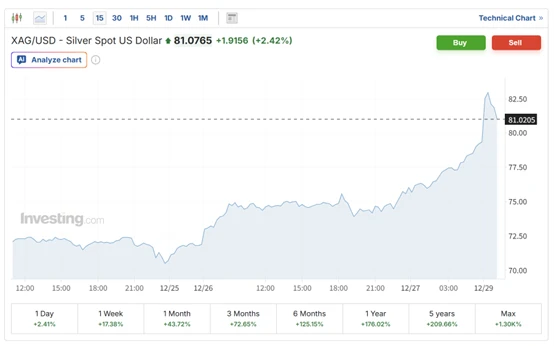

As we all know, artificial intelligence AI is undoubtedly a "power-consuming behemoth." Therefore, the "AI gold rush" in the United States may soon encounter a serious energy bottleneck.

Morgan Stanley Morgan Stanley recently warned that by 2028, due to AI data centers... The massive power consumption could leave the U.S. facing a power shortage of up to 20%. The bank estimates that if new power capacity is not rapidly added, the potential power shortage could reach 13 to 44 gigawatts (GW), equivalent to the electricity consumption of more than 33 million U.S. households.

In a recent report, a team of Morgan Stanley analysts led by Stephen Byrd stated, "We expect the U.S. power deficit to reach 44 gigawatts by 2028, after which we will consider innovative power supply solutions that do not rely on traditional grid interconnection processes."

Grid Limits

Microsoft is driving this growth. Google, Amazon Tech giants like Meta plan to invest nearly $400 billion by 2025 to expand AI computing power. However, despite ample chip supply, electricity is severely scarce. Microsoft CEO Satya Nadella acknowledged that the biggest problem right now "is not computing power, but electricity," and warned that without a power supply, some AI chips could eventually become idle.

It's important to understand that while data center construction takes only two years, power transmission line construction can take up to ten years. This supply-demand mismatch is pushing the US power grid to its limits and creating what experts call an "energy barrier"—even well-funded tech companies cannot expand without a reliable power supply.

With the world's largest data In Virginia, the heart of the region, Dominion Energy reports that its order volume jumped from 40 gigawatts to 47 gigawatts in a single year—equivalent to the power generation of 47 nuclear reactors. Further research indicates that data centers currently consume 4% of the U.S.'s electricity, a figure that could reach 12% by 2030.

Morgan Stanley analysts commented that demand for AI is growing at a “non-linear rate” and can be called the biggest technological revolution in modern history. However, this growth rate has already overwhelmed the national power grid. The bank added that “AI infrastructure stocks are at the “center” of this transformation, and the “non-linear growth rate of artificial intelligence ” will have a broader impact on asset valuations.

Alternative solutions

The report also mentions fuel cells such as those from Bloom Energy . (Could increase supply by 5-8 gigawatts), natural gas "Fast power supply" solutions such as turbines (which can add 15-20 gigawatts) or even nuclear power (which can add 5-15 gigawatts) can alleviate the power shortage crisis.

Currently, Amazon and Google are exploring small modular reactors, while the US government plans to build 10 new nuclear power plants by 2030. Texas is also accelerating its efforts, with plans to build 100 gigawatts of solar power by 2030. and batteries Energy storage project.

"The results of the above power supply solutions may be surprisingly good, thereby narrowing the (supply and demand) gap," they wrote.

Some companies are even considering radical solutions, such as space-based solar power generation and satellite data centers. Elon Musk's Starlink and Google have both proposed solutions for orbital AI chips powered by solar energy , with Google's first test scheduled for 2027.

However, in the short term, the focus remains on ensuring a stable supply of electricity to the ground. Morgan Stanley suggests that companies converting Bitcoin mining facilities into artificial intelligence computing centers could help bridge the power gap.

The report explains that two emerging business models—the “new cloud” (such as short-term AI leasing, like the five-year agreement between IREN and Microsoft ) and the “REIT endgame” (such as long-term power shell leasing, like the 15-year agreement between APLD)—are expected to shape the future of AI infrastructure.

The so-called power shell is a bare data center room that only provides power and network access.

The investment bank concluded that both models “deliver compelling value creation,” especially given that power constraints have become a decisive challenge to the expansion of artificial intelligence.

Wider impact

In reality, the impact of grid congestion extends far beyond the technology sector. Businesses may face higher electricity costs, and the location choices for new data centers will be limited. Power companies may need to prioritize certain regions or projects, leading to uneven power supply. Regulators may face pressure to expedite approval processes and invest in infrastructure upgrades to prevent bottlenecks.

Consumers may also feel the indirect impact. Electricity prices may rise in regions where demand exceeds supply. The rollout of artificial intelligence services may also be delayed, affecting areas such as cloud computing. In various fields such as AI-driven healthcare and financial instruments.

The report suggests that investors may find opportunities in companies providing grid upgrades, transmission systems, cooling technologies, and alternative energy solutions. Meanwhile, businesses heavily reliant on stable, affordable electricity supplies but lacking such guarantees also face risks.

(Article source: CLS)