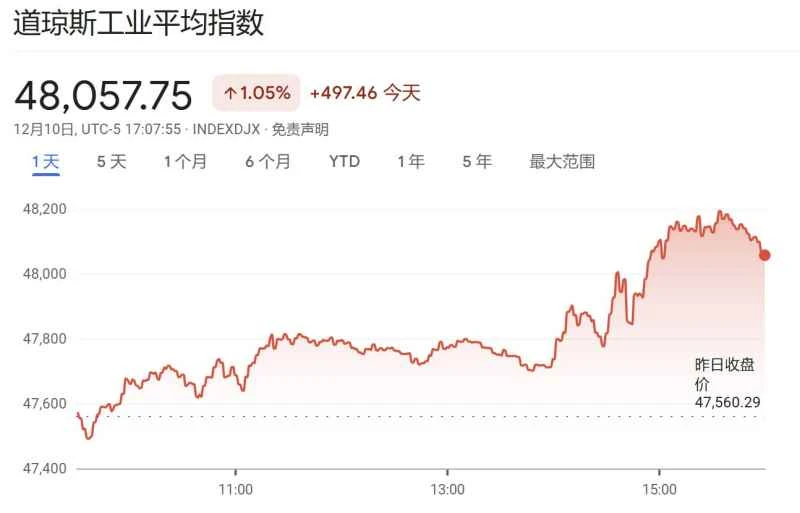

Memory chip stocks have increased fivefold in the past two months Manufacturer SanDisk (SanDisk) continued to rise in pre-market trading on Monday, and is expected to hit a new all-time high of $250 during the day.

In terms of news, rumors of a dramatic price increase, coupled with international banking giant Goldman Sachs... The stimulus of "doubling the target price" further fueled the market's high sentiment. Following SanDisk 's lead, Seagate Technology... Micron Technology Both stocks surged significantly in pre-market trading on Monday and are expected to hit new all-time highs today .

According to supply chain sources, SanDisk 's NAND flash memory has become one of the most sought-after commodities in the technology sector . Due to the company's 50% price increase for flash memory contracts in November, several storage module manufacturers, including Transcend, InnoDisk, and Apacer, have suspended shipments to reassess their product pricing. Transcend, in particular, has suspended quoting and shipping since November 7th, anticipating that the flash memory shortage will continue and prices may continue to rise.

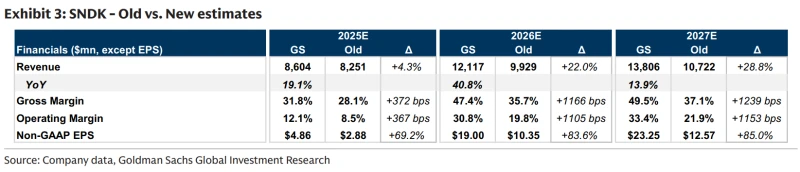

Meanwhile, a report titled "SanDisk: Supply Shortage Continues to Worsen, Driving Significant Model Leverage," authored by Goldman Sachs analysts James Schneider et al., also attracted attention in the capital markets. Goldman Sachs raised its earnings per share forecasts for SanDisk for fiscal years 2025-2027 by 69.2%, 83.6%, and 85%, respectively, while also raising its 12-month price target for the company from $140 to $280 .

Goldman Sachs stated that SanDisk's latest earnings report showed significantly better profitability and forward guidance than market expectations . Given the recent surge in its share price driven by strong NAND prices and tight industry supply and demand, management's statement that "supply growth will remain restrained in 2026" will further strengthen investor confidence in the continued supply shortage in the NAND industry .

In its earnings report released last Thursday, SanDisk reported quarterly revenue of $2.31 billion, exceeding Goldman Sachs' estimate of $2.21 billion and the average analyst estimate of $2.17 billion; adjusted earnings per share of $1.22 significantly surpassed Wall Street's average estimate of $0.90. Even more impressively, the company provided an adjusted earnings per share forecast of $3-$3.40 for the December quarter, more than double the analysts' expectations.

Goldman Sachs stated that the profit guidance significantly exceeded expectations, primarily due to higher product prices . SanDisk's gross margin is expected to improve further, driven by both rising prices and a more optimized product mix .

In the highly anticipated AI-driven ( data center) Regarding its business, Goldman Sachs believes that although SanDisk has not yet released its latest market share figures for enterprise-class SSDs (eSSDs), the company continues to make steady progress in the certification of its 128TB ultra-large capacity hard drives for hyperscale data centers . The company is expected to gradually expand its market share in the coming quarters from its low base in this market.

(Article source: CLS)