Tesla The company released its earnings after the market closed on Wednesday, reporting a 12% year-over-year increase in third-quarter revenue to $28.1 billion, ending two consecutive quarters of decline. Market expectations were for $26.37 billion. Automotive revenue rose 6% year-over-year to $21.2 billion from $20 billion in the same period last year.

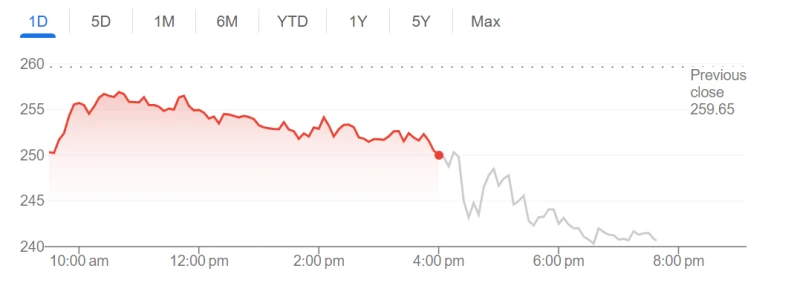

As of press time, Tesla shares were down 3.16% in after-hours trading.

The end of the third quarter coincided with the expiration of the U.S. federal electric vehicle tax credit—a policy that was repealed following a spending bill signed by President Trump. Before the expiration, consumers rushed to purchase vehicles to take advantage of this tax credit, causing some Tesla sales to be realized earlier this quarter. Earlier this month, Tesla... The company announced record-breaking third-quarter vehicle deliveries of 497,099 units; total vehicle production for the quarter was 447,450 units. However, cumulative deliveries for the first three quarters of 2025 are projected to be approximately 1.2 million units, a decrease of about 6% compared to the same period in 2024.

Net income for the quarter fell 37% year-over-year to $1.37 billion (39 cents per share) from $2.17 billion (62 cents per share) in the same period last year.

Tesla stated that the decline in net profit was due to two factors: lower electric vehicle prices and a 50% year-on-year increase in operating expenses, with the increased expenses partly related to artificial intelligence. And related to "other research and development projects".

In the last fiscal quarter, Tesla 's regulatory credit revenue fell to $417 million from $739 million in the same period last year, a year-on-year decrease of 44%. During the earnings call in July, Tesla CEO Elon Musk and CFO Vaibhav Taneja warned shareholders that higher tariff costs and the expiration of tax credits would impact the company's performance.

Earlier this month, Tesla launched lower-cost "standard" versions of the Model Y and Model 3 to boost sales. The company stated in its earnings report on Wednesday that these new models were introduced "to make our products more affordable for more consumers after the expiration of the U.S. electric vehicle tax credit."

While Tesla hopes that lower-priced models will boost sales, analysts warn that this move will squeeze profit margins—cost reductions of several thousand dollars per vehicle may not fully offset the impact of lower prices. Wall Street predicts that Tesla's vehicle deliveries will decline by 8.5% in 2025 due to factors such as the expiration of tax credits, reliance on older models, and increased competition. Furthermore, Musk's political stance has also alienated some potential customers.

Market participants are closely watching Tesla's guidance on future demand. While Tesla did not provide specific sales targets in its shareholder report, it stated that it still plans to launch Cybercab (an autonomous taxi), the Semi heavy-duty electric semi-truck, and a new generation of energy storage in 2026. Tesla is working on the "mass production" of its Megapack 3 product. Last quarter, Tesla's fastest-growing business segment was energy production and storage : revenue surged 44% year-over-year to $3.42 billion. Tesla's energy products include those for data centers. Large backup batteries for powering other facilities With solar energy Photovoltaic equipment .

Tesla has not made any specific commitments regarding the delivery volume of electric vehicles and energy products by the end of the year. "The impact of changes in global trade and fiscal policies on the automotive and energy supply chain, the company's cost structure, and demand for durable goods-related services is currently difficult to quantify."

Tesla revealed that it is currently working on its humanoid robot... Construction is underway on Optimus's "first-generation production line." The company's stock price experienced a sharp decline in early 2025, but has since recovered somewhat, with a year-to-date gain of nearly 9%, though still lagging behind major stock indices and most of its large-cap tech peers.

The company's current valuation of nearly $1.5 trillion largely reflects investors' bets on its robotics and artificial intelligence businesses. Earlier this year, Tesla launched its Autopilot service in Austin, Texas, marking a key strategic shift and fueling investor expectations that Tesla will gradually transform from a pure car sales model into a company focused on autonomous driving technology.

(Article source: CBN)