Recently, the Oriental Harbor Overseas Fund, managed by Dan Bin, submitted its Q3 13F filing to the U.S. Securities and Exchange Commission (SEC), revealing its latest U.S. stock portfolio adjustment path.

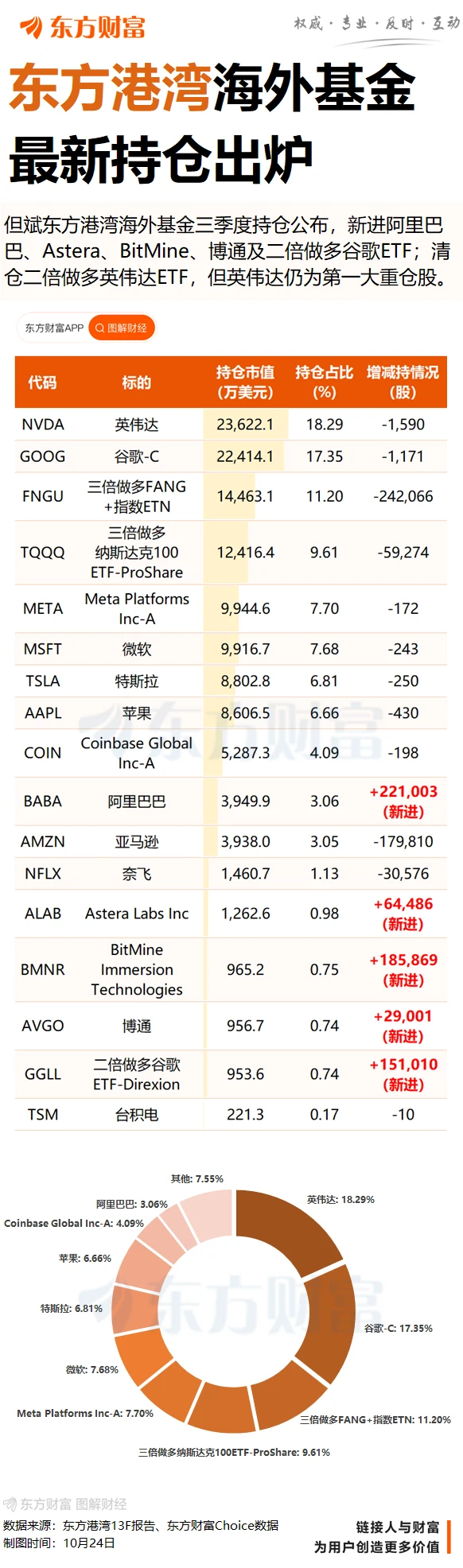

As of the end of the third quarter, the number of stocks held by Oriental Harbor Overseas Fund increased from 13 in the second quarter to 17, with assets under management of US$1.292 billion (approximately RMB 9.2 billion) at the end of the period, an increase from US$1.126 billion at the end of the second quarter.

Dan Bin bought five new stocks in the third quarter, including a significant purchase of Alibaba. Nvidia Google remains one of the top two holdings, and the company is strengthening its AI industry chain layout by adding two new semiconductor companies . Company – Broadcom Astera Labs, while significantly reducing its holdings in Amazon. and Netflix I liquidated my 2x long position in Nvidia ETF.

Initial purchase of Alibaba shares, reduction of holdings in Amazon and Netflix.

In the third quarter, Dan Bin made a round of portfolio adjustments. First, he bought five new stocks: Alibaba , Broadcom , Astera Labs, BitMine Immersion Technologies (cryptocurrency), and a 2x leveraged long GOOGL ETF.

The biggest move was its first purchase of Alibaba shares , totaling 221,000 shares. The market value of the shares at the end of the period was US$39.5 million, accounting for 3.06% of the portfolio and ranking as its tenth largest holding.

As early as the beginning of September, Dan Bin stated on social media that the gap between domestic internet giants and global giants has been widening in recent years, and it is very meaningful to strive to catch up and achieve new historical highs.

Dan Bin cited Alibaba as an example, noting that its market capitalization was once close to that of American internet giants, but now it is only 15.25% of Amazon's . As of September 15, 2025, Apple... Amazon, Google, Facebook, and Microsoft The combined market capitalization of these five companies is approximately $14.698 trillion, while the combined market capitalization of China's BAT (Baidu, Alibaba, Tencent) is approximately $1.18 trillion.

The largest reductions were in Amazon and Netflix , with reductions of 50% and 71.5% respectively, causing both stocks to drop out of the top ten holdings. At the same time, Dan Bin also adjusted leveraged products, adding a new 2x leveraged long GOOGL ETF while completely liquidating his 2x leveraged long Nvidia ETF.

It's worth noting that after initially buying Coinbase in the second quarter, Dan Bin again purchased crypto assets in the third quarter, this time BitMine Immersion Technologies. BitMine is a company focused on the Bitcoin and Ethereum networks, with core businesses including cryptocurrency mining, immersive cooling technology, and institutional-grade vault services. However, BitMine's stock price has been highly volatile, experiencing single-day surges of 694% and 130%, as well as drops of 30% and 40%.

Embrace AI

In the third quarter, Dan Bin further strengthened his AI industry chain layout, acquiring two new semiconductor companies— Broadcom and Astera Labs—buying 29,000 and 64,000 shares respectively. Dan Bin believes that Broadcom's customized ASIC chips and Nvidia's GPUs are complementary rather than substitutive, and the two will develop in parallel to meet the differentiated needs of AI infrastructure.

As of the end of the third quarter, Dan Bin's top ten holdings were mainly technology stocks, with Nvidia and Google remaining his top two holdings, valued at $236 million and $224 million respectively, accounting for 35% of his total holdings. Following closely behind were 3x leveraged FANG+ index ETNs and 3x leveraged Nasdaq ETNs. 100ETF, Meta, Microsoft , Tesla Apple , COINBASE, and Alibaba ranked sixth through tenth.

Amidst the debate over an AI "bubble," Dan Bin firmly believes that the risk of missing out on an era far outweighs the risk of a bubble. (Artificial Intelligence ) This is not a short-term trend, but a major technological revolution that may last 10 to 30 years.

In the latest monthly report, Huang Haiping, Director of Investment Research at Orient Harbor, wrote that people are accustomed to viewing problems with a static perspective. This hinders our understanding and insight into the changes of the times, causing us to not only overlook opportunities when they arise but also ignore risks when they are exposed.

Huang Haiping pointed out that OpenAI recently staged a spectacular "alliance and consolidation" drama—a high-stakes gamble on AI computing power, with OpenAI successively partnering with Oracle. SoftBank, Coweave, and SoftBank signed a cooperation agreement, thus creating a century-long alliance. The debate over the computing power bubble is destined to span the entire development cycle of the AI era, and it is believed that the potential demand for AI computing power far exceeds the current supply.

"History doesn't simply repeat itself, but it does share a common rhythm. OpenAI's high-stakes gamble is merely a footnote in the development of this AI computing power bubble. Regardless of the outcome, it may not change the direction of history. Currently, the AI computing power bubble is still in its early stages, with reasonable valuations. The pressure on the economy and industry remains relatively mild. More and more AI applications are growing at an ever-increasing revenue growth rate, and the financing structure is still very healthy. At this stage of development, we have no reason not to embrace it actively," said Huang Haiping.

Dongcai Illustrated Guide: Some Useful Tips

(Source: Securities Times) (Times.com)