META released its third-quarter earnings report after the market closed on Wednesday, Eastern Time.

The financial report shows that Meta's profit declined sharply in the third quarter of 2025 due to a one-time non-cash income tax charge of nearly $16 billion. At the same time, Meta also raised its full-year spending forecast and stated that it will further increase total spending significantly in 2026 to ensure sufficient funds for its data center operations. Maintain a high level of investment in other infrastructure.

Following the release of its financial report, META's stock price plummeted 7.37% in after-hours trading.

During the earnings call, Meta CFO Susan Li specifically explained this one-time tax expense. Meanwhile, Meta CEO Mark Zuckerberg addressed the Wall Street analysts in attendance, outlining his vision for artificial intelligence. Plans for business growth, etc.

Key points from the META earnings conference call

I. Dual growth in users and core business, with continuous optimization of monetization efficiency.

User scale reaches new highs: Daily active users across all platforms exceed 3.5 billion, Instagram surpasses the milestone of 3 billion monthly active users, and Threads reaches 150 million daily active users with user engagement time increasing by 10% year-on-year, with video content becoming a key driver. — Instagram video usage time increased by more than 30% year-over-year, and Reels' annualized revenue exceeded $50 billion.

Strong revenue and profit performance: Q3 total revenue of $51.2 billion (up 26% year-over-year); advertising business is the core engine, with end-to-end AI-driven advertising tools generating over $60 billion in annualized revenue, and the Advantage Plus automated advertising solution helping advertisers reduce customer acquisition costs by 14%, while WhatsApp click ad revenue increased by 60% year-over-year.

II. Intensified AI Strategy: Advancing Both Computing Infrastructure and Technology Implementation

Advanced computing power deployment: Plans to significantly increase capital expenditure in 2026 (with a growth rate significantly higher than in 2025) , focusing on the Meta Super Intelligence Lab (MSL) and AI infrastructure, building data centers in phases and collaborating with third parties (such as Blue Owl in cooperation with data centers ) to ensure computing power;

Accelerated technology implementation: Meta AI has over 1 billion monthly active users, and model optimization (such as LAMA 4) has directly driven usage growth. It will also integrate cutting-edge MSL models in the future. The Vibes AI creation tool was launched, and media generation increased tenfold after its launch. Enterprise-level AI pilot projects in the Philippines and Mexico have yielded significant results, with users engaging in millions of dialogues with enterprise AI. Plans are in place to expand to US website scenarios.

III. Hardware Business: Wearable Devices Lead the Way, VR Under Short-Term Pressure

AI glasses are becoming a new growth driver: Ray-Ban Meta and Oakley Meta glasses have seen strong sales , and the new Meta Ray-Ban display glasses sold out in 48 hours. Q4 AI glasses revenue is expected to grow significantly year-on-year, and AI functions will become a core use case in the future, with the goal of covering billions of users.

VR business faces short-term setbacks: Reality Labs expects Q4 revenue to decline year-on-year due to the high base created by the launch of the Quest 3 headset in Q4 last year, and the inclusion of some sales in Q3 due to early retail inventory buildup this year. However, in the long term, the company remains focused on the research and development of "full-view" products (such as the Orion prototype).

IV. Financial Planning: Focusing Expenditure on AI, with Cash Flow Supporting the Strategy

The spending and capital orientation is clear: total spending in 2025 is expected to be US$116-118 billion (an increase of 22%-24% year-on-year), with capital expenditures of US$70-72 billion ; the growth rate of spending will further accelerate in 2026, mainly invested in AI infrastructure (including cloud services and depreciation) and AI talent compensation .

High flexibility in capital allocation: Infrastructure pressure is reduced through off-balance-sheet financing methods such as joint ventures and third-party collaborations (e.g., the Blue Owl data center partnership is not included in CapEx), while maintaining shareholder returns—Q3 saw a $3.2 billion share buyback, $1.3 billion in dividends, and cash and marketable securities. It reached $44.4 billion.

V. The new U.S. tax law will bring significant tax savings in the future.

Meta's Chief Financial Officer, Susan Li, specifically explained the one-time tax expense in the financial statements during the meeting, stating that due to adjustments under the new U.S. tax law, a one-time non-cash tax expense occurred—an impairment adjustment to "deferred tax assets that are no longer expected to be used." This adjustment directly led to a significant increase in the tax rate for the quarter. This expense is merely an accounting adjustment and does not involve any actual cash outflow.

With this one-time tax expense included, Meta faced an effective tax rate of 87% in the third quarter. However, if this one-time expense is excluded, the effective tax rate in Q3 was 14%, which is more in line with the company's previous tax burden level for daily operations.

Susan Lee made it clear that the new U.S. tax law will still bring significant cash tax savings to the company for the remainder of this year and in future years. This expenditure fully reflects the full expected impact of the transition to the new tax law, and there will be no similar one-time tax expense due to the same policy adjustment in the future.

She anticipates that, barring any further changes to U.S. tax policy, the company's tax rate will be between 12% and 15% in the fourth quarter of 2025, returning to normal levels.

The following is the complete transcript of the Q&A session from the META earnings call (translated with AI assistance).

Participants

CEO – Mark Zuckerberg

Chief Financial Officer – Susan Li

Meeting Moderator - Krista

Krista: Thank you everyone. Now we'll begin the Q&A session. If you're streaming this meeting live, please mute your computer speakers. The first question is from Morgan Stanley. Brian Nowak of Morgan Stanley, please speak.

Brian Novak: Thank you for answering my questions. I have two questions for Susan. First, Susan, the core optimization plans for models, ad ranking models, and more types of computing power by 2026 sound very promising, and the scale of the infrastructure development behind them seems quite large. Could you help us understand what early quantifiable signals you've seen from the A/B testing of these optimizations? Which of these signals are most encouraging, and what gives you confidence that these capital expenditures will deliver a return on investment (ROIC)? That's my first question. My second question is relatively brief: How significant is the revenue headwind for the Reality Labs business segment in your Q4 guidance? Thank you.

Susan Lee : Thank you, Brian, for your question. I think your first question covers several aspects, and I will try to break it down one by one. Please let me know if there are any parts I haven't covered. First, it's important to note that the increase in capital expenditure in 2026 compared to 2025 will come from several core areas—Meta Superintelligence Lab (MSL), Core AI , and non-AI-related spending. All of these areas will see growth, with the most significant increase in AI demand at MSL.

Regarding our core AI advancement plan, when formulating our 2025 budget last year, we outlined a roadmap for resource investment encompassing human resources and computing power, anticipating returns on these investments in 2026. This involves multiple aspects of ad ranking optimization and performance improvement, and we have been consistently seeing the effects of these investments this year. There are numerous specific initiatives, and we primarily monitor progress through two indicators: the improvement in ad effectiveness and the growth in conversion rates. For us, conversion rate is a complex metric because advertisers optimize for different value objectives. However, after controlling for variables, we still observe strong year-over-year growth in the value-weighted conversion rate, and the growth of the weighted conversion rate continues to outpace the growth of ad impressions.

In addition, we discussed some new model architectures this year that will help us better utilize more data and computing power to improve advertising effectiveness, and we expect this trend to continue in 2026. We have already started the 2026 budget development process and still see a range of investment directions that are expected to drive revenue growth. We are excited about these investment opportunities and they will be an important support for our continued strong revenue growth next year.

Regarding your second question about revenue headwinds for Reality Labs, we haven't quantified the specific scale yet, but we expect Reality Labs' revenue in the fourth quarter to be lower than the same period last year , for reasons I've already mentioned. The main factor is that we launched the Quest 3 headset in the fourth quarter of last year, while there are no new headsets launching this year. Also, since the Quest 3 headset will launch in October 2024, we included all holiday season-related Quest 3 headset sales in the fourth quarter of last year, while this year retail partners purchased Quest headsets in the third quarter to prepare for the holiday season, and those sales are already included in the third quarter. Although revenue from AI glasses will see a significant year-on-year increase in the fourth quarter due to strong demand for new products, this growth will not be enough to offset the revenue headwinds from the Quest headset business.

Krista: The next question is from JPMorgan Chase. Doug Anmuth of JPMorgan, please speak.

Doug Ambrose: Okay, thank you for taking the question. I strongly agree with the strategy of proactively deploying computing power for superintelligence. Could you please discuss how, when formulating plans for increased capital expenditures and a significant increase in the rate of expenditure growth next year, you will balance the impact on profitability and free cash flow with the growth of your core business? Also, are there any target figures we should be focusing on regarding cash holdings or overall net cash? Thank you.

Susan Lee : Thank you for your question, Doug. We are still in the early stages of developing our 2026 budget, a process that is highly variable and dynamic . Clearly, our current computing capacity is still insufficient to meet demand – both the Meta Superintelligence Lab team and our core businesses have numerous applications that generate positive ROI and urgently require more computing power.

Therefore, our plan must not only ensure that computing power needs are met in 2026, but also reserve flexibility and options for potential needs in 2027 and 2028. However, the budget proposal is still under development and has not yet been finalized, so there are no specific target figures to share at this time. What is clear, however, is that our strategic priority in the budget formulation process is to ensure sufficient computing power to gain a favorable position in the field of artificial intelligence; this is our primary consideration.

Mark Zuckerberg : I'd also like to add a few points. While, as Susan said, the budget is still being finalized, and we usually share more details early next year, we've consistently observed a pattern so far: after building a certain scale of infrastructure based on positive expectations, there's always an increased demand for computing power—especially in core business areas—and this demand often generates substantial profits, ultimately leading to a shortage of computing power.

This indicates that increasing infrastructure investment is likely to be a profitable decision in the medium to long term. This is because the primary use of this computing power is to advance AI research and development and new AI businesses, thereby supporting the development of core businesses and new products. Even if some computing power is not currently used in these areas, we are fully capable of investing it in the intelligent optimization of a series of applications and advertising businesses, achieving profitability by improving recommendation quality.

Of course, there is also the possibility of overinvestment. But as I mentioned before, new demands for computing power are emerging almost weekly, both internally and externally—external organizations frequently contact us, hoping we will provide API services or share computing power, although we have not yet started such businesses. Obviously, even if there is a surplus of computing power, we have solutions. The most extreme case is completing infrastructure construction several years ahead of schedule. Although there will be some depreciation losses, this computing power will eventually be fully utilized as the business develops.

Therefore, my view is that rather than letting limited capital expenditures prevent many profitable investment opportunities in our core business from materializing, we should proactively accelerate investment to ensure that we can meet the needs of AI R&D and new businesses while also improving the computing power supply for our core business. Of course, infrastructure development is still subject to many operational constraints, and we are working diligently to advance this work, sharing more progress in the coming months and next year. Overall, the opportunities in this area are extremely broad.

Krista: The next question is from Goldman Sachs. Eric Sheridan, please speak.

Eric Sheridan: Thank you very much for taking the question. Mark, you previously discussed plans to move towards superintelligence. I'd like to bring the topic back to consumer AI: how are users currently interacting with Meta AI across various applications? What signals have you observed? In the future, as superintelligence research results are implemented and models are continuously upgraded, how will this change the usability of Meta AI and user habits? Thank you.

Mark Zuckerberg : There are already a huge number of users using Meta AI, as I mentioned in my opening remarks, with over 1 billion monthly active users. We've observed that user adoption is steadily increasing as model quality improves (currently primarily through post-training optimization of LAMA 4 models). Therefore, we believe that once the next generation of models developed by Meta Superintelligence Labs (i.e., models with truly cutting-edge capabilities and unique functions) are integrated into Meta AI, its potential for growth will be enormous.

It's worth noting that Meta boasts an industry-leading track record in promoting new, user-favorite products to billions of users. Therefore, I predict that Meta AI, equipped with advanced models, will see widespread adoption in the coming years, a truly exciting prospect.

It's worth noting that this extends beyond Meta AI itself—artificial intelligence will also spawn various products based on new content formats. This trend is already beginning to emerge in the video and content creation fields, and more innovations are expected in the future. Furthermore, enterprise-level artificial intelligence (Business AI) is also an important direction.

Beyond spurring new product development, smarter models will also drive upgrades to core businesses: optimizing content recommendations across a suite of applications and improving ad delivery effectiveness. As we've seen, this area still has enormous room for improvement, and with the optimization of AI technology, opportunities continue to expand; there is currently no indication that growth has reached its ceiling.

As I mentioned in the previous question, our application and advertising businesses are currently experiencing a "computing power shortage"—although we have built up a significant amount of computing power, much of that resources are being invested in future business development. Allocating more computing power to our core businesses would unlock enormous growth potential.

Krista: The next question is from Mark Shmulik of Bernstein. Please speak.

Mark Schmullick: Hello, thank you for taking the time to ask a question. Susan, what are your thoughts on the sustainability of increased advertising effectiveness and user engagement next year, and how the scale of these increases will compare to the past two years? Also, regarding the timeline for the new initiatives at the Meta Super Intelligence Lab, should we interpret this as the potential launch of newer, cutting-edge models next year? Or should we focus more on the progress of new products you favor, such as Vibes? Thank you.

Susan Lee thanked Mark for his question. Regarding ad optimization, some of our recent innovations involve improvements to large-scale models. It's important to note that we do not use large models like JEM for inference, as their scale and complexity would make them prohibitively costly. Our approach is to transfer the capabilities of large models to lightweight, smaller models through "knowledge transfer," and then use these smaller models for runtime inference.

In addition to developing basic models, we are also optimizing inference models by developing new technologies and architectures to achieve a positive, scalable increase in ROI for computing power and complexity. Overall, we have a large advertiser base and a significant amount of demand flow within the system—even if we only achieve a base-point improvement in advertising effectiveness in a particular quarter, or a single-digit increase in conversions relative to impressions, the sheer size of the base will still drive significant absolute revenue growth.

Mark Zuckerberg: Regarding the progress of the Meta Superintelligence Lab, I'd like to add something. We haven't announced specific launch dates for the models or products yet, but we expect to see results from both in the future—we plan to develop new models and new products, and we'll share any progress as soon as it's made. I'm really looking forward to it.

Krista : The next question comes from Bank of America. Justin Post of Bank of America, please speak.

Justin Post : Okay, thank you. Mark, you mentioned two development cycles earlier, and both cycles clearly brought considerable profit margins to the company. Entering the AI cycle, despite market concerns about related investments, I'd like to ask: What tools do you foresee being launched for users in the future? New competition has emerged in this field; what are your thoughts on that? Secondly, will profit margins differ in the AI cycle compared to previous cycles? Is there any reason to believe there will be differences? Thank you.

Mark Zuckerberg: It's too early to talk about profit margins for new products. Every product has its unique attributes, and the relevant patterns need time to be discovered. My core goal is to build a business that creates the greatest value for users while maximizing profits (not just profit margins). Therefore, we will focus on developing the highest quality products to provide the greatest value to as many users as possible.

Krista: The next question comes from Barclays bank Ross Sandler of Barclays, please speak.

Ross Sandler: Okay, hello Mark. Many other AI labs focus on achieving more abstract, long-term milestones like Artificial General Intelligence (AGI). When building your new team, how do you balance achieving these long-term goals with developing products that can immediately generate revenue for Meta? Is your previous goal of providing personalized AI for billions of people still a core direction? Or are Vibes, Sora (video generation models), and other areas also considered important directions? How should we understand the company's overall strategic direction? Thank you.

Mark Zuckerberg: Here's how I see it: R&D will generate new technological capabilities that can be integrated into various products. For example, stronger reasoning capabilities are crucial in many areas—powering personal assistants, optimizing enterprise-level AI, helping advertisers intelligently plan marketing campaigns, and even influencing the ranking and decision-making mechanisms of content feeds in the future. This is just one example.

For example, high-quality video generation capabilities not only provide users with new creative tools but also expand the content libraries of Instagram and Facebook, thereby increasing user engagement. Simultaneously, they help advertisers create higher-quality creative content, driving monetization efficiency. Similarly, various technological capabilities will generate multifaceted application value.

I believe the key to product development lies in identifying which new products have practical value based on an existing list of technological capabilities and prioritizing them. Fundamentally, however, the development of new technological capabilities will exhibit an exponential growth trend. Furthermore, I believe that achieving leadership in a particular area will yield enormous rewards—this is not a simple "task-based" competition (such as "if others can generate content, so can we"), but rather companies that hold a leading position in each capability area will capture most of the potential value in that area.

There are countless potential applications in artificial intelligence, and no single company can maintain a leading position in every area—I firmly believe this. Our core strategy is not to replicate what others have done, but to focus on developing unique technological capabilities. Due to competitive and strategic considerations, I cannot disclose specific priorities, but I hope the above explanation conveys our thinking: we are committed to developing innovative technologies, integrating them into multiple products, and then leveraging computing power to reach billions of users. This process will not only spawn new products and businesses but also significantly enhance existing operations.

Krista: The next question is from Mark Mahaney of Evercore ISI, please speak.

Mark Mahaney: Thank you. I'd like to ask about Meta AI's product development and monetization path: What aspects of Meta AI's user adoption and usage are most encouraging to you? Also, we know you typically follow a path of "launching the product first, then increasing user engagement, and finally considering monetization." Where is Meta AI currently in this path? Have you clearly defined its monetization strategy? Thank you very much.

Mark Zuckerberg: The two things that excite us the most are: First, we have successfully built a product with a large user base that users find valuable; second, there is a clear positive correlation between improvements in model quality (optimizations that we believe are valuable) and user engagement – which shows that we still have enough room to enhance user engagement by improving model capabilities and gradually make Meta AI a leading product.

Regarding our current stage: We have recently been fully committed to building the Meta Super Intelligence Lab, and have assembled a team that I am very proud of—the most talent-dense team in the industry—comprising numerous top researchers, infrastructure experts, and data specialists, all focused on next-generation technology research and innovation. Once the relevant results are implemented, we will integrate them into multiple products; this will be the core work of the next stage, and the prospects are very promising.

From a monetization perspective, these new models will drive revenue growth in a variety of ways—such as increasing user engagement, optimizing ad performance, and helping advertisers conduct marketing campaigns more efficiently.

Another opportunity that has been frequently mentioned in previous meetings but not discussed this time is that in the future, advertisers will only need to tell us their business goals and provide their payment method, and the AI system will automatically handle everything else—including generating personalized videos or various creative content, and targeting customers. The capabilities we are currently developing are laying the foundation for achieving this goal, so I am optimistic about it.

Krista : The next question comes from Citigroup. Ronald Josey of Citi, please speak.

Ronald Josie: Okay, thank you for taking the time to ask a question. This question directly follows on Mark's previous point. We understand that the annualized revenue (ARR) of end-to-end automation has reached $60 billion. Could you please elaborate on the adoption rate of this business among advertisers? More broadly, when you integrate ranking and recommendation optimization measures such as Andromeda, GEMS, and Lattice with automation, how does it overall improve advertisers' return on investment (ROI)? Thank you.

Susan Lee : Okay. We've been steadily building the Advantage Plus product line and expanding its target scenarios. In the third quarter, we completed the global rollout of the "Simplified Creation Process" for Advantage Plus lead generation campaigns—advertisers conducting sales, app, or lead generation campaigns can now enable end-to-end automation from the very beginning of campaign creation.

Similar to the "simplified creation process" for other target scenarios, this feature helps advertisers optimize and automate multiple aspects of marketing campaign setup, including audience selection, ad placement scenario selection, budget allocation, and pacing control, to achieve the most efficient campaign results.

We observed that Advantage Plus continues to drive improved advertising performance—advertisers who use this feature to conduct lead marketing campaigns experience an average reduction of 14% in cost per lead acquisition, a significant advantage compared to advertisers who do not use this feature.

We believe there is still significant room for growth in Advantage Plus adoption: many advertisers only use our end-to-end automation solution in certain marketing campaigns, so we are poised to further expand our market share. To capitalize on this opportunity, we are continuously optimizing product performance and adding features to key use cases that are not yet covered.

At the same time, we are also working to encourage advertisers who only use a single automation feature (such as advertisers who only use the Advantage Plus audience feature) to expand their usage and help them understand the advantages of adopting multiple automation features at the same time.

Overall, Advantage Plus is a continuously evolving platform: we not only expand its feature set but also extend these features to a wider range of advertisers. As Mark noted, advertisers currently using these automation solutions generate $60 billion in annualized revenue, and this figure still has significant room for growth.

Krista: The next question is from Youssef Squali of Truist Securities. Please speak.

Youssef Squale : Okay, thank you very much. Mark, regarding the wearables business: Do you think the hardware sales of this business can cover the upfront investment costs? Or will it require new revenue streams such as advertising, services, and e-commerce on the new computing platform? If it relies on new channels, what are the key constraints? Also, Susan, how are you planning to finance on-balance-sheet and off-balance-sheet financing for AI-related initiatives? Meta recently partnered with Blue Owl on a data center in Louisiana. Is this included in the 2026 capital expenditure guidance? If not, how much will this type of financing support Meta's future funding? Will it slow down the growth rate of capital expenditures after 2026? Thank you.

Mark Zuckerberg : I'll start by talking about wearable devices, and then Susan will answer questions about funding. Currently, both Ray-Ban Meta and Oakley Meta are progressing very well. If this momentum continues, I believe this business will be a highly profitable investment . Its revenue streams include two parts: device sales themselves, and subsequent ancillary services and AI-related revenue.

Therefore, the opportunities in this field are enormous. It's important to emphasize that our investment extends beyond the devices themselves to building supporting services. Currently, many users purchase these devices for non-AI features (although they also appreciate AI capabilities), but I anticipate that over time, AI will become the core reason users utilize these devices, which in itself will create significant business opportunities.

While Ray-Ban Meta and Oakley Meta continue to grow, we are also investing in more cutting-edge products, such as the Orion prototype (a product form with a broader vision) showcased at last year's Connect conference. These products are still in the early stages of commercialization and have a long way to go before becoming a sustainable and profitable business. Our overall goal is to bring these products to hundreds of millions or even billions of users, at which point their profit potential will be enormous.

Susan Lee : Youssef, regarding your second question: The joint venture we announced with Blue Owl is an attempt to bring in external capital to develop data centers – a model that provides long-term options for future computing power needs while also addressing the uncertainty and scale challenges of computing power needs in the coming years.

Regarding capital expenditure accounting: Before the establishment of the joint venture, we had already included part of the construction cost of the data center in the upfront capital expenditure; in the future, the construction cost of the data center will no longer be included in capital expenditure, and we will bear the remaining construction cost according to our 20% shareholding ratio (this part of the expenditure will be included in "other investment cash flows").

Krista: The last question is from Wells Fargo. Ken Gawrelski of Wells Fargo, please speak.

Ken Gorellsky: Thank you. I have a question for Mark: If a leading-edge model is successfully launched next year, in the ever-evolving AI ecosystem, do you think value will primarily flow to platform providers, or more to large-scale first-party applications? Thank you.

Mark Zuckerberg: I'm not entirely sure what you mean by "platform" and "application" in this context, but overall, I think there's a huge potential for value creation in the field of artificial intelligence.

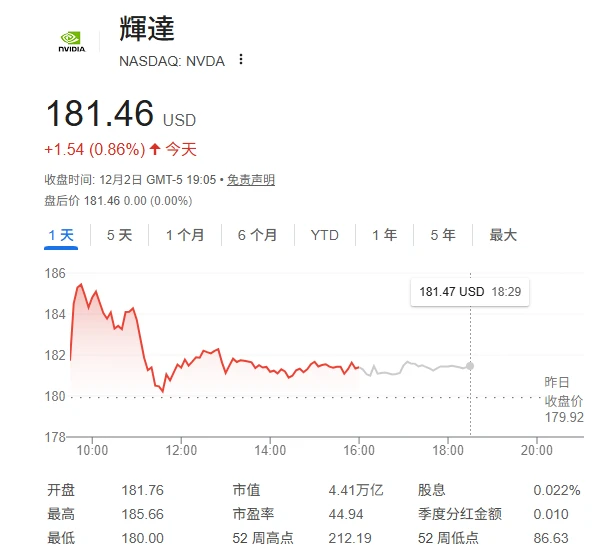

From the current market perspective, hardware manufacturers (such as Nvidia) The cloud service has performed exceptionally well, and its success is well-deserved. Cloud service partners and related companies are also thriving, and this trend is expected to continue, with significant future opportunities. At the application level, most applications are currently small in scale, but they will clearly become important growth areas in the future.

Looking back at the history of the technology industry, we find that companies typically leverage breakthroughs in a single technology to develop new products, thereby building communities or forming other types of network effects, ultimately evolving into a sustainable and profitable business. The difference lies in the fact that the pace of technological iteration today far exceeds that of the past—multiple new products can be developed around each new capability, and each product has the potential to grow into a sizable business.

Therefore, I am optimistic about the overall prospects of this field. Meta possesses a strong capability to reach billions of users in new product development and large-scale deployment—this is our core strength and will create tremendous value for the company. Whether it's optimizing recommendation algorithms, improving service quality, integrating model capabilities to expand the content pool, or leveraging the various effective strategies accumulated over more than two decades of operation, these will continue to drive business growth. We will continuously improve the system's versatility and intelligence, optimize the user recommendation experience, and expand the content library; these measures will all yield significant results.

Looking ahead, we will launch more new products and gradually extend them to billions of users, building new businesses (whether based on advertising, e-commerce, or user-paid models). Currently, the field of artificial intelligence is still in its early stages, but our core business has begun to show returns, giving us more confidence to increase investment—we must ensure we don't miss opportunities and avoid underinvestment.

Kenneth Dorell : Okay, thank you all for participating today. We look forward to speaking with you again soon.

(Article source: CLS)