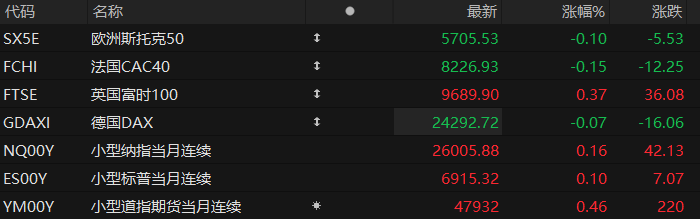

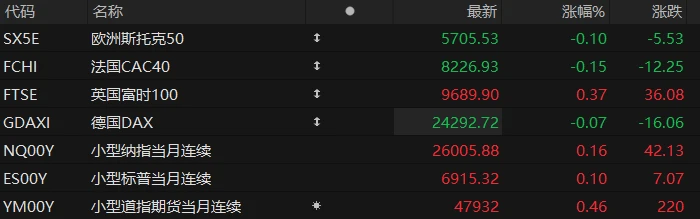

U.S. stock index futures rose across the board in pre-market trading on Tuesday, while most major European indices fell. As of press time, the Nasdaq... S&P 500 futures rose 0.16%, S&P 500 futures rose 0.10%, and Dow Jones futures rose 0.46%.

In terms of individual stocks, large-cap tech stocks generally strengthened in pre-market trading, with Tesla among them. Amazon rose nearly 1%. Google rose about 0.7%, Nvidia rose 0.7 %. Up about 0.5%, Meta and Microsoft Slightly higher in pre-market trading.

Gold and precious metals The sector declined in pre-market trading, with Harmony Gold... Newman Mining and Pan American Silver fell nearly 5%. It fell by more than 3%, but subsequently recovered some of the losses; in terms of news, spot gold plunged 3% overnight, once falling below the $3,900/ounce mark.

Popular Chinese concept stocks generally fell in pre-market trading, with Alibaba among them. Baidu Li Auto XPeng Motors Both fell by more than 1%. (Bilibili) Defying the market trend, the stock surged over 3%, with its new game "Escape from Yakov" exceeding market expectations. Additionally, Tianhong Technology... The stock surged more than 9% in pre-market trading after the company's Q3 results exceeded expectations, with adjusted EPS rising by approximately 52%.

On the morning of the 28th local time, Japanese Prime Minister Sanae Takaichi and US President Donald Trump, who was visiting Japan, held talks at the State Guest House in Tokyo. Media reports stated that the two immediately began exchanging compliments upon meeting—Trump thanked Japan for "investing heavily in the United States," and Takaichi claimed that US-Japan relations had "entered a golden era."

The Japanese government has released a significant list of potential investment projects under its $550 billion U.S. Investment Instrument, offering the first glimpse into which specific proposals this core mechanism, a key component of the U.S.-Japan trade agreement, might fund within the United States.

For the super bull market in US stocks that started in early 2023, driven by the major catalyst of such large-scale Japanese investment in the United States, the market may put aside the so-called "AI bubble theory". Under the catalysis of such huge investment, the bull market trajectory of US stocks may continue.

Hot News

From "ceiling" to "baseline": US stock bulls sound the charge for the S&P 5000.

As seasonal volatility nears its end, Wall Street bullish analysts are once again vying to predict a year-end rally in the S&P 500.

As of Monday's close, driven by positive trade news, expectations of interest rate cuts, and strong corporate earnings, the S&P 500 closed at 6875 points, up 993 points (16.89%) year-to-date . Given the current macroeconomic backdrop, bulls confidently state that the S&P 500's breakthrough of the important psychological level of 7000 points has become the "benchmark conclusion."

UBS Securities Michael Romano, head of derivatives sales at a hedge fund, wrote in a research note last Sunday: "There are plenty of catalysts driving risk assets higher. The 7,100-point level, once seen as the year-end 'ceiling' for forecasts, is rapidly becoming the baseline scenario, as the market is already pricing in next year's upside. "

This optimism will face a crucial test this week: five of the "Big Seven" U.S. stocks (representing a quarter of the S&P 500 by market capitalization) will release their earnings after the market closes on Wednesday and Thursday. Meanwhile, the Federal Reserve, the Bank of Japan, and the European Central Bank will also issue policy statements.

If US stocks remain unscathed by the end of the week, seasonal factors will act as a "market tailwind." Goldman Sachs Statistics show that since 1985, from October 20th to the end of the year, the Nasdaq 100 index has risen by an average of 8.5%, and the S&P 500 index has returned an average of 4.2%.

Undeterred by the gold price plunge? Experts predict it will rise to $5,000 next year, as key tailwinds remain!

After a period of rapid price increases, international gold prices began a sharp decline, falling below the $4,000 mark on Monday. Although several institutions have warned that the correction is far from over, one research firm believes that the upward trend in gold is far from over and predicts that the price will reach $5,000 next year.

Analysts at UK research firm Metals Focus stated in their annual " Precious Metals Investment Focus" report that ongoing economic uncertainty remains the biggest factor supporting gold prices.

Analysts wrote, "In line with trends throughout 2025, continued uncertainty surrounding U.S. trade policy and its impact on the global economy is expected to remain a key driver of gold sentiment."

At the same time, analysts also expect retail investor demand to remain strong, as further easing by the Federal Reserve is expected to reduce the opportunity cost of gold as a non-yielding asset in an environment of rising inflation.

JPMorgan Chase shares this bullish view on gold prices. Natasha Kaneva, global head of commodities strategy, expects the average gold price to be slightly above $5,000 per ounce by the last quarter of 2026. The bank believes continued demand from investors and central banks will support this level.

Trump invited OpenAI and Salesforce to a dinner in Tokyo. CEOs gathered to celebrate Japan's major investment deal in the US.

On the eve of concluding his visit to Tokyo, US President Trump plans to have dinner with several business leaders, where he will announce the results of Japanese investment in the US.

Invited guests included Salesforce CEO Marc Benioff, Toshiba CEO Taro Shimada, and Rakuten founder Hiroshi Mikitani. The dinner will be held at the residence of U.S. Ambassador to Japan George Glass, and attendees will also include OpenAI co-founder Greg Brockman and representatives from Honda Motor Co. (HMC.US) President Toshihiro Mibe, and Anduril Industries founder Palmer Leigh.

This dinner coincided with the White House announcing a new round of economic investment commitments to the United States. Under the previous trade framework, Trump lowered and set tariff caps on Japanese goods; in exchange, Japan pledged $550 billion in financial support for U.S. projects.

US Stocks Focus

PayPal became ChatGPT's first payment wallet, with pre-market gains exceeding 15%.

On Tuesday (October 28) local time, payment company PayPal announced that it has signed a cooperation agreement with OpenAI, and its digital wallet will be embedded with ChatGPT, allowing users to directly access the chatbot. The purchase was completed online. Driven by this news, PayPal shares surged over 15% in pre-market trading.

According to PayPal CEO Alex Chriss, the agreement was finalized last weekend; starting next year, both sides of the PayPal ecosystem—consumers and merchants—will be able to access ChatGPT, where users can buy goods and merchants can list and sell their inventory.

Chriss stated, "We have hundreds of millions of loyal PayPal wallet users who can now enjoy a secure and reliable checkout experience by clicking the 'Buy with PayPal' button on ChatGPT."

OpenAI is expanding the e-commerce capabilities of ChatGPT. Last month, the company announced that ChatGPT users could purchase goods from merchants on Shopify and Etsy platforms; two weeks ago, it also announced a partnership with Walmart. An e-commerce cooperation agreement was reached.

“This is a completely new shopping model. It’s hard to imagine that agenttic commerce won’t become an important part of the future,” Chriss said.

Is a new growth engine emerging? Analysts: Apple Service revenue will surpass $100 billion for the first time.

Despite increasing legal and regulatory pressure on the App Store, analysts predict that Apple is poised to surpass $100 billion in annual revenue from its services business for the first time this year. According to Visible Alpha analysts, Apple's services division is projected to generate $108.6 billion in revenue in fiscal year 2025 (ending September), representing a roughly 13% increase from the previous year.

Apple's services include iCloud, Apple Pay, and AppleCare insurance. If this figure is achieved, Apple's services business alone will surpass Disney's. The annual revenue of Tesla or Tencent.

With iPhone sales growth slowing, services have become one of Apple's most important growth engines, doubling in size over the past five years. JPMorgan analyst Samik Chatterjee stated that services are expected to account for a quarter of Apple's total revenue, but could contribute as much as 50% of profits, reflecting the "user stickiness" of products like Apple Pay and iCloud subscriptions. Chatterjee added, "Consumer engagement on the iPhone continues to increase, benefiting not only from the growth in device installations but also from higher monetization per device."

Furthermore, the multi-billion dollar partnership agreement between Apple and Google has further boosted service revenue. Google pays Apple an annual fee to be the default search engine on the iPhone. This is a substantial source of revenue for Apple, and at zero cost.

Electricity is King! Google and U.S. Energy NextEra partners to restart Iowa nuclear power plant

U.S. energy company NextEra and Google announced a landmark agreement on Monday (October 27) to restart the Duane Arnold Energy Center in Iowa—the state’s only nuclear power facility.

This move will satisfy the needs of artificial intelligence. (AI) and data centers The US electricity sector has grown significantly due to development. Demand. The 615-megawatt nuclear power plant is scheduled to resume full operation in the first quarter of 2029, but this requires prior regulatory approval.

The Duane Arnold nuclear power plant ceased operation in 2020 after nearly 50 years of generating electricity. This restart marks the full return of nuclear power to Iowa and highlights the increasingly close integration between large technology companies and clean baseload electricity.

According to the latest statement, Google and NextEra have signed a 25-year agreement. Under the agreement, Google will purchase the majority of the factory's output to power its cloud services and artificial intelligence infrastructure, providing a 24/7 carbon-free energy supply. The remaining capacity of the factory will be sold to the Central Iowa Electric Cooperative (CIPCO) on the same terms.

UnitedHealth Delivering a better-than-expected Q3 quarterly report signals accelerated growth and recovery in 2026.

UnitedHealth's third-quarter results exceeded Wall Street expectations, and the company raised its full-year outlook, indicating that the healthcare giant has stabilized after a severe crisis. The report showed that UnitedHealth's Q3 revenue was $113.2 billion, a 12.3% year-over-year increase, exceeding expectations; adjusted earnings per share were $2.92, slightly higher than the average analyst estimate.

The company stated that it is preparing for "continued accelerated growth in 2026." The company noted that key metrics for healthcare spending exceeded analysts' expectations, but costs remain high.

The company raised its adjusted earnings per share (EPS) forecast for this year by 25 cents to at least $16.25. This is well below the company's target range for 2025 and would be the lowest annual earnings since 2019. UnitedHealth Group has a history of consistently exceeding quarterly earnings expectations, and this resumption of upward guidance could be a turning point for cautious investors.

UnitedHealth is attempting to regain investor confidence after cutting earnings forecasts, replacing senior management, and disclosing a federal criminal investigation. The sharp drop in its financial outlook earlier this year shocked Wall Street and interrupted years of steady profit growth.

"One quarter cannot form a trend, but we see this as the first step in UnitedHealth's recovery of investor expectations and tradition," JPMorgan analyst Lisa Gill wrote in a report.

(Article source: Hafu Securities )