Saxo Bank Ole Hansen, head of commodity strategy, said on Wednesday that gold and silver prices are experiencing a long-awaited correction, with silver's sharp decline highlighting the liquidity gap between the two metals. However, both remain under-positioned in portfolios, while the structural drivers behind gold's price rise remain unaffected.

“While unusually strong demand ahead of Diwali in India has supported gold prices, the risk of a pullback in gold and silver has been steadily rising in recent days. However, a highly technical and sustained rally, coupled with renewed risk-taking in the stock market, a stronger dollar, and the approach of Diwali (which typically signals weaker physical demand in Asia), has made traders increasingly cautious, focusing more on preserving gains rather than chasing new highs,” he said.

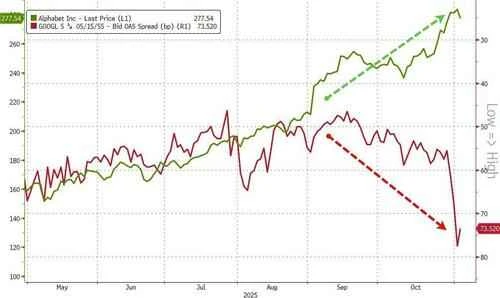

Hansen stated that while the exact trigger for this week's sharp sell-off remains unclear, the fact that gold prices failed to break through $4,380 three times "may have helped change the precious metals' trajectory ." "Trader's mindset" shifts from greed to fear.

He explained, "What follows is typical position tightening, unable to cope with sudden sell-offs by technical leveraged traders, as well as buyers who have recently run into trouble. The latest price action once again highlights the importance of the liquidity difference between gold and silver, with the latter being about nine times less liquid than gold. These differences amplify rallies and pullbacks: a surge in buying quickly leads to limited supply, and any shift toward profit-taking generates extremely large volatility."

“This strong pullback demonstrates how one-sided the market’s focus has become after a nine-week surge (gold up 31% and silver up 45%), leading to a natural price correction. As mentioned earlier, the main catalyst, besides the strengthening dollar, was the weakening demand in India after Diwali,” he added.

Hansen also stated that both metals need to be adjusted to prevent the formation of a bubble, which could then burst more violently in the future.

He specifically mentioned, "Regarding silver, the market focus has now shifted to the upcoming Section 232 investigation in the United States, which targets imports of key minerals such as silver, platinum, and palladium. This decision could reshape the Atlantic. " Short-term supply chain and price dynamics across the Taiwan Strait.

“If the final outcome is zero tariffs, it will allow more U.S.-held silver to flow into Europe, thereby easing the supply shortage in London and narrowing the recent premium of London silver relative to COMEX silver prices (which reached extreme levels during the pandemic),” he added.

Of course, imposing new tariffs would have the opposite effect. He said, "Existing silver in the US will be semi-stagnant, exacerbating the scarcity of silver in London and pushing up the premium for COMEX silver. In this scenario, silver prices could quickly retest and potentially surpass recent highs, driven by new squeeze dynamics rather than genuine demand growth."

Finally, Hansen stated that Saxo Bank maintains its bullish outlook on gold and silver until 2026.

“After a much-needed correction/consolidation, traders may pause to reflect and conclude that the factors driving this year’s historic rally have not disappeared and may continue to support metals that are no longer overbought but remain under-positioned in their portfolios, ” he said.

(Article source: CLS)