In recent weeks, artificial intelligence has become a hot topic. The (AI) market appears to be facing a major reshuffle: Google is emerging as a frontrunner, overshadowing Nvidia. But Morgan Stanley Morgan Stanley recently reassured investors that there is not much reason to worry about the "AI giant."

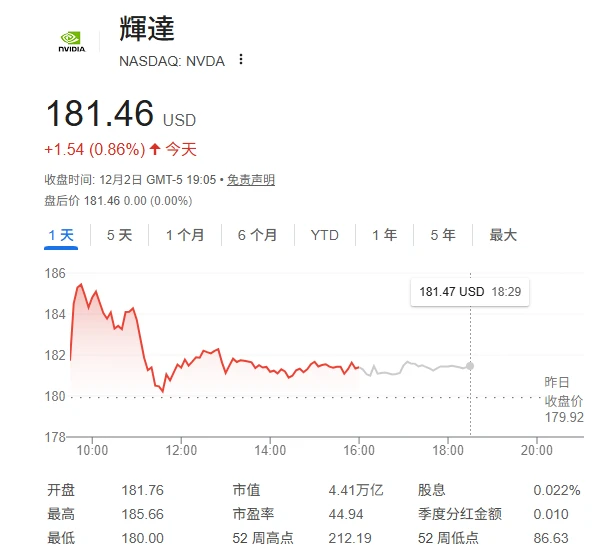

Nvidia 's stock price fell 9% last month, and even the company's outstanding third-quarter results failed to provide new momentum for itself and the broader artificial intelligence industry. Prominent investors such as Japan's richest man, SoftBank's Masayoshi Son, and billionaire Peter Thiel have sold off their Nvidia shares , casting a shadow of fear over the market regarding a potential bubble.

But Morgan Stanley analyst Joseph Moore countered the pessimism this week, raising his price target for the stock from $235 to $250. This is one of the highest price targets on Wall Street, implying that the stock could still rise by about 38% from current levels.

He believes the threat to the market share of this AI leader, particularly in the Asian market, has been exaggerated.

In fact, speculation that Nvidia's dominance in the artificial intelligence market may be threatened is nothing new. Ever since ChatGPT sparked the AI craze in 2022 and Nvidia became the undisputed darling, investors have been wondering how long it can maintain its position as the largest AI hardware manufacturer.

Nearly three years after the release of ChatGPT, Google seems poised to reinvent AI chips. Market Trends: With the emergence of Gemini 3, NVIDIA's self-developed AI chip, TPU (Tensor Processing Unit), has finally stepped into the spotlight. Seeing its GPU dominance being challenged, NVIDIA urgently issued a statement emphasizing that its products offer higher performance, greater versatility, and better substitutability than ASICs.

However, Morgan Stanley believes that other chipmakers do not pose a significant threat to Nvidia. Meanwhile, the analyst recently visited Asia and shared his views on why Nvidia should not worry about competition from the East.

“Despite the significant attention given to AI solutions in Asia, we believe they are very limited on several levels, including cluster size and outreach technology, and Asian software still aspires to Western solutions,” he wrote in the report.

On the other hand, at the GTC conference at the end of October, Jensen Huang revealed that Nvidia has a total of up to $500 billion in AI GPU computing infrastructure orders for the entire calendar year of 2025 and 2026. These orders correspond to the company's Blackwell architecture, which is at the core of this round of global deployment of artificial intelligence, and the Rubin architecture AI GPU computing cluster to be launched in 2026.

Moore stated that his team had "verified" one of the expectations.

“After meeting with several contacts in Asia and the United States, we are willing to raise our expectations to bring revenue to this level,” he added.

Finally, although this analyst also raised his forecast for Broadcom , another chipmaker... Moore has set a target price for Broadcom, but he still believes Nvidia is the clear winner in the industry.

“We predict that Broadcom and AMD’s AI processor revenue will grow slightly faster than Nvidia’s in 2026, but this mainly reflects supply chain constraints, with all key products facing supply limitations in 2026,” he said.

Overall, Morgan Stanley believes that even with increased competition in the AI chip market, Nvidia will maintain the best price-performance ratio and be able to gain access to a wider range of AI applications and workloads than its competitors.

(Article source: CLS)