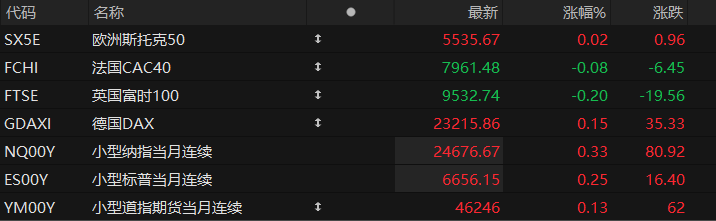

U.S. stock index futures rose across the board in pre-market trading on Wednesday, while major European indices showed mixed results. As of press time, the Nasdaq... S&P 500 futures rose 0.33%, S&P 500 futures rose 0.25%, and Dow Jones futures rose 0.13%.

In terms of individual stocks, most star tech stocks rose in pre-market trading, with Nvidia among them. Google rose about 1.5%, while SanDisk and Tesla also saw gains. Broadcom rose about 1%. Amazon Up about 0.5%; Netflix , apple , Microsoft Both fell slightly by about 0.3%.

Nvidia, the chip giant with a market capitalization of $4.5 trillion, will release its third-quarter earnings report after the US stock market closes on Wednesday (early Thursday morning Beijing time). This report will determine the direction of global markets in the final weeks of this year.

Currently, market anxiety is spreading: from Bitcoin to tech stocks, from gold to government bonds, from private equity to corporate bonds, almost all asset classes are experiencing selling pressure. Against this backdrop, investors are focusing their attention on Nvidia , a move driven by both hope and desperation. The company's performance will directly reflect the true returns on the tech giants' hundreds of billions of dollars invested in AI.

Currently, Wall Street analysts are generally optimistic about Nvidia's upcoming earnings report, expecting both net profit and revenue to grow by more than 50%.

Hot News

The Federal Reserve is about to release its meeting minutes.

The Federal Reserve will release the minutes of its October meeting at 3:00 a.m. Beijing time on Thursday, as investor uncertainty about the direction of U.S. interest rates grows.

The meeting minutes will, for the first time, provide a detailed account of the majority of policymakers' views on the future path of interest rates during the October meeting. A clear division among Federal Reserve officials regarding whether further policy easing before the end of the year is appropriate has been reflected in their recent remarks.

The meeting minutes may also indicate whether the balance of risks has shifted. According to CME Group's FedWatch tool, investors currently see only a 51% chance of a Fed rate cut in December.

Is AI less appealing than space exploration? A former Sequoia Capital executive claims SpaceX is more valuable than OpenAI.

Roelof Botha, who stepped down as global leader of Sequoia Capital two weeks ago, said at an event on Tuesday that SpaceX, the aerospace company founded by Musk, is more advanced than artificial intelligence. OpenAI, a leading company, is more likely to become the most valuable company.

Botha points out that SpaceX alone accounted for 80% of the orbital satellite launch business last year, dominating the industry. While OpenAI is remarkable, it faces several competitors in the large language model field and even greater competition in the consumer sector, so it does not possess an absolute dominant advantage.

Furthermore, Botha emphasized that Musk's iron-fisted control over his companies has also helped him effectively respond to industry changes. Musk has always wanted to avoid being bound by the bureaucratic practices of traditional boards, but this doesn't mean he's unwilling to accept advice; he simply wants to build successful businesses.

Top Wall Street banks' bearish sentiment + Goldman Sachs President: The US AI bull market should take a break.

As the US stock market continued its correction into November, executives at top Wall Street institutions seemed to have reached a tacit agreement, unanimously suggesting that the current bull market in US stocks should take a break.

A recent example is Goldman Sachs President John Waldron, who said during an event in Singapore on Wednesday: " In my view, the market may pull back further from here. I do think the technicals are leaning towards more protection and further declines. "

Against this backdrop, the S&P 500 fell more than 3% this month, potentially ending its six-month winning streak. More crucial than the magnitude of the decline is the technical breakdown.

Similar to Wardlong, JPMorgan Chase Daniel Pinto, vice chairman and president of the company, also said on Tuesday that the valuation of the artificial intelligence industry needs to be reassessed, and any decline will have a ripple effect on the entire stock market.

Pinto stated, "For these valuations to hold water, you have to assume that productivity will increase to a very high level—and that will indeed happen, but it may not arrive as quickly as the market is currently pricing in."

US Stocks Focus

Google launches next-generation AI weather forecasting model, targeting the global commercial weather market.

Tech giant Google announced on its website the release of its most advanced weather forecasting model, "WeatherNext 2," which it claims will provide more efficient, accurate, and higher-resolution global weather forecasts.

The press release states that WeatherNext 2, jointly released by Google DeepMind and Google Research, generates forecasts eight times faster than its predecessor and is accurate to one hour. The model can predict key variables, including wind speed, wind direction, precipitation, and air pressure, with high precision.

Google added that WeatherNext 2's breakthrough is thanks to a brand-new model that can provide hundreds of possible weather scenarios. "Using this technology, we're helping meteorological agencies make decisions based on a range of different scenarios through experimental cyclone forecasts."

The research team explained that the performance improvement is due to a novel AI modeling method called Functional Generative Networks (FGN), which directly injects "noise" into the model architecture, making the generated predictions physically realistic and interconnected.

Tesla's self-driving business has achieved another milestone, receiving approval to operate Robotaxi in Arizona.

Tesla has been approved to begin offering self-driving ride-hailing services in Arizona, marking a significant step in its emerging robotics industry . The taxi business has cleared the way for expansion into new states.

The Arizona Department of Transportation recently granted the automaker a so-called transportation network company license. This landmark permit allows Tesla to... It is possible to provide vehicle operation services to the public using an autonomous driving system, with the assistance of human safety operators.

The company has informed Arizona of its plans to offer ride-hailing services in the Phoenix area, having previously held a permit that allows it to test autonomous vehicles.

Lithium price recovery boosts Chile's mining and chemical industry (SQM.US) Earnings! Q3 net profit increased by nearly 36% year-on-year, and lithium sales hit a record high in the quarter.

Benefiting from the recovery in lithium carbonate prices, lithium giant Chilean Minerals & Chemicals achieved profit growth in the third quarter of 2025.

Financial reports show that Chile's mining and chemical industry achieved Q3 revenue of US$1.173 billion, a year-on-year increase of 8.9%. Adjusted EBITDA was US$404 million, a year-on-year increase of 23.5%. Net profit was US$178 million, a year-on-year increase of 35.8%.

Of these, revenue from lithium and derivatives business reached $604 million, a 21.4% increase from $497 million in the same period last year; lithium sales volume in the quarter also increased by 43% year-on-year, setting a new record for the company. As of press time, Chilean mining and chemical stocks rose more than 2% in pre-market trading on Wednesday.

(Article source: Hafu Securities) )