Although the probability of a Fed rate cut in December has fallen below 50% in the interest rate swap market, some investors are still actively positioning themselves for hedging, betting that the Fed will cut rates for the third consecutive time next month.

Recent moves indicate that options traders are aggressively buying December options linked to the Secured Overnight Financing Rate (SOFR) in an attempt to profit from a potential 25-basis-point rate cut —SOFR being closely correlated with the federal funds rate. These bets come as a large volume of economic data is resuming to be released following the longest government shutdown in history.

Data shows that open interest in options contracts expiring two days after the Federal Reserve's December 10th interest rate decision continued to climb on Monday. Because these options cover the December policy meeting, they have become an ideal tool for hedging against the Fed's year-end policy decision. The most active December SOFR option contract in recent weeks has a strike price of $96.50 and currently has approximately 863,000 open contracts. This strike price corresponds to an SOFR rate of 3.5%, 38 basis points lower than the current effective federal funds rate.

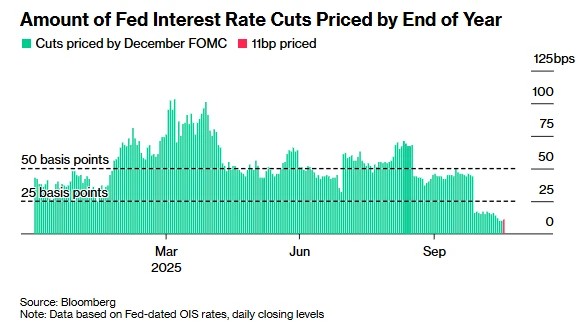

This wave of bets on interest rate cuts in the options market stands in stark contrast to the current pricing in the interest rate swap market: the latter indicates that the probability of a rate cut at the next Fed meeting has fallen to 40/60 – only about 40% , while two weeks ago the market was pricing in a rate cut probability as high as 70%. These changes in interest rate pricing have even extended into next year; in expectations for the Fed's decision on January 28th, the market is pricing in a rate cut of less than 25 basis points.

Some industry insiders say that the rapid emergence of interest rate cut bets in the options market seems to be partly due to the anticipated release of US data, which may exacerbate concerns about the state of the US economy and job market, thus tilting the interest rate balance back towards a rate cut.

The U.S. federal government has begun releasing economic data delayed due to the 43-day government shutdown. Data released Tuesday showed a sharp increase in the number of Americans receiving unemployment benefits from mid-September to mid-October, suggesting that the unemployment rate in October may be high. Meanwhile, an ADP report showed that private employers cut an average of 2,500 jobs per week in the four weeks ending November 1.

Federal Reserve Governor Waller also said on Monday that U.S. companies have begun to talk about layoffs more frequently as they plan to cope with weak demand and artificial intelligence . This could lead to increased productivity. Waller reiterated his view that the Federal Reserve should cut interest rates again at its December meeting, citing a weak U.S. labor market and monetary policy harming low- and middle-income consumers.

The most important macroeconomic data this week will be the U.S. September non-farm payrolls report, which will be released on Thursday. Economists surveyed by the media expect the report to show that employers added 50,000 jobs that month.

Due to a lack of new economic data for investors to assess the health of the economy, long-term Treasury yields at the end of the yield curve have recently remained confined to a narrow trading range. An industry statistic shows that the vacuum of US macroeconomic data has resulted in the 10-year Treasury yield fluctuating by only 11 basis points since the Federal Reserve meeting on October 29.

On Tuesday, the U.S. Treasury market remained relatively stable. By the close of trading in New York, the yield on the two-year Treasury note, which typically moves in tandem with the Federal Reserve's interest rate expectations, fell 2.93 basis points to 3.572%, while the yield on the 10-year Treasury note fell 2.52 basis points to 4.113%.

(Article source: CLS)