① Question 1: How will the Federal Reserve assess the future path of interest rates? ② Question 2: How does the Federal Reserve view the current state of the US economy amidst the data fog? ③ Question 3: Will the Federal Reserve formally announce the end of its balance sheet reduction?

The Federal Reserve will release its highly anticipated October interest rate decision at 2:00 AM Beijing time on Thursday, followed by a press conference by Chairman Powell half an hour later (2:30 AM), as is customary. This is undoubtedly the most important event of this week's "super week," which includes decisions from the four major central banks in the US, Europe, Japan, and Canada, as well as earnings reports from numerous tech giants!

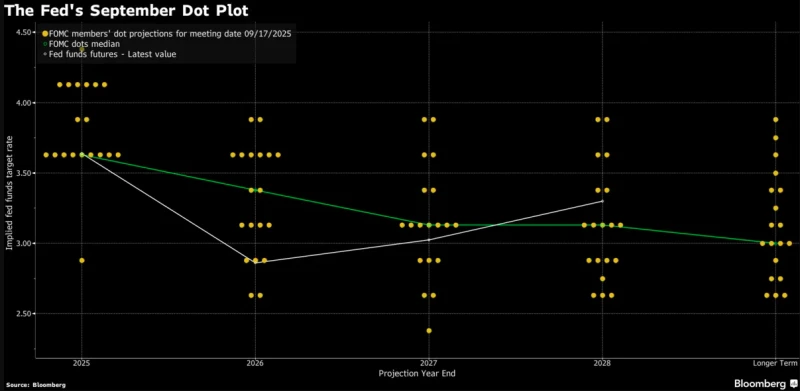

Many industry insiders believe that the easiest task for the Federal Reserve on Wednesday might be to announce another rate cut at the end of its two-day policy meeting. However, the real challenge will lie in handling other details —details that present significant challenges to current policymaking. Since this is not a quarter-end decision, no new economic projections or interest rate dot plot will be released at this meeting.

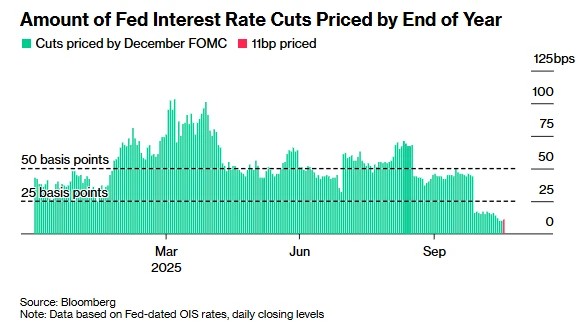

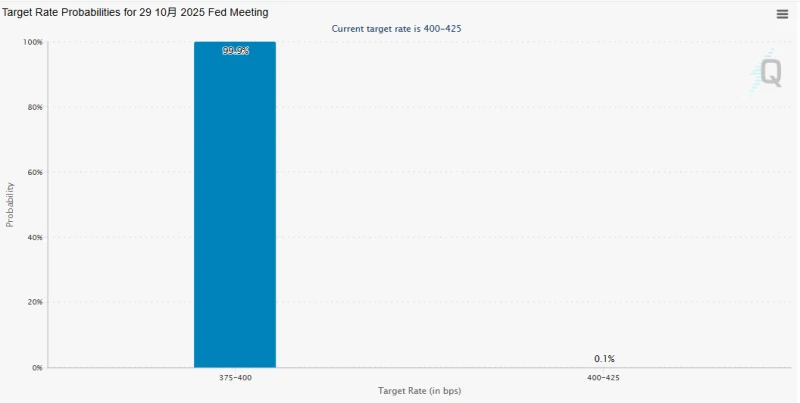

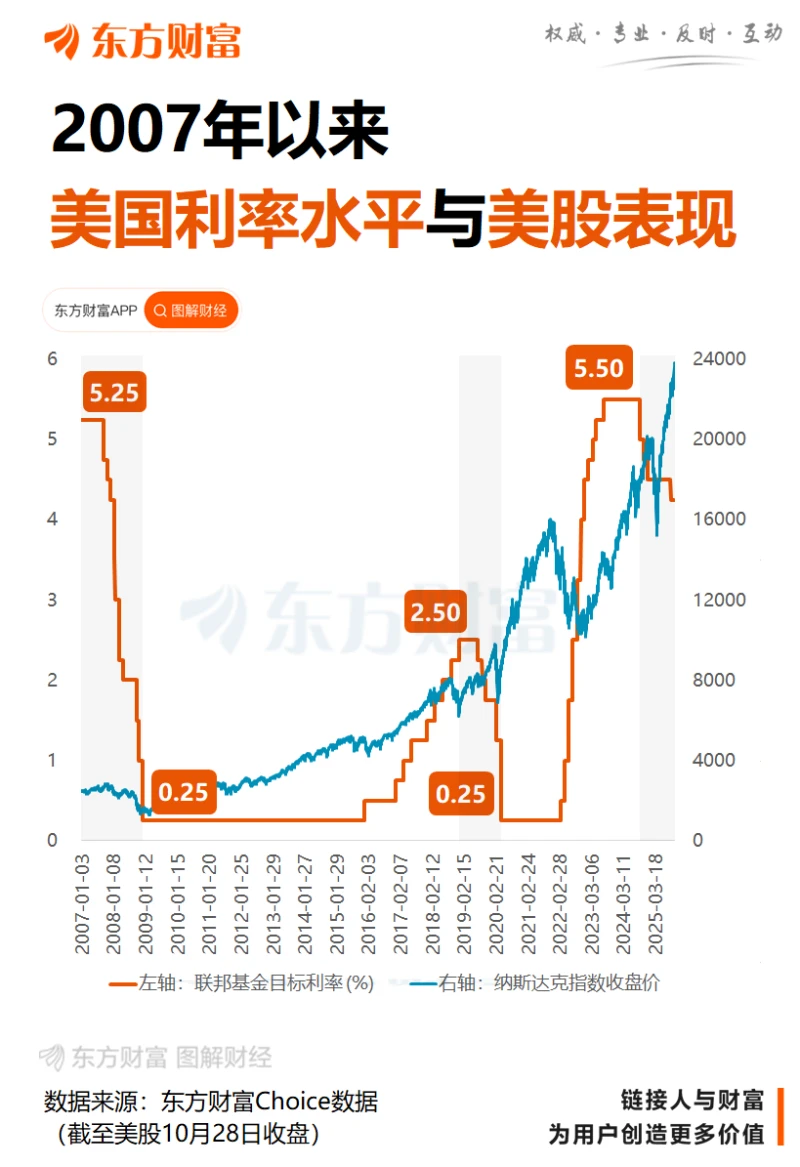

Currently, the market widely expects the Federal Open Market Committee (FOMC) to announce a 25 basis point rate cut at its second consecutive meeting tonight, lowering the target range for the federal funds rate to 3.75%-4%—according to the CME Group's FedWatch Tool, the probability of this rate cut is now as high as 99.9%.

However, the near-certain probability of a rate cut this month may not mean that the Federal Reserve is entirely in agreement on the outlook for monetary policy. In fact, due to the lack of official government data caused by the US government shutdown, the Fed is currently in an extremely awkward position—at this week's policy meeting, policymakers from different camps—are likely to engage in heated debate over the future path of interest rates, the challenges posed by the lack of economic data, and even whether to end balance sheet reduction ahead of schedule.

Below is our preview of some key points to watch tonight on this "rate cut night" from the Federal Reserve . These uncertainties will likely determine the direction of global financial markets tonight and for some time to come:

Question 1: How will the Federal Reserve assess the future path of interest rates?

Given that a Fed rate cut tonight is practically a done deal, the most pressing question for market traders is whether the Fed can provide further clues about its future policy direction.

Federal Reserve Chairman Jerome Powell expressed concerns about the labor market in a speech earlier this month, hinting at a possible interest rate cut in October. Recent private sector data and anecdotal surveys do indeed suggest that the U.S. job market may still be deteriorating.

A report from payroll processing firm ADP stated that private sector jobs fell by 32,000 in September; meanwhile, the Federal Reserve's Beige Book—a report that compiles surveys from across the country and is used by the Federal Reserve during its meetings—also depicted a weak job market.

However, despite acknowledging risks in the job market, a significant number of Federal Reserve officials also expressed concern about inflation. Data also shows that while the U.S. September CPI fell short of expectations across the board, core CPI (considered a better indicator of underlying inflation trends) still rose 3% year-on-year, remaining a full percentage point above the Fed's target.

Yale University professor and former head of monetary affairs at the Federal Reserve, Bill English, pointed out, "In the current policy cycle, there is a real division within the Federal Reserve—one side believes that while interest rates can be cut, there is no rush to act, while the other side argues that despite the (inflation) risks, more aggressive easing measures should be taken at this moment. There is a serious division between those who advocate for an immediate rate cut and those who advocate for a wait-and-see approach."

Based on recent statements and mainstream Wall Street opinion, Stephen Milan, the Federal Reserve governor newly appointed by Trump this summer, is likely to vote against a larger rate cut again— just as he did at the September policy meeting.

Meanwhile, Cleveland Fed President Hammark, Dallas Fed President Logan, and St. Louis Fed President Schmid are likely to remain reserved about further rate cuts. Schmid, a rotating voting member this year, holds voting rights at this meeting —industry insiders expect him to be a potential dissident who would support maintaining the current interest rate.

Against this backdrop, many analysts expect Federal Reserve Chairman Jerome Powell to avoid giving overly clear guidance on the policy path for the next few meetings at tonight's press conference. He will also be more cautious due to the lack of official economic data caused by the government shutdown.

Deutsche Bank Matthew Luzzetti, chief U.S. economist, said, "At present, we can only hope that the data released in the future will help bridge the differences between the Fed's hawks and doves. But as long as the differences remain, Powell will try to avoid signaling the direction of the meetings in December and beyond."

Yale professor English also said, "I expect him (Powell) to try to take a middle road and not reveal too much about whether there will be a rate cut in December—I don't think he wants to be locked into a December rate cut. But on the other hand, he seems to be worried about the outlook for the labor market and real activity, so he doesn't want to appear too hawkish."

Second point of suspense: How does the Federal Reserve view the current state of the US economy amidst the data fog?

Due to the US government shutdown, US financial... The market was shrouded in a fog of economic data. During this period, the U.S. Bureau of Labor Statistics released only a delayed September CPI data, allowing the market to glimpse the "tip of the iceberg" of the true state of the U.S. economy.

With the release of the Federal Reserve's monetary policy statement and Powell's press conference tonight, market participants will undoubtedly be eager to know how the Fed views the current state of the US economy. In any case, the Fed possesses more information and data than the average market participant…

Industry insiders suggest that investors may need to pay attention to whether the Federal Reserve will further emphasize statements regarding "downside risks to employment" and "easing inflationary pressures" in its monetary policy statement. Of course, more information and clues will likely come from Powell's own remarks.

“When you can’t get data on at least one of the Fed’s dual mandates, it’s very difficult to formulate policies to achieve both goals…,” noted Luke Tilley, chief economist at Wilmington Trust. He was referring to the Fed’s dual mandate of maximizing employment and maintaining price stability, as well as the missing September non-farm payroll report due to the government shutdown.

“I expect they will convey more uncertainty about the future path—they must be prepared to shift and keep rates stable; or, if necessary, cut rates more quickly when the data is finally available,” Tilley said.

Tilley believes the slowdown in the US job market is likely due primarily to weak labor demand, rather than a reduction in labor supply caused by decreased immigration resulting from Trump administration policies. He anticipates that job growth will not accelerate. "The job market is a lagging indicator, and its continued decline suggests that the economy has reached a turning point."

Patrick Harker, former president of the Federal Reserve Bank of Philadelphia and current professor at the Wharton School of the University of Pennsylvania, said, "The Fed is in a difficult position right now. The current situation seems to be stagflation—not as severe as in the 1970s, but there is definitely a sense of stagflation."

"The labor market is clearly weakening. Although official data is not yet available, all other indicators suggest it is softening. While there hasn't been a precipitous drop, it is indeed weakening, while inflation remains persistently high." Harker also believes that inflation is unlikely to ease in the short term because tariffs are gradually being transmitted to the economic system, and retailers who had previously held back have begun to raise prices.

Question 3: Will the Federal Reserve officially announce the end of its balance sheet reduction program?

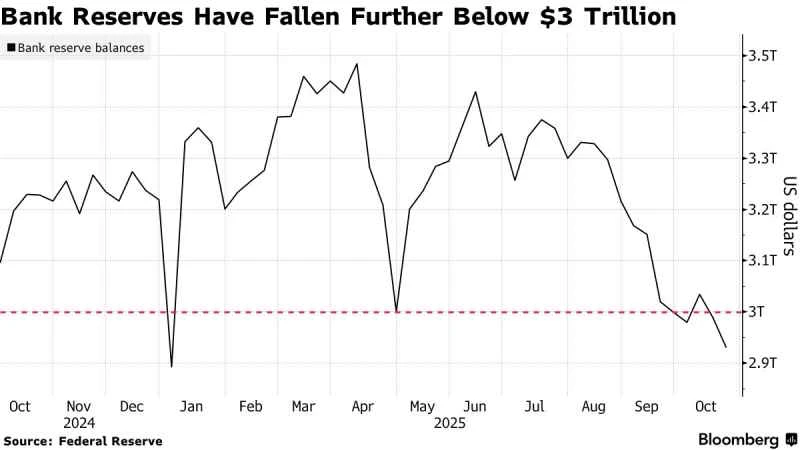

Finally, the third major suspense surrounding this Fed decision is undoubtedly the topic of "ending balance sheet reduction," which has been increasingly mentioned by investment banks recently.

JPMorgan Chase and Bank of America Strategists have recently anticipated that the Federal Reserve may announce a halt to shrinking its approximately $6.6 trillion balance sheet at this week's policy meeting, thus ending the process aimed at withdrawing liquidity from financial markets. Both of these major Wall Street banks have further moved up their forecasts for the Fed ending quantitative easing (QT), citing recent increases in borrowing costs in the dollar funding market.

From a data perspective, the key factor the Federal Reserve considers in deciding whether to continue shrinking its balance sheet—the reserves of the U.S. banking system—fell below the $3 trillion mark for the second consecutive week last week, just as the Fed is about to finalize its balance sheet adjustment path.

Federal Reserve Chairman Jerome Powell stated in a speech earlier this month that when banks... The balance sheet reduction process will stop when reserves are slightly above a level deemed "adequate" by policymakers—the minimum required to prevent market turmoil. He suggested the Federal Reserve believes this level is within reach, saying the central bank may approach this point "in the coming months."

Macroeconomist Anna Wong stated, "The Federal Reserve is expected to cut interest rates by 25 basis points at its meeting on October 28-29, but the market is currently uncertain whether the FOMC will simultaneously announce the end of quantitative tightening (QT). Our prediction is that the FOMC will announce the formal end of QT in November."

It's worth noting that a substantial block trade also occurred in the US interest rate market late last week, seemingly positioning for the Federal Reserve's upcoming announcement of the end of its balance sheet reduction program. According to data from the CME Group, a large trade involving 40,000 November-expiring contracts occurred on Thursday, betting that the November secured overnight funding rate (SOFR) would average less than 9 basis points higher than the expected federal funds rate.

Data shows that the SOFR is currently 4.24%—this rate is the overnight borrowing rate for short-term cash primarily secured by Treasury bonds, reflecting the funding costs in the overnight repurchase market. The federal funds rate is currently 4.11%—this rate is the cost of unsecured overnight lending that banks charge each other to meet reserve requirements. Essentially, this trade is a bet that if the Federal Reserve announces a reduction in its quantitative tightening program at its two-day meeting this week and implements a 25-basis-point rate cut as expected, the average SOFR in November will fall to 3.95% or lower, while the federal funds rate will be at 3.86% (4.11% - 0.25%) or higher.

Steven Zeng, U.S. interest rate strategist at Deutsche Bank , said this is a bet that the Federal Reserve will stop QT this week and announce new policies to appease the funding markets, which will reduce the spread between SOFR and the federal funds rate from its current level.

Tilley pointed out, "There are signs that the Fed is nearing the bottom in terms of whether reserves are sufficient, and you could even say that there is actually some tightness in terms of liquidity. So that's why I expect (at least) an announcement of ending balance sheet reduction at this meeting, if not direct action."

Dongcai Illustrated Guide: Some Useful Tips

(Article source: CLS)