Advanced Micro Devices (AMD) Co., Ltd. The company (AMD) announced its third fiscal quarter results. The report shows that as AMD further expands its artificial intelligence... Data Center The company boosted its business and increased sales of PC processors, resulting in significant increases in both profit and sales in its latest quarter.

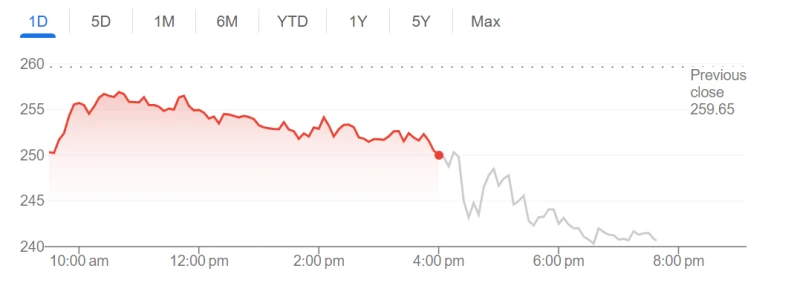

However, despite the quarterly results exceeding Wall Street expectations, the company's stock price has already risen 107% year-to-date, far outperforming the market, making selling pressure considerable. Coupled with widespread concerns in the US stock market on Tuesday regarding the high valuations of AI tech stocks, the company's stock fell in after-hours trading.

The company's stock price fell more than 3.7% in after-hours trading.

This scenario is strikingly similar to the performance of Palantir, a leading AI application stock, just a day earlier. Despite the company's new earnings report released on Monday exceeding expectations and raising its guidance, it still closed down 7.94% on Tuesday.

AMD releases satisfactory financial report

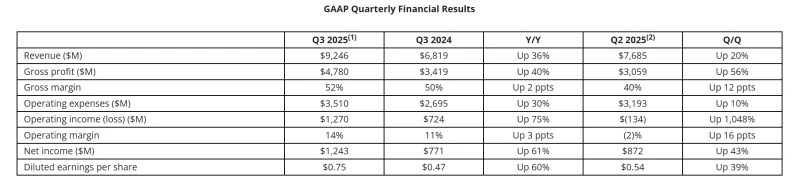

Compared to the analyst consensus data compiled by LSEG, the company's performance in the third fiscal quarter ending September 27 is as follows:

Earnings per share: Adjusted at $1.20, compared to an expected $1.16.

Revenue: $9.25 billion, up 36% year-over-year, compared to an expected $8.74 billion.

Net income climbed to $1.24 billion, or 75 cents per share, compared with $771 million, or 47 cents per share, in the same period last year.

Looking at it by department

AMD's data center business, which includes standard CPUs and GPUs for artificial intelligence , reported revenue of $4.34 billion in the third quarter of this fiscal year, a 22% year-over-year increase. Analysts had previously expected revenue of $4.13 billion.

Client-side (including PC processor) revenue reached $2.75 billion, a 46% year-over-year increase, exceeding analysts' expectations of $2.61 billion and setting a new record.

game The business generated $1.3 billion in revenue, a 181% year-over-year increase, while analysts had expected $1.05 billion.

For its fourth fiscal quarter, AMD expects revenue of approximately $9.6 billion, representing a 25% year-over-year increase. This figure is slightly higher than LSEG's estimate of $9.15 billion. AMD anticipates an adjusted gross margin of 54.5% for the quarter, consistent with analysts' expectations of 54.5%.

The company stated that this guidance does not include revenue generated from shipments of its Instinct MI308 chips to China. Executives had stated the same in the previous quarter.

AMD Chairman and CEO Dr. Lisa Su stated:

"Our outstanding quarter, with record revenue and earnings, reflects strong market demand for our high-performance EPYC and Ryzen processors and Instinct AI accelerators. Our record third-quarter results and strong fourth-quarter expectations mark a significant improvement in our growth trajectory. The continued growth of our computing business and the rapid expansion of our data center AI business will significantly drive revenue and earnings growth for the company."

AMD is collaborating with several tech giants

In recent months, AMD has been rapidly expanding, attempting to catch up with Nvidia in the AI processor market. This will allow OpenAI to break Nvidia's monopoly on AI processors. For years, OpenAI and other companies have relied on Nvidia 's GPUs to run large-scale artificial intelligence models.

Last month, AMD and OpenAI reached an agreement under which the latter may acquire a 10% stake in AMD. The two companies stated that OpenAI will deploy 6 gigawatts of AMD Instinct graphics processing units over the next few years, across multiple hardware generations, with the first deployment of 1 gigawatt chips starting in the second half of next year.

Also in October, Oracle The company announced plans to deploy 50,000 AMD Instinct MI450 AI chips in its cloud services starting next year.

In the earnings statement, AMD Executive Vice President and Chief Financial Officer Jin Hu said, "Our continued investment in artificial intelligence and high-performance computing is driving significant growth and enabling AMD to create long-term value."

(Article source: CLS)