① Goldman Sachs The report shows that hedge funds are investing in artificial intelligence. Exposure to related technology hardware reached its peak in October, with significant buying in semiconductors. ① And related chip industry stocks; ② Speculative funds believe that the artificial intelligence market will continue to rise, betting that the stocks of Asian and American companies will rise.

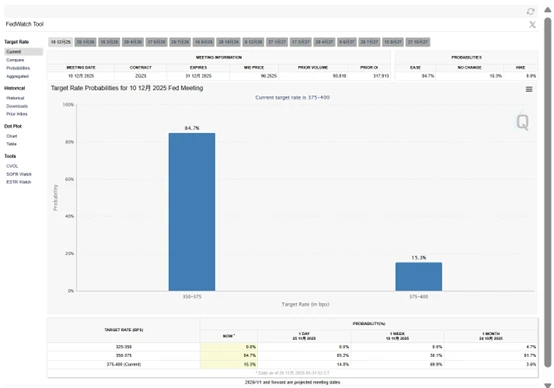

Goldman Sachs stated in a client report that since the bank Since data tracking began in 2016, hedge funds' exposure to AI -related hardware reached its highest level in October of this year. This suggests that speculative capital may believe the AI market will continue to rise.

Goldman Sachs stated that global hedge funds made significant purchases of semiconductor and related chip stocks in October, with buying concentrated in long positions, betting on a rise in the stocks of Asian and American companies.

Does having AI guarantee victory, while lacking AI will lead to defeat?

On Tuesday, Doug Peta, chief U.S. investment strategist at BCA Research, stated in a research report that in the current U.S. stock market, the stock prices of companies related to artificial intelligence, especially those that can obtain investment or improve their businesses from artificial intelligence, are booming, while the market performance of companies that are not related to the concept of artificial intelligence is significantly lagging behind.

Under this trend, communication services Technology and utilities The best performing S&P 500 so far this year The sector performed significantly better than the benchmark S&P 500 index.

But Goldman Sachs says hedge funds' enthusiasm for tech stocks has shifted. Speculators have reduced their holdings in US power stocks . The deal involves the power companies, which have long been considered a vital support force for artificial intelligence and its research and development.

Goldman Sachs stated that hedge funds' enthusiasm is increasingly shifting towards semiconductors and related equipment, a shift that began in September.

Furthermore, the report states that these hedge funds are no longer generally focusing on the largest tech companies, the so-called "Magnificent Seven," but are instead paying more attention to smaller companies related to the AI concept.

The bank stated that purchases of Asian technology companies have driven overall capital inflows into emerging markets (excluding China), while hedge funds' bets on the Chinese market have reached "multi-year highs."

(Article source: CLS)