I. Overview of US Stock Index Options

Trading volume in the US stock index options market has declined slightly, while the put/call ratio has increased slightly, indicating that bullish forces have somewhat withdrawn.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6760 points and call orders peaking at 6800 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 25300, Put single peak at 24850.

II. US Stock Options Trading Volume Ranking

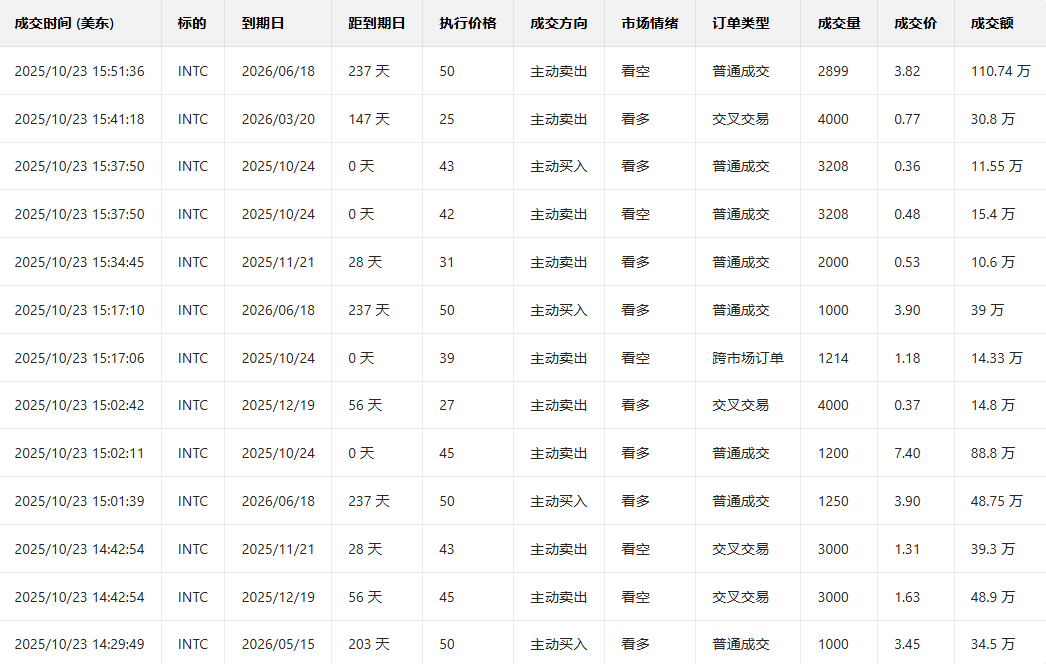

1. Intel The stock rose 3.36% in the previous trading day. The put/call ratio increased significantly the day before, and trading volume also increased. Short sellers made a big bet that the earnings report would miss, but judging from the results after the earnings report, the short sellers' bet failed this time.

Observe the large orders with unusual activity in options trading; near the close of the market, major investors are mainly bullish.

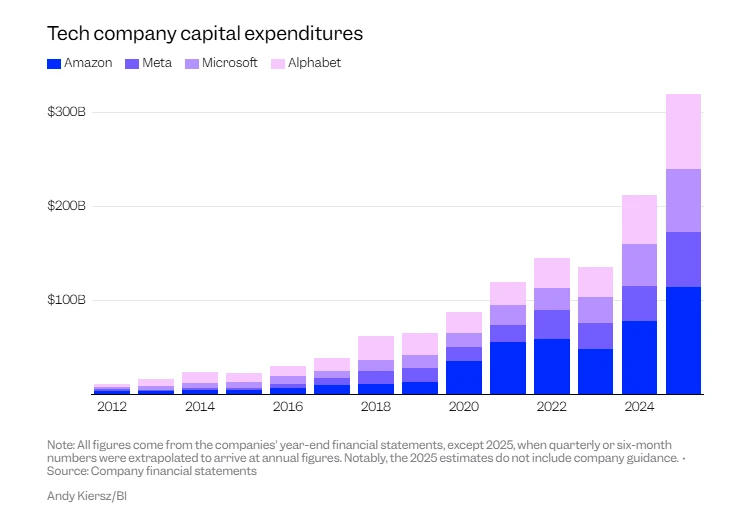

In terms of news, Intel's revenue grew year-over-year for the first time in a year and a half in the third quarter, and it achieved net profit for the first time since the end of 2023, with gross margin reaching a new high in a year and a half. The CFO stated that the company's chips are currently in short supply, and this situation will continue into next year, partly due to data centers. Carriers' demand for upgraded CPUs. Intel 's fourth-quarter revenue guidance, excluding Altera, was slightly below analysts' expectations at the median, but actually performed better because some analysts' forecasts included Altera revenue. Intel stated that it received $5.7 billion in investment from the US government in the third quarter; Nvidia... The $5 billion investment is expected to be completed within the year.

2. Microcomputer The stock fell 8.72% in the previous trading day. The put/call ratio rose slightly the day before, and the trading volume increased significantly, indicating that the bears were in control.

Looking at the put orders expiring this Friday, many have seen price increases of over 4 times.

Observe the large orders with unusual activity in options trading; it appears that large investors are more bullish near the close of trading.

Top 10 US Stock Options Trading Volume Ranking

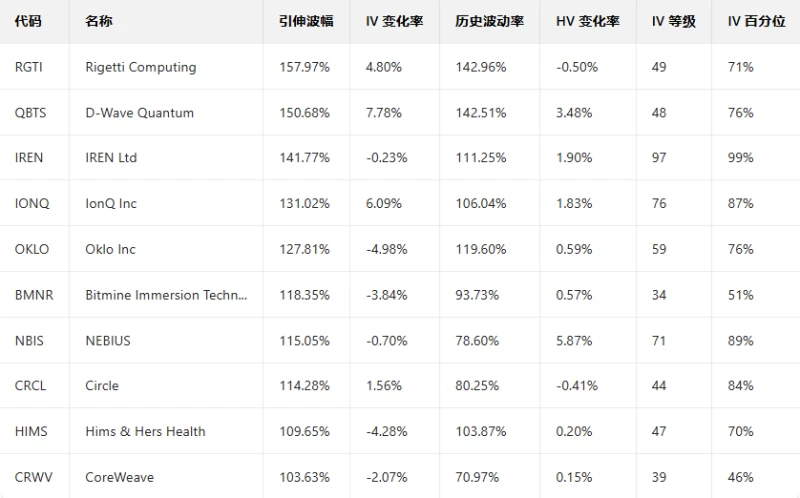

Top 10 US Stocks by Implied Volatility (Underlying Asset Market Cap > $10 Billion, Options Trading Volume > $100,000)

III. Top Ten US Stock ETF Options Trading Volume Ranking

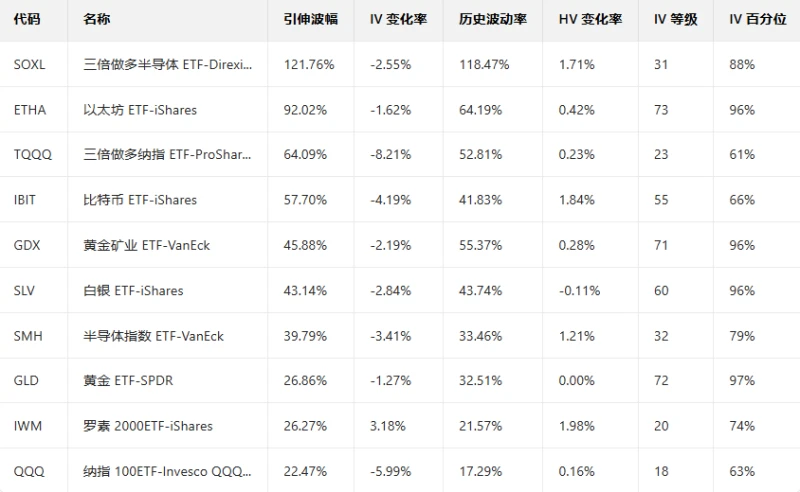

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )