① More than a decade later, the story of "The Big Short," which was written into a novel and even adapted into a film, seems to be playing out a 2.0 version; ② Only this time, the prey of the "big shorts" is no longer the real estate market rife with the subprime bubble, but rather AI, which has been hyped up to the sky this year...

For seasoned veterans who have navigated the market for many years, the situation at Deutsche Bank before the 2008 financial crisis was particularly significant. The memory of sales and trading departments quietly pushing credit default swaps (CDS) to clients to hedge against a potential subprime crisis and the complete collapse of the global financial system is still fresh in many people's minds.

If you're less experienced, watching the movie *The Big Short* might offer some insight into the background —the character of Jared Wernett (played by Ryan Gosling), a Deutsche Bank agent in the film, is based on Greg Lippmann, a former Deutsche Bank bond trader. Lippmann played a key role in creating the massive CDS market, which allowed investors to short the real estate market before the 2008 financial crisis…

Interestingly, more than a decade later, this story, which was written into a novel and even adapted into a film, seems to be playing out a 2.0 version—only this time, the prey of the "big short sellers" is no longer the real estate market rife with subprime bubbles, but rather AI, which has been hyped up to the skies this year…

Michael Burry, one of the real-life inspirations for the film "The Big Short," just disclosed in his 13F report this week that he heavily shorted two major AI concept stocks—Palantir and Nvidia— in the third quarter. .

Burry's companies hold Palantir put options with a notional value of $912 million (equivalent to 5 million shares) and Nvidia put options with a notional value of $186 million, which together account for 80% of his portfolio weight.

Coincidentally, news broke this Wednesday that Deutsche Bank was investing in data centers... The industry has provided billions of dollars in debt to meet the needs of artificial intelligence. and cloud computing Following its needs, it is exploring ways to hedge its exposure in the data center sector.

It is understood that the bank Executives within the company have been discussing how to manage their exposure to the booming artificial intelligence industry. Currently, so-called hyperscale data center operators are investing hundreds of billions of dollars to build the infrastructure to meet their AI needs, and this infrastructure is increasingly being financed by debt.

According to sources, the German financial institution is considering several options—including shorting a basket of artificial intelligence-related stocks to help mitigate downside risk by shorting companies in the sector. The bank is also considering a transaction called Synthetic Risk Transfer (SRT), using derivatives to purchase default protection for a portion of debt —packaging and selling the associated default risk to external investors.

Does the above operation sound familiar to investors?

Currently, data center financing has become a core bet for Deutsche Bank's investment banking business. According to two sources familiar with the matter, Deutsche Bank primarily finances projects for companies like Alphabet and Microsoft. and Amazon Loans are provided to companies that offer services to mega-corporations, with these debts secured by long-term contracts promising stable returns.

In recent months, Deutsche Bank has also provided debt financing to Sweden's EcoDataCenter and Canada's 5C, which together raised over $1 billion to fuel their expansion. The investment bank did not specify how much it lent to the sector, but estimates range from several billion dollars.

Admittedly, hedging one's own risks is not unusual for an investment bank. However, it's important to understand that hedging exposure to the artificial intelligence industry can be extremely difficult in the current AI boom, as shorting a basket of AI-related stocks in a burgeoning market is very costly. If Deutsche Bank is truly so convinced that data center capital expenditures have a self-sustaining "cyclical nature," why would it go to such lengths and incur such enormous hedging costs?

The well-known financial blog Zerohedge pointed out that the SRT structure that Deutsche Bank is reportedly studying looks very similar to the old CDO (collateralized debt obligations), which is divided into different tiers in a kind of "mathematical magic" way. This can deceive rating agencies and obtain a good credit score, which inevitably raises questions about the potential risks behind it.

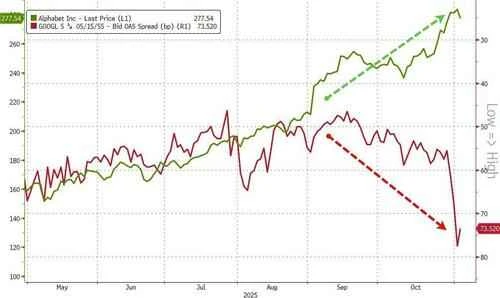

In fact, some market participants have recently noticed a phenomenon: the performance of some investment-grade credit assets in the TMT sector has significantly decoupled from that of TMT stocks. This is particularly evident in recent instances involving Google, Meta, and Oracle . The divergence between stock price movements and the price trends of their related credit assets confirms this point...

(Article source: CLS)