① Thanks to his aggressive bets on AI, SoftBank founder Masayoshi Son's wealth surged 3.5 times in just four months, reaching $55.1 billion, making him Japan's richest man again; ② From repeatedly missing out on Nvidia... From stock holding opportunities to now betting on AI data centers , robot Masayoshi Son's wealth trajectory, intertwined with the chip ecosystem, once again reflects the vicissitudes of global capital trends.

With his almost all-in bet on AI, SoftBank Group founder Masayoshi Son has once again claimed the title of Japan's richest man.

According to statistics, since June of this year, Masayoshi Son's net worth has surged from approximately $15 billion to $55.1 billion (approximately 391.1 billion yuan), a 3.5-fold increase. On Wednesday, Son also slightly surpassed Tadashi Yanai, chairman of Fast Retailing, the parent company of Uniqlo, to become Japan's richest person . This position had been held by Yanai for most of the past decade and had remained unchanged since April 2022.

Masayoshi Son's soaring wealth corresponds to the recent surge in SoftBank Group's stock price . The 68-year-old Japanese billionaire owns about one-third of SoftBank's shares.

(SoftBank Group daily chart, source: TradingView)

This year, in the field of AI, Masayoshi Son's ambitious business plans include investing $30 billion in OpenAI and partnering with ChatGPT developer Oracle. He is partnering with MGX in the UAE to build a $500 billion AI data center and related infrastructure in the United States. He is also seeking cooperation with TSMC. The two sides will collaborate to build a trillion-dollar industrial park in Arizona for AI and robotics .

In recent months, Masayoshi Son has also unexpectedly made moves against Intel. The company made a $2 billion investment and spent $5.4 billion to acquire ABB Group’s robotics business.

Undoubtedly, Masayoshi Son's wealth story is closely linked to the wildly popular AI narrative. Some analysts warn that a network of related-party transactions, built by Nvidia and OpenAI, is artificially fueling the hype in the capital markets .

But for Masayoshi Son, he has experienced many ups and downs in his personal wealth .

Masayoshi Son founded SoftBank in the 1980s, starting as a software distributor and also publishing some books on computers. Over the next 40 years, he developed SoftBank into a well-known brand encompassing telecommunications, fintech, and a prominent venture capital fund.

Aside from running his own businesses, Masayoshi Son's wealth story is more about "investing in and recognizing talent."

As one of the earliest investors in internet companies, he purchased a stake in Yahoo in 1995 and briefly surpassed Bill Gates to become the world's richest person during the dot-com bubble at the beginning of the century. But before he could even celebrate, SoftBank's stock price plummeted.

However, during this bubble period, Masayoshi Son made the decision to invest in Alibaba, which was just starting out. He initially invested $20 million , and then another $60 million in Alibaba in 2004. More than a decade later, this investment yielded a profit of over $100 billion , allowing Masayoshi Son to once again become Japan's richest man.

Interestingly, Masayoshi Son originally had a faster path to becoming Japan's richest man: SoftBank acquired British chip design company ARM for $31 billion (£24 billion) in 2016. Nvidia offered approximately $40 billion to acquire ARM in 2020, with $21.5 billion to be paid in Nvidia stock . This deal ultimately fell through due to antitrust review failures.

The $21.5 billion worth of Nvidia stock back then is now worth nearly $330 billion.

From another perspective, even if the Arm deal had gone through, Masayoshi Son might not have been able to hold onto Nvidia stock until today.

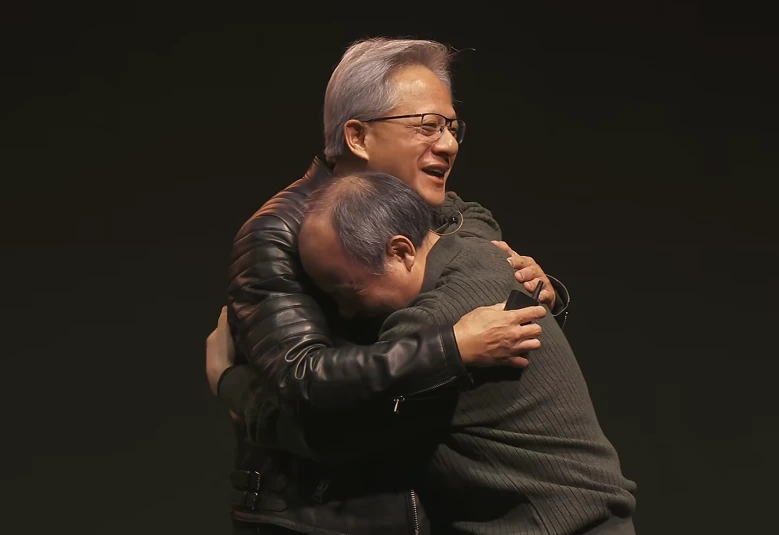

During his speech at the NVIDIA AI Summit in Japan at the end of last year, Jensen Huang called on Masayoshi Son to reminisce about their past friendship. According to the NVIDIA CEO himself, SoftBank, owned by Son, was once NVIDIA's largest shareholder, but Son sold all his shares in 2019. Amid laughter from the audience, the two "embraced and cried."

Against this backdrop, SoftBank, which reaped huge returns from its 2017 investment in Alibaba, established the Vision Fund to search for the "next Alibaba ." SoftBank immediately set its sights on Nvidia, investing approximately $4 billion to acquire about 4.9% of the shares. However, after holding the stake for nearly two years, it sold off its entire stake, netting a profit of $3 billion. These shares would be worth over $240 billion today.

In fact, after completing the acquisition of ARM, Masayoshi Son immediately approached Jensen Huang to propose the privatization of Nvidia, but it ultimately failed to materialize.

Joking aside, Huang Renxun also praised Son Masayoshi, saying that as an industry veteran who has been in the business since the PC era, Son is the only entrepreneur he has ever seen who has correctly bet on all the computer industry winners in the PC, traditional Internet, mobile Internet, cloud services and now AI era, and has cooperated with the winners.

(Article source: CLS)