For U.S. retail investors who flocked to chasing hot stocks, Tuesday was arguably the worst day since the market turmoil triggered by Trump's trade war in April...

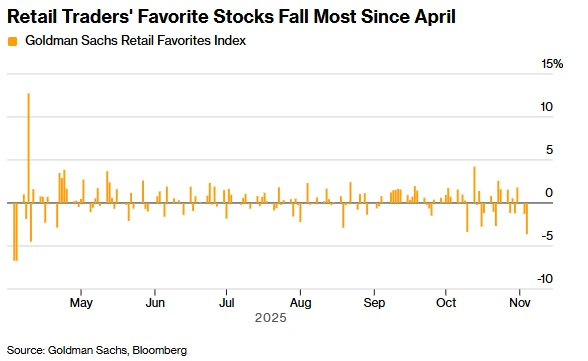

Market data shows that the stock price fell due to Palantir's weaker-than-expected earnings guidance and the disclosure by John Burry, the inspiration for "The Big Short," that he was shorting the stock and Nvidia. The impact of Goldman Sachs The group's "Retail Favorites Index" suffered a major blow overnight.

This index tracks the stock portfolios heavily held by non-professional traders, with key components including Palantir and Tesla. Companies extremely popular among US retail investors, such as Reddit and Robinhood Markets. By Tuesday's close, the index had ultimately fallen 3.6% for the day, roughly three times the decline of the S&P 500 over the same period.

This also marks the largest drop in the "retail investor preference index" since April 10, when US stocks plummeted due to market concerns about the implementation of the US president's tariff policies.

This year, retail investors who primarily engage in day trading have used artificial intelligence... The surge helped push major U.S. stock indexes to their highest levels for the year, while also raising concerns within the industry about a growing speculative bubble.

According to JPMorgan Chase Data shows that after a sharp drop at the open on Tuesday, retail traders remained active, having bought $560 million worth of individual stocks and ETFs by 11 a.m. New York time. This may have contributed to the early rebound on Tuesday – the S&P 500 briefly narrowed its losses before turning negative again.

Melissa Armo, CEO of investment training platform Stock Swoosh, described the market movement as follows: "People tried to push the market up in the morning, but ultimately failed. This happens when people panic and sell."

Palantir, a darling of day traders after a significant year-to-date surge, saw its stock price plummet by about 8% on Tuesday, amid market concerns that the software company was overvalued and that the overall AI sector's rally was unsustainable. (Deutsche Bank ) "Their performance was good, but the market was disappointed by the lack of clarity in the companies' outlook for the entire year of 2026," strategist Jim Reid wrote in a report.

Factors exacerbating overnight market panic included renowned hedge fund manager Michael Bree—the inspiration for the film "The Big Short," famous for predicting the U.S. housing market crash—who disclosed in a 13F filing that his firm was heavily shorting Palantir and Nvidia . This regulatory filing came just days after he issued a cryptic warning to retail investors last Friday about excessive market optimism.

Meanwhile, Bitcoin's plunge this week also severely impacted retail investors and dragged down cryptocurrency-related stocks. On Tuesday, Bitcoin's price fell below the $100,000 mark for the first time since June. This decline comes not long after the historic liquidation three weeks ago that wiped out billions of dollars in leveraged crypto positions.

Looking ahead, Armo said he is currently preparing for another possible drop on Wednesday.

Regarding whether it's a good time to buy at the bottom, Armo suggests that investors, if they can tolerate the "pain," should prepare a list of stocks they want to buy in advance. She emphasizes, "The premise is that they can bear the pain; if not, I suggest selling."

(Article source: CLS)