① OpenAI plans to go public in 2027, with a potential valuation of up to one trillion US dollars; ② Novo Nordisk ③ Volkswagen Group suffered an operating loss of nearly 1.3 billion euros in the third quarter.

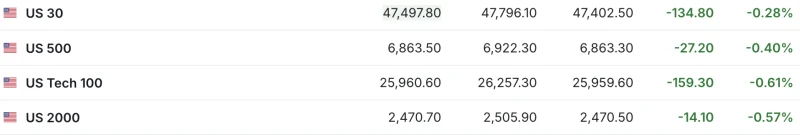

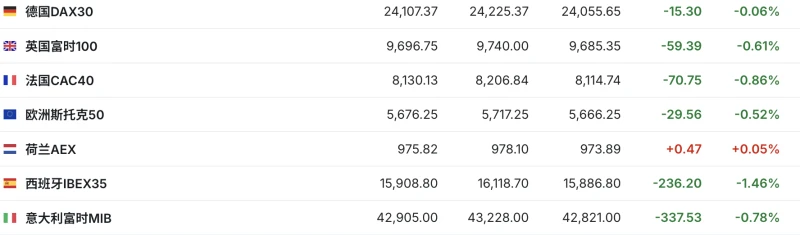

U.S. stock index futures fell across the board on Thursday as investors digested the outcome of trade negotiations and earnings reports from several large technology companies. Major European indices also generally declined.

(Source: Investing.com)

Wall Street's performance was mixed in the previous trading session. The Dow Jones Industrial Average retreated after hitting a record high during the session, ultimately closing down about 0.2%, while the S&P 500 closed flat and the Nasdaq... The index closed up nearly 0.6%.

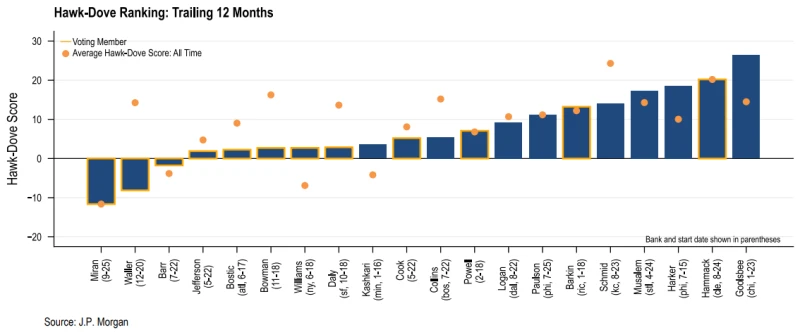

Market sentiment was influenced by hawkish comments from Federal Reserve Chairman Jerome Powell. The Fed announced a 25-basis-point rate cut on Wednesday, in line with market expectations, but Powell stated in a press conference, "Further rate cuts at the December meeting are not a certainty, far from it."

Investors had previously expected the Federal Reserve to cut interest rates by 25 basis points twice in succession at its October and December interest rate meetings.

Chris Maxey, chief market strategist at Wealthspire Advisors, said, "This rate cut was relatively easy, and the market gave the Fed some room to maneuver. Currently, monetary policy is in a reasonable balance with the employment/inflation situation. Powell's lack of confidence in a December rate cut has unsettled the market, and this could be the beginning of a 'sluggish market reaction'."

Investors are trying to assess companies' capabilities in artificial intelligence. Spending speed and return on investment in the (AI) field: three tech giants – Alphabet (Google's parent company), Meta, and Microsoft. All of them released their quarterly results after the market closed on Wednesday.

Alphabet's stock price surged 8% in pre-market trading due to strong earnings; however, Meta and Microsoft shares fell by approximately 10% and over 2%, respectively. The market's reaction to these earnings reports dragged down the overall market performance.

Sam Stovall, chief investment strategist at CFRA, pointed out that if tech companies' earnings reports show that AI-related productivity is improving faster than expected, the Federal Reserve may be forced to cut interest rates more sharply than originally planned.

He also cautioned that October is historically one of the most volatile months, and the uncertainty surrounding future prices could actually present attractive buying opportunities for traders.

apple and Amazon The company will release its earnings report after the market closes on Thursday.

Company News

OpenAI plans to go public in 2027, with a potential valuation of up to one trillion US dollars.

OpenAI reportedly plans to file for an IPO as early as the second half of 2026 and go public in 2027. The IPO valuation could reach approximately $1 trillion, potentially making it one of the largest IPOs in history. OpenAI aims to raise at least $60 billion.

An OpenAI spokesperson stated, "An IPO is not our focus, so we cannot set a specific date. We are building a sustainable company and advancing our mission to make artificial general intelligence accessible to everyone."

[Off-road light strip may detach, Tesla] 6,197 Cybertrucks recalled in the US

On October 30, the National Highway Traffic Safety Administration (NHTSA) announced that Tesla is recalling 6,197 2024 Cybertruck models due to a possible misuse of the primer used when installing the light strips to the windshield, which could cause the off-road light strips to detach.

Novo Nordisk bids to acquire US company Metsera

On October 30, Danish pharmaceutical company Novo Nordisk announced that it had submitted a proposal to acquire US biopharmaceutical company Metsera. Novo Nordisk will acquire all outstanding common stock of Metsera for $56.50 per share in cash (equivalent to a total equity value of approximately $6.5 billion or an enterprise value of approximately $6 billion), and will also pay contingent value rights (CVR) at a maximum of $21.25 per share in cash (or a total value of approximately $2.5 billion) depending on the achievement of certain clinical and regulatory milestones. It is understood that Pfizer... The company also made a takeover offer to the company last month.

Lilly Third-quarter revenue was $17.6 billion.

Eli Lilly announced on October 30 that its third-quarter revenue was $17.6 billion, a 54% year-over-year increase; adjusted earnings per share for the third quarter were $7.02. Eli Lilly raised its full-year 2025 revenue guidance to $63 billion to $63.5 billion.

As of press time, Eli Lilly's US-listed shares were up more than 3% in pre-market trading.

Merck Third-quarter sales reached $17.276 billion, a 4% year-over-year increase.

Merck released its third-quarter financial report on October 30, showing sales of $17.276 billion, up 4% year-over-year; net income of $5.785 billion, up 83% year-over-year, on a GAAP basis; and earnings per share of $2.32, up 87% year-over-year, on a GAAP basis.

Volkswagen Group reports nearly €1.3 billion operating loss in third quarter.

On October 30, Volkswagen Group released its financial results for the third quarter of 2025: vehicle deliveries reached 2.199 million units, up 1.0% year-on-year; revenue reached €80.305 billion, up 2.3% year-on-year; operating loss reached €1.299 billion, compared to an operating profit of €2.833 billion in the same period last year; and operating cash flow from the automotive division reached €8.521 billion, down 9.7% year-on-year.

Total Group reported adjusted net income of $3.98 billion in the third quarter, a 2.3% decrease year-over-year.

TotalEnergies reported third-quarter revenue of $43.84 billion and net profit of $3.68 billion on October 30. Adjusted net profit was $3.98 billion, a 2.3% decrease year-over-year.

Key events to watch in the US stock market (Beijing time)

October 30

21:15 The European Central Bank will announce its interest rate decision.

21:45 ECB President Christine Lagarde holds a press conference on monetary policy.

At 21:55, Federal Reserve Governor Bowman delivered a pre-recorded speech at an online conference.

October 31

01:15 Dallas Fed President Logan, a 2026 FOMC voting member, delivers a speech.

(Article source: CLS)