The Federal Reserve is expected to cut interest rates for the third consecutive meeting this week, but Fed Chairman Jerome Powell may face another significant challenge in securing support from his colleagues for this easing measure…

Every Fed rate cut this year has been met with dissenting votes—and at this week's final FOMC meeting of the year, it is widely speculated that three FOMC voting members will again cast dissenting votes.

With only one policy tool to address the conflicting goals of high inflation and a weak job market, Powell, the Federal Reserve chairman known for building consensus during difficult times, may now find himself unable to completely "hold the line" towards the end of his term…

Given Powell's strong prestige within the FOMC (his term as chairman expires next May), this may also indicate that the next Fed chair nominated by Trump will find it more difficult to manage his 18 colleagues.

Will the number of dissenting votes in the last three meetings be the same as in the previous 47 meetings?

Federal Reserve officials generally agree that interest rates should be lowered to a level that neither exerts significant economic pressure nor actively stimulates the economy, but they disagree on the specific value of the neutral interest rate—which is the root of the increasing opposition.

Barclays "That's the crux of the matter," said Marc Giannoni, chief U.S. economist at Capital and former head of research at the Dallas Fed. "At this stage, it's difficult to argue whether policy is neutral, expansionary, or contractionary."

In the six weeks since the Federal Reserve's last meeting, opinions have become increasingly divided on how many more rate cuts are needed. Officials have been exchanging their views – some urging further rate cuts to support the weak labor market, while others advocate for a pause in rate cuts given persistent inflation, and market expectations for a December rate cut have fluctuated accordingly.

Finally, two Federal Reserve officials considered Powell's "closest allies" ( Williams) Powell's willingness to support interest rate cuts, along with Daly's, finally tipped the scales in favor of the dovish camp at the December meeting, indicating that Powell may be trying to steer more FOMC members in that direction...

This is a tried-and-true strategy that Powell employed repeatedly during his tenure as Federal Reserve Chairman—few dissenting votes emerged during his tenure. Unlike other central banks, the Fed typically operates on a consensus-driven basis—potential dissenters often attempt to gain support by modifying post-meeting statements or the Chairman's guidance on the future path of interest rates. Supporters argue that this approach enhances policy confidence, thereby reducing market uncertainty and volatility.

But this era of "unity and cooperation" seems to be coming to an end with only six months left in Powell's term. This month's meeting is expected to be the fourth in a row to see at least one dissenting vote. At the same time, if three more dissenting votes appear in December, the total number of dissenting votes in the last three meetings (September, November and December) will reach eight, matching the total number of dissenting votes in the previous 47 meetings!

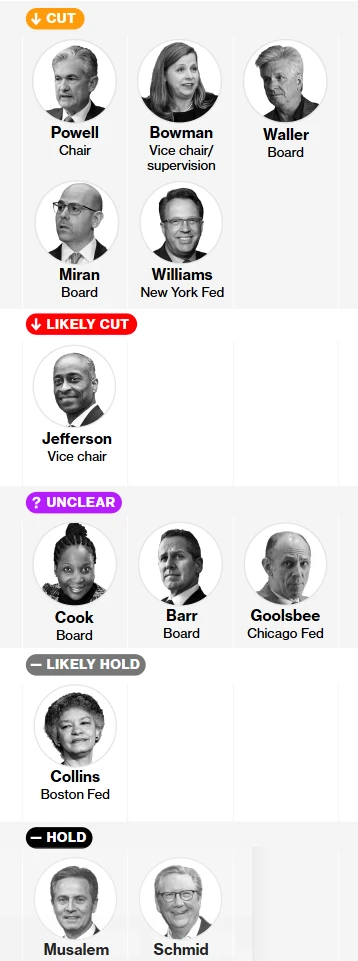

The chart below illustrates the industry's assessment of the potential camps of the 12 FOMC voting members at this week's meeting, which can be roughly divided into the following five tiers:

Officials who support interest rate cuts: Powell, Vice Chairman Bowman, Governor Waller, Governor Milan, and New York Fed President Williams ;

Officials who may support an interest rate cut: Vice Chairman Jefferson;

Officials with unclear positions: Governor Cook, Governor Barr, and Chicago Fed President Goolsby;

Officials who may support maintaining stable interest rates: Boston Fed President Collins;

Officials who support maintaining stable interest rates: St. Louis Fed President Mussallem and Kansas City Fed President Schmid.

As we can see, if the Federal Reserve decides to hold rates steady at its policy meeting this week, it is indeed possible that three (Collins, Mussallem, and Schmid) or even more dissenting votes will emerge again.

Will it be even more difficult to build consensus for the next Federal Reserve chairman?

Many industry insiders say that with US President Trump about to nominate the next Federal Reserve Chair, frequent and large numbers of dissenting votes may become the norm at future Fed policy meetings. This US president, who is keen on "micro-management," has never hidden his desire for significant interest rate cuts. If Trump's nominated Fed Chair advocates for further rate cuts, it will make many Fed officials—especially those concerned about inflation—more skeptical.

Kevin Hassett, the White House National Economic Council director and currently the leading candidate to succeed Powell, has stated that due to artificial intelligence... The boom is boosting U.S. economic productivity, allowing the Federal Reserve to cut interest rates significantly. Just as with the introduction of the internet in the 1990s, achieving higher output with less input can mitigate the impact of economic growth on inflation.

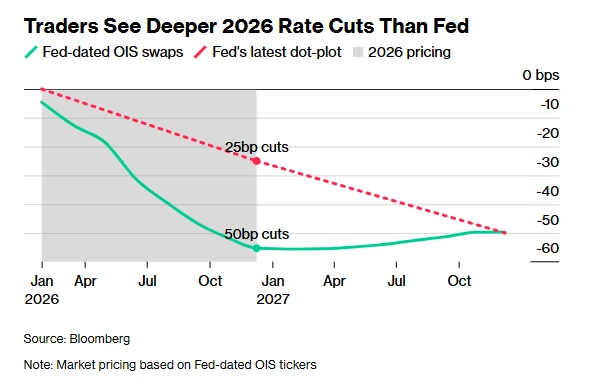

But most of Hassett's potential future colleagues do not entirely agree with this outlook. In the dot plot projections released in September (to be updated tomorrow night), officials on average expect only one more rate cut in 2026 and only one more in 2027.

In any case, many Federal Reserve officials are currently more concerned with how to formulate the right policies as quickly as possible.

Voters supporting another rate cut this month are likely to cite recently released data showing continued weakness in the labor market, including the unemployment rate climbing to 4.4% in September. Data released last week by ADP Research showed that the U.S. employment situation worsened further in November, with private sector layoffs reaching 32,000, the largest drop in nearly three years.

But officials reluctant to cut rates further may argue that policy should continue to curb inflation. Data delayed due to pandemic-related shutdowns showed that the Fed's preferred inflation gauge, the core PCE price index, rose 2.8% year-over-year in the 12 months ending in September, still well above the Fed's 2% target.

“I would be more worried if there were no disagreements,” said Mester, who served as president of the Federal Reserve Bank of Cleveland from 2014 to 2024. “The current disagreements precisely illustrate that the U.S. economy may be heading in different directions.”

Given that the official U.S. non-farm payroll data for November will not be released until December 16 (after the Federal Reserve meeting), and the November CPI data will not be available until December 18, this has added more anxiety to those who closely monitor economic developments.

Therefore, many industry insiders currently expect that the Fed's decision to cut interest rates this week will likely be "packaged" with hawkish language —both to appease officials who prefer to maintain the status quo and to reflect the view of most policymakers that there is no need for further significant rate cuts.

(Article source: CLS)