reserves, doubling their pace of purchases after the US and its allies froze Russian assets in 2022.

UBS Group (UBS Group AG) Precious Metals Andrew Matthews, head of distribution, said that since the outbreak of the Russia-Ukraine conflict, "we have seen a significant change in central bank buying behavior, and since then, they have clearly become key potential long-term buyers in the market, and we believe this will continue."

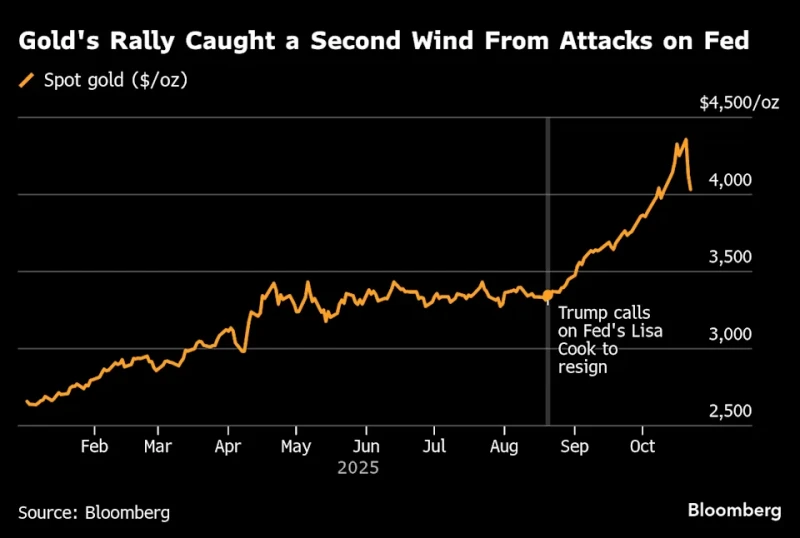

This year, US President Trump's aggressive moves to reshape global trade, coupled with heightened geopolitical uncertainty, have fueled the gold price rally. The prospect of Federal Reserve interest rate cuts has also boosted gold's appeal relative to non-interest-bearing assets, while Trump's threats to central bank independence have further enhanced gold's appeal as a safe-haven asset.

This was followed by “devaluation trading,” a broad term referring to the exodus of investors from sovereign debt and its denominated currencies due to concerns about their depreciation over time. This led to a greater role for retail investors in recent months. Inflows into gold ETFs, popular with both Western institutional and retail investors, surged, and options trading volume also increased significantly.

The bull market is not over yet.

For Jerry Prior, CEO of Mount Lucas Management, a $1.7 billion hedge fund, the long-term drivers for gold are “firmly rooted here.” He expects gold prices to fluctuate within a narrow range, potentially falling to around $4,000, before rebounding on safe-haven demand and economic data.

While this week's pullback is significant for a stable asset like gold, it only brought prices back to levels seen just over a week ago. Gold prices are still rising this month and have gained approximately 55% year-to-date.

UBS commodities strategist Giovanni Staunovo said the sell-off was likely "some form of consolidation, with a significant drop, but currently at a one-week low."

“I still believe the structural reasons for gold’s rise remain, but some form of consolidation could be beneficial for gold, ” he said.

(Article source: CLS)