After a period of frenzied price increases for precious and industrial metals in 2025, forecasters believe that strong investor demand for gold, silver, and copper is about to weaken, leading to a significant drop in these metal prices from their current near-historic highs.

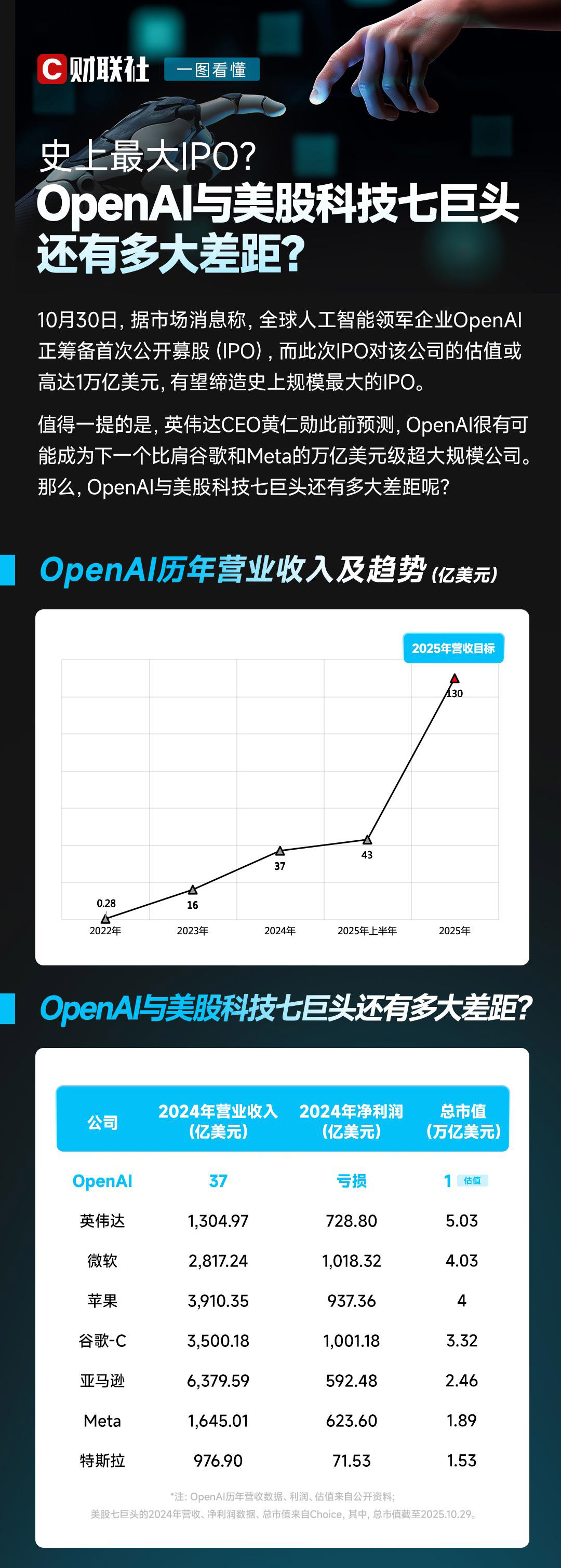

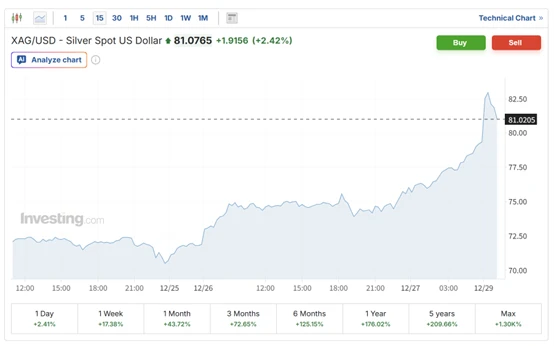

Gold, as a safe-haven and inflation hedge, received more attention from investors in 2025 due to economic concerns. Last year, it rose by 64%, marking its best year since 1979. Silver prices surged by 150%, also its best year since 1979. New York copper rose by more than 40%, marking its best year since the global financial crisis.

Bull market reversal

In a recent report, researchers at Capital Economics stated that they believe demand driven by "fear of missing out" (FOMO) could dissipate by 2026, potentially causing prices for these metals to "fall just as rapidly."

In another report, the company stated that copper prices, currently trading at around $13,200 per ton, are expected to fall back to around $10,500 per ton by the end of the year, which would represent a 20% decrease in copper prices.

Prior to this, Capital Economics also predicted that gold prices would fall to around $3,500 per ounce by the end of 2026, which would mean a drop of nearly 21% from current levels for the precious metal.

David Oxley, chief climate and commodities economist at Capital Economics, noted that metal prices rose rapidly in the last few months of 2025, and that "retail investor enthusiasm" may have been part of the reason for the price volatility.

He explained that, admittedly, the price increases of many metals, including silver and copper, are largely due to supply and demand imbalances. Currently, the growing demand for data centers and other artificial intelligence (AI) infrastructure is causing shortages and price increases in these two metals. However, "higher prices will incentivize more people to recycle metals or increase the supply of metals."

S&P Global said on Thursday that it expects growth in the AI and defense sectors to increase global copper demand by 50% by 2040, but without increased recycling and mining efforts, the annual supply gap is expected to exceed 10 million tons.

At the same time, Oxley also pointed out that demand for certain metals (such as silver) seems to have recently become "less sensitive" to price changes, which could be a sign that prices are about to return to normal.

“Looking ahead, the old adage ‘high prices are the cure for high prices’ will, to some extent, come true over time. In this context, contrary to increasingly optimistic forecasts from analysts, we still maintain that gold and other metal prices will be lower than current levels by the end of this year,” he added.

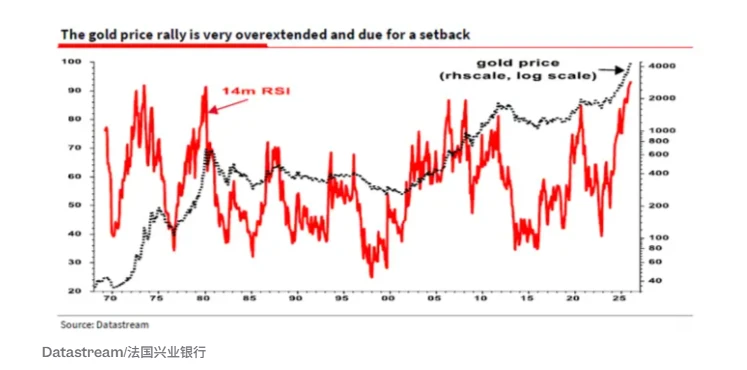

Overbought signal

In fact, some metals have already issued overbought technical signals. For example, according to Societe Generale's analysis of gold's Relative Strength Index (RSI), gold appears to have reached its most severe overbought level ever.

Previously, Wells Fargo Investment Institute also wrote in December of last year that silver seemed to be "overheating," citing the metal's RSI reading. Joe Mazzola, head of trading and derivatives strategy at Charles Schwab, wrote in a report that the recent strength in precious metal prices appears to be partly due to "speculative buying."

Meanwhile, Deutsche Bank analyst Michael Hsueh stated that gold and silver prices may fall due to the Bloomberg Commodity Index's annual weight rebalancing in January. Some forecasters emphasize that if the price decline in these metals reaches the expected level, it will mark a reversal of the historic upward trend.