Markets are worried that the tech stocks that have soared in recent years may repeat the mistakes of the dot-com bubble burst. Despite concerns about artificial intelligence... There is much debate about whether AI is in a bubble, but historical experience suggests that investors can pay attention to some warning signs to understand whether the AI craze has peaked.

Goldman Sachs Strategists recently stated that they believe the market's fervor for artificial intelligence risks repeating the fate of the dot-com bubble burst in the early 21st century, but there is still room for AI stocks to rise in the near future .

Dominic Wilson, senior advisor on the bank’s global market research team, and Vickie Chang, macro research strategist, wrote in a report to clients last Sunday that the stock market does not look like it did in 1999, but the risk of the AI boom becoming increasingly similar to the frenzy of the early 21st century is rising.

“We believe that as the AI investment boom continues, the risks of imbalances accumulated in the 1990s may become increasingly apparent. We have recently seen signs similar to the turning point of the 1990s boom,” Goldman Sachs said in a report, adding that the current AI trading trend is quite similar to the tech stock performance in 1997 (a few years before the bubble burst).

Wilson and Chang identified five warning signs that preceded the bursting of the dot-com bubble and urged investors to pay close attention:

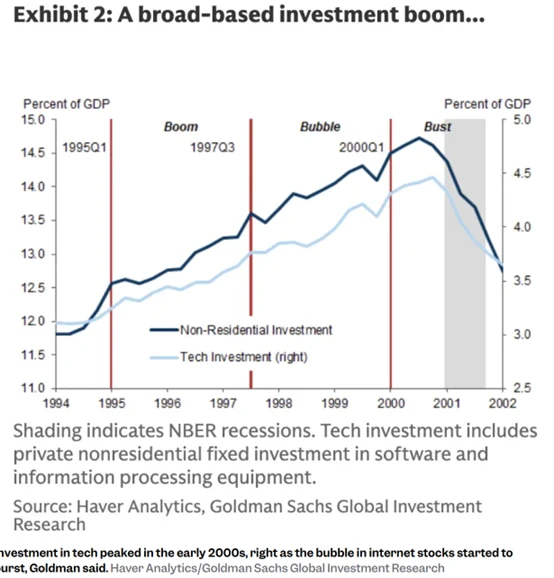

1. Investment spending has reached its peak.

In the 1990s, investment spending in technology equipment and software rose to "exceptionally high levels," peaking in 2000 when non-residential investment in the telecommunications and technology sectors reached about 15% of U.S. GDP.

Goldman Sachs analysis shows that such investment spending began to decline sharply in the months leading up to the bursting of the dot-com bubble .

Strategists stated, "Therefore, high asset prices have had a significant impact on actual spending decisions."

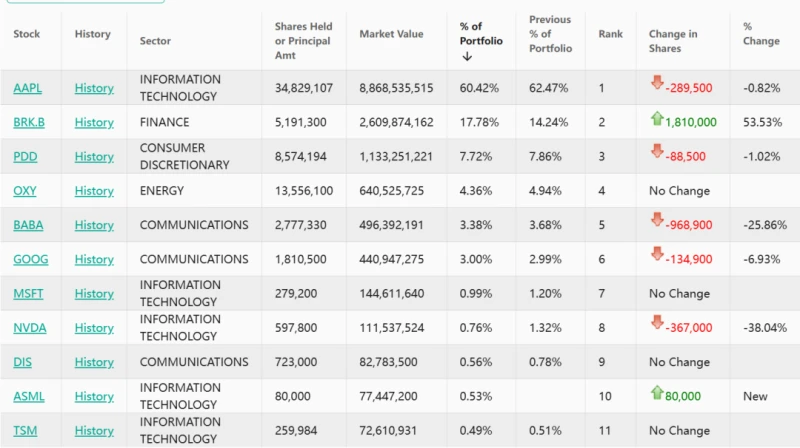

Investors are increasingly wary of the large investments that major tech companies are making in artificial intelligence this year. Amazon Meta, Microsoft Google's parent company Alphabet and Apple Capital expenditures are projected to reach approximately $349 billion by 2025.

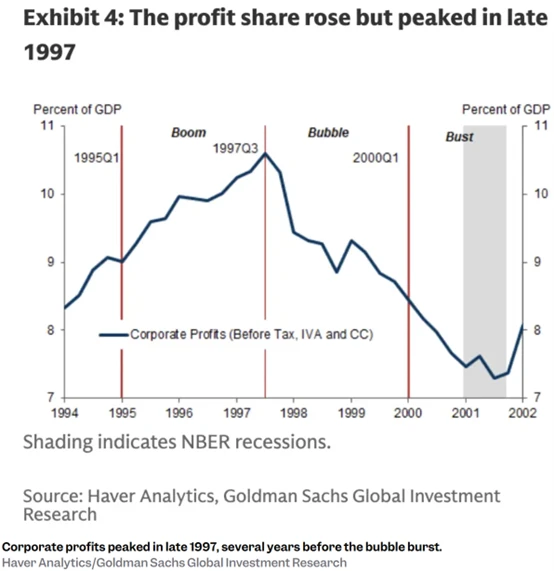

2. Corporate profits began to decline.

Corporate profits peaked around 1997 and then began to decline.

“Profitability peaked long before the boom ended,” the analysts wrote. “Although reported profit margins remained strong, in the later stages of the boom, macroeconomic data showed declining profitability while stock prices accelerated.”

Corporate profits currently appear strong . According to FactSet data, the S&P 500's composite net profit margin in the third quarter was approximately 13.1%, higher than the five-year average of 12.1%.

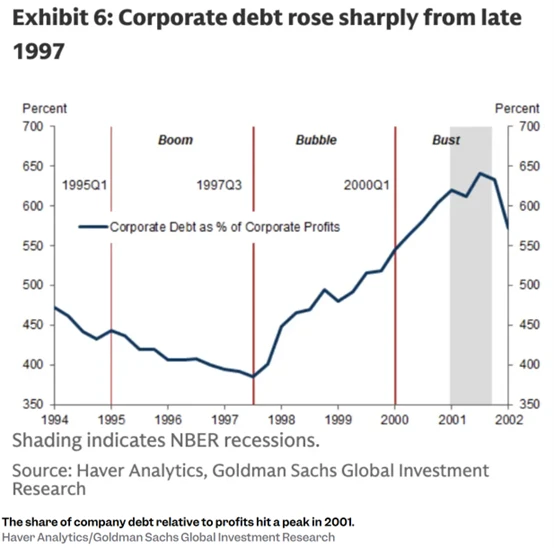

3. Corporate debt is rising rapidly.

Goldman Sachs analysis shows that corporate debt continued to expand in the lead-up to the bursting of the dot-com bubble, with the debt-to-profit ratio peaking in 2001 (when the bubble was bursting).

Strategists say: "Increased investment coupled with declining profitability has led to a deficit in the corporate sector's financial balance (the difference between savings and investment)."

Some large tech companies finance their AI spending through debt financing. For example, Meta raised $30 billion through a bond issuance at the end of October to support its artificial intelligence spending plans.

However, Goldman Sachs added that most companies today appear to be relying on free cash flow to finance capital expenditures, and their debt-to-profit ratios are far lower than at the peak of the dot-com bubble .

4. Federal Reserve cuts interest rates

In the late 1990s, the Federal Reserve was in a rate-cutting cycle, which was one of the factors driving the stock market higher.

Goldman Sachs wrote: "Interest rate cuts and capital inflows are adding fuel to the fire in the stock market."

The Federal Reserve cut interest rates by 25 basis points at its October policy meeting. According to CME's FedWatch tool, investors expect the Fed to cut rates again by 25 basis points in December.

Market experts such as Ray Dalio have warned that the Federal Reserve's easing cycle could fuel market bubbles.

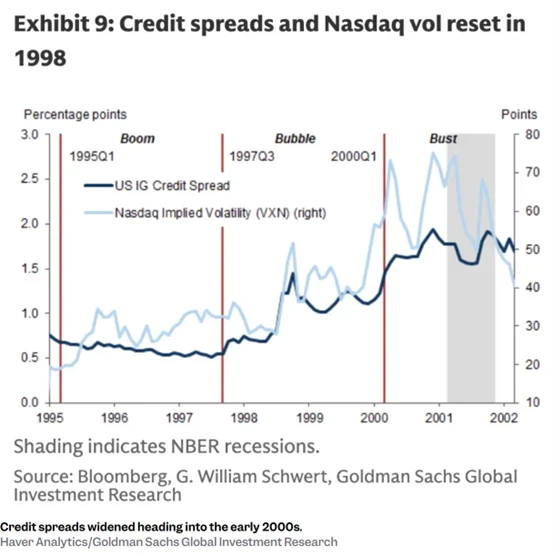

5. Credit spreads widened

Goldman Sachs pointed out that credit spreads widened on the eve of the dot-com bubble burst.

Credit spreads refer to the portion of a bond or credit instrument’s yield that exceeds the yield of benchmark bonds such as government bonds. Credit spreads widen when investors perceive increased risk and demand higher returns as compensation.

Credit spreads are currently at historically low levels, but have begun to widen in recent weeks.

The ICE Bank of America High Yield Index Option-Adjusted Spread showed that as of last week, the credit spread rose to 3.15%, an increase of 39 basis points from 2.76% at the end of October.

Goldman Sachs strategists said these warning signs appeared at least two years before the dot-com bubble actually burst in the 1990s, adding that they believe there is still room for AI trading to rise .

(Article source: CLS)