With the busiest earnings season over last week, the current earnings season for US stocks is now halfway through. Institutional statistics show that the market's excess returns this quarter have declined compared to historical averages. Meanwhile, given current valuation levels, the delicate outlook for the Federal Reserve's policy stance could present potential headwinds.

Goldman Sachs Positive earnings reports did not translate well.

Despite the strong performance of the third-quarter earnings season, the market did not fully reward it.

Data compiled by Goldman Sachs shows that while stocks that outperform earnings expectations continue to rise after the earnings release, the gains are lower than historical levels. The median excess return relative to the S&P 500 is only 32 basis points, compared to a historical average of around 98 basis points.

Aside from the economic recovery period following the pandemic at the end of 2020, the frequency of "positive performance surprises" is currently the highest this century—notably, this performance is driven by both sales growth and profit margin improvement.

Why are stock prices no longer surging as dramatically as they used to with better-than-expected earnings? Goldman Sachs' portfolio strategy team, led by David Kostin, believes that investors are now more focused on a company's future earnings prospects than ever before. Market volatility caused by the trade war and recent events involving US regional banks... The panic triggered by credit problems has further exacerbated this trend. Goldman Sachs also believes that most investors may regard the market consensus of a 6% earnings growth rate as a "conservative forecast," or even consider this figure "unrealistically low."

The market is currently paying close attention to artificial intelligence among large-cap technology stocks. (AI) Related Spending. Goldman Sachs emphasizes that capital expenditures by mega-technology companies continue to exceed investor and analyst expectations. For example, in early 2025, the market predicted these companies' capital expenditures for the following year would be $314 billion, while that expectation has now risen to approximately $518 billion. A key point raised in the report is: "Investors' acceptance of increased capital expenditures depends on the strength of earnings growth and the market's perception of the monetization potential of AI investments."

Kostin uses Alphabet (Google's parent company) and Meta as examples for comparison—Alphabet's stock price rose after it raised its 2026 net profit guidance, while Meta's stock price fell after its earnings report, as it maintained a relatively stable 2026 guidance. Of the companies that have released earnings reports this month, half mentioned the potential for AI-related efficiency improvements, a slight increase from the second quarter. This situation may boost investor confidence in the sector.

Morgan Stanley Be wary of two major risks

Morgan Stanley's chief U.S. equity strategist and star analyst, Michael Wilson, said that Federal Reserve policies and funding markets could put pressure on the stock market.

Valuation is generally not the primary factor determining the timing of a stock market correction. According to FactSet data, the S&P 500's forward 12-month price-to-earnings ratio is currently at 23, significantly higher than the 10-year average of around 18.6, placing it at a high level. One reason the market can tolerate such high valuations is that if investors are confident that corporate earnings growth will outpace stock market gains for some time, then high valuations become justified.

"We believe this is an underappreciated trend that we expect to continue into 2026, driving a widening range of earnings contributions from both major and minor indices," Wilson said in a report released Monday. "As always, the stock market has anticipated this shift before consensus forecasters."

In fact, a major highlight of the current earnings season is the much stronger-than-expected corporate revenue performance: as of now, S&P 500 component companies' revenue has increased by 2.3% year-over-year, twice the historical average growth rate. This suggests an overall optimistic outlook for corporate profitability. Easing trade concerns have also boosted market confidence. However, Wilson and his team also acknowledge that the stock market may face some short-term risks.

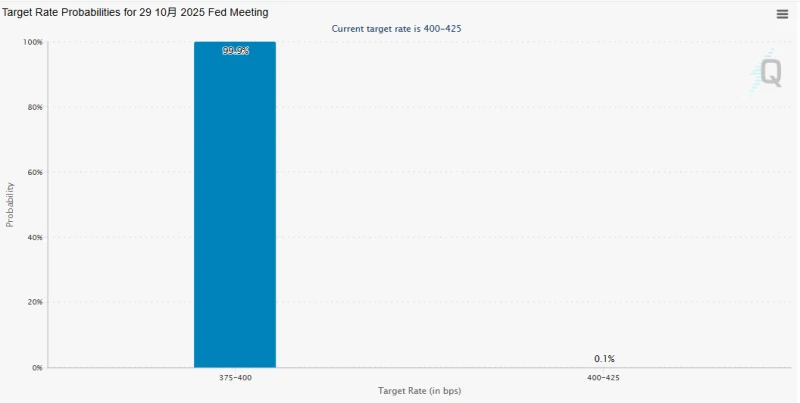

One risk is that the pace of the Federal Reserve's rate cuts may disappoint the market. Wilson points out that although the bond market has lowered its rate cut expectations after Fed Chairman Powell poured cold water on the possibility of a December rate cut last week, the stock market seems unmoved. "The stock market is currently reacting mildly to this change, partly because the market is still in a 'good news is good news/bad news is bad news' environment—as evidenced by the significant positive correlation between stock returns and bond yields."

If the pace of interest rate cuts slows slightly while the economy remains stable or continues to improve, the stock market can accept this. However, Wilson is more cautious on this issue, stating, "We need to pay attention to the signals released in the short term by the bond market (lowering the pricing of Fed rate cuts) and the stock market (poor breadth)." Furthermore, the ongoing government shutdown, preventing the release of key economic data, may also cause the Fed to pause its easing policies. He added, "This means that it is still too early to bet on rotation between small-cap/quality/deeply cyclical stocks until the Fed clearly demonstrates a 'preemptive' willingness (i.e., the federal funds rate is well below the 2-year Treasury yield).

Another risk Wilson is concerned about is the rising pressure in the funding markets. Trading volume in the overnight repo market (short-term funding market) has been steadily increasing recently. If this trend continues, coupled with a widening spread between the secured overnight funding rate (SOFR) and the federal funds rate, or even failed transactions, the Federal Reserve's announcement last week that it would halt its quantitative easing (QT) program to reduce its balance sheet in December may be a response to this issue. "In our view, the final outcome will depend on the performance of the short-term funding markets. The stock market is likely to react, especially in some highly speculative sectors."

(Article source: CBN)