① Michael Burry, the real-life inspiration for the film "The Big Short," seems to be targeting the end of a bubble again, just as he did during the subprime mortgage crisis; ② In this latest move, Burry simultaneously used put options to short two of the most prominent AI stocks in the current market frenzy—Palantir and Nvidia. This is exactly the same strategy he used in 2008 to short real estate through credit default swaps (CDS).

After his "comeback" last week after a two-year hiatus and his warning of a bubble, Michael Burry, the real-life inspiration for the movie "The Big Short," proved on Monday that he wasn't just using words to scare the market, but was actually laying the groundwork for a massive short position...

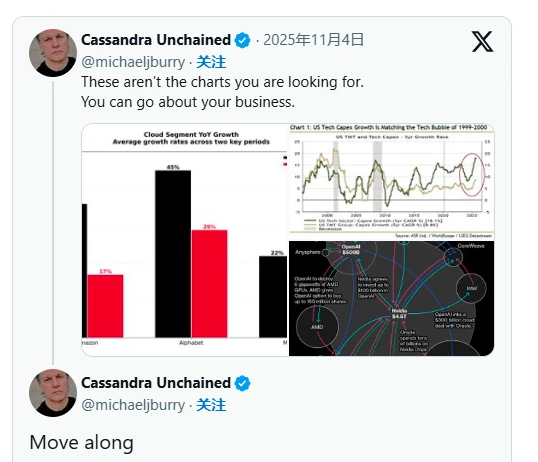

As reported last week, Burry shared a still from the movie "The Big Short" on social media platform X last Friday, showing Christian Bale, the actor who plays him, staring blankly at a computer screen. He captioned the photo, "Sometimes we see the bubble. Sometimes we can make a difference. Sometimes, the only way to win is not to participate."

Although Burry didn't explicitly state what he meant by "bubble" at the time, industry insiders generally believed he was referring to the current AI boom. And on Monday, Burry further confirmed this…

In his latest tweet, Burry compared Alphabet and Amazon in a chart. and Microsoft The difference between the growth of the cloud business segment between 2018 and 2022 and the current period suggests that the returns on this AI boom are simply too low. This echoes a growing concern in the market that, like the massive overinvestment in fiber optic capital expenditures during the early stages of the dot-com bubble, the current AI boom is likely to be short-lived . Many of the leading companies in the bubble may eventually collapse.

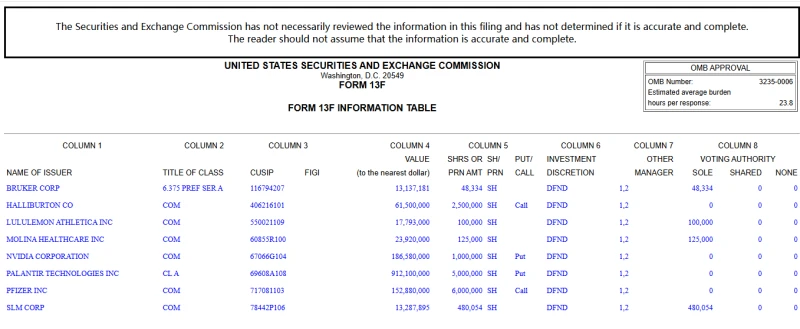

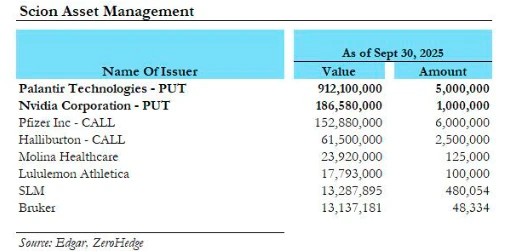

Then something even more intriguing happened: Scion Asset Management, headed by Burry, released its third-quarter 13F report two weeks early—the report showed that Burry not only saw a bubble, but was also taking action.

The first half of the 13F filing is unremarkable: it mainly shows its holdings in traditional small-cap stocks such as Bruker, Lululemon, SLM, and Molina Healthcare.

However, the latter part is intriguing—first, the entire position consists of a combination of put and call options; second, the underlying assets of the main put options are the two giants currently defining the artificial intelligence bubble: Palantir and Nvidia .

Moreover, in terms of scale, these are not ordinary put options, but massive positions —measured by the size of the assets managed by Bury. The notional value of the Palantir put options is as high as $912 million (equivalent to 5 million shares), and the notional value of the Nvidia put options is $186 million, together accounting for 80% of the Scion Asset Management portfolio.

Unfortunately, the exact option premium paid by Bury is currently unknown, as is the specific term of the put option (including the strike price and expiration date).

All that can be confirmed is that Burry seems to be targeting the end of the bubble again, just as he did during the subprime mortgage crisis. In this latest move, Burry is simultaneously shorting two of the most prominent stocks in the current AI frenzy – Palantir and Nvidia, a strategy strikingly similar to his 2008 strategy of shorting real estate through credit default swaps (CDS).

Of course, what investors currently have is that, given that both Palantir and Nvidia's stock prices are currently higher than their levels on September 30th (the final coverage period of the 13F filing), assuming Burry hasn't closed his positions, he has already suffered significant losses on these two positions. The next question is whether Burry's latest pessimistic prediction will actually come true…

Interestingly, although Burry made a name for himself during the subprime crisis, his judgment and actions were actually about two years ahead of time. Although the final direction of the transaction was correct, the holding costs of the related CDS still caused him heavy losses.

Furthermore, Burry has a history of failures in recent years—his last attempt to catch a market top was in January 2023, when he tweeted with just one word: "Sell." However, he soon admitted that he had misjudged the situation.

(Article source: CLS)