As uncertainty surrounding the U.S. economy deepens, divisions and disagreements within the 19-member Federal Reserve Board are also intensifying, putting Fed Chairman Jerome Powell's much-praised communication skills to the ultimate test...

The Federal Reserve's decision to cut interest rates last week was not unexpected, but the meeting was historic—the Fed decided to cut rates by 25 basis points by a vote of 10 to 2. The two dissenting votes came from the "hawkish" camp that supports tighter monetary policy and the "dovish" camp that supports looser monetary policy. Such a situation is extremely rare —it has only happened three times in the history of the Fed's interest rate meetings since 1990.

Stephen Milan, the Federal Reserve governor appointed by Trump this year, voted last week to cut interest rates by 50 basis points, while Kansas City Fed President Schmid voted to keep rates unchanged.

Behind these two figures lies a deeper division within the Federal Reserve. In fact, Wall Street may have never seen a Fed like this before—the Fed Board of Governors is increasingly being dominated by a dovish "central army" supported by Trump; while at the regional Fed levels, hawkish "local armies" are vehemently criticizing the continuous rate cuts that ignore inflation…

Has the debate between hawks and doves at the Federal Reserve devolved into a "factional conflict"?

Historically, it has not been uncommon for the U.S. Federal Reserve Board, composed of 19 members (12 of whom have voting rights), to be divided—these 19 members include seven Federal Reserve governors and the presidents of the 12 regional Federal Reserve Banks.

In the past, the division between the Fed's "dovish" and "hawkish" factions has never been as broadly reflected as the current opposition between members of the Board of Governors and regional Fed presidents. While there are centrist camps on both sides, a clear trend is that nearly half, if not more than half, of the Fed's Board of Governors members currently favor an accommodative policy, while most regional Fed presidents are more cautious about further rate cuts.

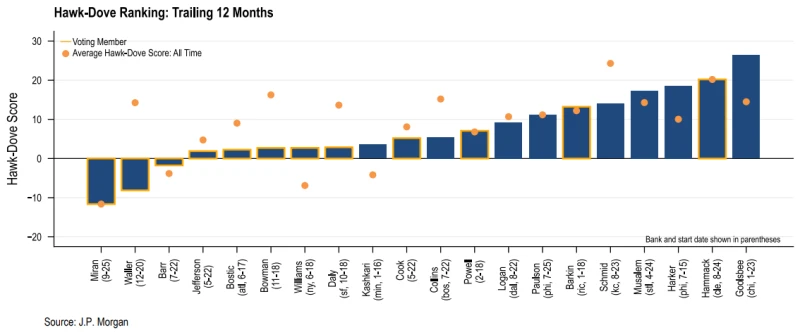

From the following JPMorgan Chase chart The chart depicting the hawks and doves within the Federal Reserve clearly shows that five of the six most dovish officials currently holding positions within the Fed are Federal Reserve Governors: Milan, Waller, Barr, Jefferson, and Bowman.

The remaining two council members, Powell and Cook, who are also frequent targets of attacks from the White House, belong to the centrist camp.

In contrast, regional Federal Reserve presidents are now almost entirely comprised of hawks and centrists.

Since the conclusion of the Federal Reserve's interest rate meeting last Wednesday, Dallas Fed President Logan, Kansas City Fed President Schmid, Cleveland Fed President Hammark, and Chicago Fed President Goolsby have all expressed concerns about further interest rate cuts.

Meanwhile, three Federal Reserve governors—Milan, Waller, and Bowman—publicly supported last week's rate cut and advocated for further easing. Waller and Bowman have been included by Treasury Secretary Bessant on the shortlist of candidates to succeed Powell as the next Federal Reserve chairman, whose term expires next May.

In fact, in our article in August this year, "7 Board Members + 12 Regional Fed Presidents! Can Trump Really 'Unify' the Fed?", we speculated on the White House's potential reform plans for the Fed. Judging from the current situation, although the Trump administration failed to directly remove Board Member Cook on the grounds of falsifying mortgage records, it has at least initially gained greater power on the Federal Reserve Board of Governors.

Is Powell facing an "unprecedented" problem?

At the press conference following last week's policy meeting, Federal Reserve Chairman Jerome Powell also emphasized these internal divisions within the Fed. He told reporters that officials held "strongly different views" on how to proceed, meaning that easing policy in December as the market had previously anticipated was "far from settled." In fact, given the current situation, the outcome of the December interest rate decision may ultimately be like a coin toss, somewhere between another 25 basis point cut or no change.

All of this is happening at a challenging time—investors are not only dealing with a data vacuum caused by the US government shutdown (expected to be the longest on record), but existing indicators are showing a weakening labor market and sticky inflation. Meanwhile, the Federal Reserve is becoming highly politicized, with the Trump administration constantly attacking the central bank's independence and preparing to nominate a successor to Powell.

Admittedly, faced with calls for greater interest rate cuts within the Federal Reserve Board—the center of power—the regional Fed presidents, who have no voting rights, are currently trying to demonstrate their influence, but the final outcome remains to be seen.

As Tim Duy, chief U.S. economist at SGH Macro Advisors, points out, "Power comes from the council."

If policy divergences continue to intensify, many investors will face an unfamiliar situation—they are already accustomed to the Federal Reserve's pre-emptive policy signals and consensus-driven operating model. ( BNP Paribas) James Egelhof, chief U.S. economist, believes that the “very high degree of consensus” that investors are used to may become “unpredictable” in the coming months.

While Egelhof still expects the Federal Reserve to continue cutting interest rates (including in December), he also points out that the decision-making process could become "noisy and chaotic," leading to a policy path that is "more volatile and unpredictable" than in the past. "Polarization will lead to uncertainty," he said.

Against this backdrop, Duy said, "It has become more difficult for Powell to reach a consensus in the area of monetary policy," although he added that Powell has done an "excellent job" in building consensus during his years as chairman.

Perhaps a line from the movie "A World Without Thieves" can describe Powell's current predicament: "The morale is low, and the team is hard to lead..."

(Article source: CLS)