In 2002, Musk rented an old warehouse at 1310 Grand Avenue East, El Segundo, a suburb of Los Angeles, to develop his space business, and the unassuming SpaceX was born.

23 years later, SpaceX is preparing for its IPO, planning to raise well over $30 billion, with an overall valuation target of approximately $1.5 trillion.

SpaceX could become the largest IPO in history.

Part of the funds raised will be used to develop a space data center.

According to the latest information from sources, SpaceX is moving forward with its initial public offering (IPO) plan, aiming to raise well over $30 billion, which could become the largest IPO in history.

The company, reportedly owned by Elon Musk, the world's richest man, aims to reach a valuation of approximately $1.5 trillion, far exceeding Saudi Aramco's 2019 record of $29 billion, which became the world's largest IPO.

It is understood that SpaceX's IPO was primarily driven by its Starlink satellite internet service . The company is riding strong growth momentum (including the prospects for its direct-connect mobile business) and is making progress in the development of its Starship rockets for lunar and Mars missions. Part of the IPO proceeds is expected to be used to develop space data centers , including the purchase of the chips needed to operate them.

Musk had previously expressed interest in space data centers , stating that Starlink satellites could be used to build large data centers in space, and that SpaceX would begin implementing this.

Some sources familiar with the matter said that SpaceX's management and advisors are pushing for an IPO as early as mid-to-late 2026.

Following this news, shares of other space companies rose across the board. EchoStar, which has agreed to sell spectrum licenses to SpaceX, surged as much as 12% intraday before retreating to close up about 6%. Space transportation company Rocket Lab rose 3.6%.

Valuation "rocket-like" growth may surpass Tesla's.

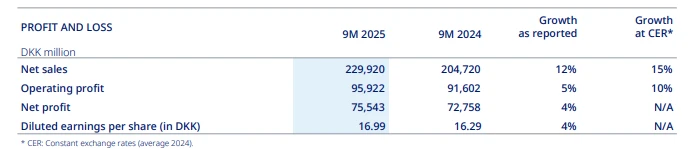

Less than a quarter of Tesla's revenue

Just last week, news broke that SpaceX is launching a secondary stock offering with a potential valuation of $800 billion, potentially competing with OpenAI for the title of "world's most valuable private company".

In recent years, compared to Elon Musk's electric car company Tesla , SpaceX's market capitalization has grown at a rocket-like pace. In July of this year, based on SpaceX's internal share sale plan, the transaction valued the company at approximately $400 billion, more than doubling its valuation from $180 billion at the end of 2023. Now, in less than six months, its valuation has doubled again.

Musk recently posted on social media, stating that "SpaceX has maintained positive cash flow for many years, regularly repurchasing shares twice a year to provide liquidity for employees and investors." He added that the valuation growth is the result of the combined effects of Starship, Starlink development, and the acquisition of global direct-connect spectrum.

It is worth noting that, with Tesla In comparison, SpaceX's valuation premium appears to be very high.

As of the market close on December 9, Tesla's market capitalization was $1.48 trillion, with revenue of nearly $98 billion last year. If SpaceX goes public at its target valuation, its market capitalization will be higher than Tesla's , but its projected revenue this year is $15 billion, increasing to $22-24 billion by 2026, less than a quarter of Tesla's.

(Source: Daily Economic News)