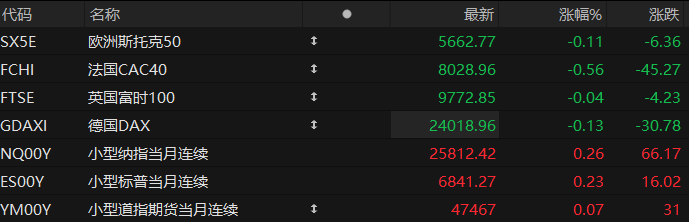

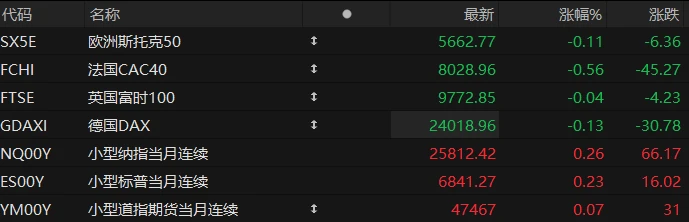

U.S. stock index futures rose across the board in pre-market trading on Thursday, while major European indices generally fell. As of press time, the Nasdaq... S&P 500 futures rose 0.26%, S&P 500 futures rose 0.23%, and Dow Jones futures rose 0.07%.

In terms of individual stocks, major US tech stocks were mixed in pre-market trading, with Nvidia showing mixed performance. Up over 1.5%, Meta and Google rose nearly 1%, Tesla... Up about 0.5%; Microsoft Amazon , apple The stock dipped slightly in pre-market trading.

Digital advertising technology company Applovin shares rose more than 8% in pre-market trading after the company's Q3 revenue surged 69% and it also spent 3.2 billion to increase share buybacks.

Duolingo The stock plunged more than 24% in pre-market trading after the company's fourth-quarter earnings guidance fell short of investor expectations.

Popular Chinese concept stocks generally rose in pre-market trading, with XPeng Motors among them. Baidu rose more than 7%. JD.com rose more than 3%. Weibo NetEase rose nearly 2%. Bilibili It rose by more than 1%.

Alibaba The stock rose nearly 3% in pre-market trading; in terms of news, Alibaba's Hong Kong-listed shares closed up more than 4%, and Taobao Flash Sale new customers' orders for Double 11 e-commerce exceeded 100 million.

Bridgewater Associates founder Ray Dalio warned that the Federal Reserve's decision to end quantitative tightening (QT) may be adding water to a bubble, creating an even bigger bubble.

On Wednesday local time, Dalio published an article on LinkedIn pointing out that the Fed's current easing policy is being implemented when asset valuations are high and the economy is relatively strong. Ending QT is "stimulus into a bubble" rather than the traditional "stimulus into a depression".

Federal Reserve Chairman Jerome Powell recently stated that as banks... With the expansion of the system and the size of the economy, the Federal Reserve "will increase reserves again when appropriate." In Dalio's view , this means that QE is returning—albeit packaged as a "technical operation."

Hot News

The US economy is caught in a reflexive cycle: cost-cutting by businesses drives up stock prices, the wealth effect stimulates consumption, and consumption in turn supports performance.

Not only AI has a "closed loop," but the US economy is also operating in an atypical "closed loop": companies reduce costs and increase efficiency by laying off employees, which boosts stock prices, and the soaring stock market stimulates consumption through the wealth effect. In turn, strong consumption supports corporate performance and economic resilience.

Macroeconomic trends blogger and economist David Woo describes this phenomenon as a Soros-esque "reflexive" closed loop. He warns that this cycle, fueled by corporate layoffs, rising stock prices, and consumer spending, is creating a bubble that could be broken once the AI-driven stock market boom fades or consumer confidence collapses.

JPMorgan Chase The latest research released on the 4th provides data support for this phenomenon. Analysts Joseph Lupton and Maia G Crook noted in a report that the current market exhibits a "strange decoupling"—a general deterioration in the labor market occurring simultaneously with strong growth in household wealth. This decoupling is common in developed markets, but it is particularly pronounced in the United States.

JPMorgan Chase believes that the "wealth effect" driven by rising stock prices is acting as a bridge, temporarily compensating for the shortfall caused by slowing labor income growth. However, analysts also emphasize that this resilience in consumption driven by asset prices is unlikely to be sustainable in the long term. They warn that once the wealth effect weakens, the stock market could quickly transform from a "buffer" for the economy into an "amplifier" that exacerbates downward pressure.

After losing $300 billion in market capitalization, has Bitcoin not yet bottomed out? Multiple bearish signals are still flashing!

Bitcoin is poised for its worst week since early March. And there are currently no signs that investors are ready to buy the dip, with the crash resulting in a loss of approximately $300 billion in the digital asset market. Bitcoin has fallen 6.2% so far this week. During this period, its price dipped below the $100,000 mark for the first time since June. Strategists point to a series of warning signs for Bitcoin and the market as a whole.

This signifies a complete reversal in market sentiment since early October, when Bitcoin surged to all-time highs fueled by a frenzy of leveraged trading. However, the subsequent sudden liquidation of $19 billion worth of leveraged cryptocurrency positions has yet to restore market confidence.

Michael Novogratz's Galaxy Digital on Wednesday lowered its year-to-date Bitcoin price forecast to $120,000 from $185,000, citing "significantly reduced leverage." Furthermore, several bearish signals currently exist in the cryptocurrency market.

Two major "bubble indicators" are converging, and the US stock market is hitting the most acute warning of the "Buffett Indicator"!

Since its April lows, the U.S. stock market has surged, accumulating a 36% gain, arrogantly ignoring all risk warnings. Now, it's directly colliding with the valuation metric most valued by Warren Buffett.

This tool, known as the "Buffett Indicator," despite its flaws, is a key measure for measuring stock market bubbles. Currently, it has surpassed the pandemic-era high set before the 2022 bear market. By comparing the total market capitalization of the US stock market (approximately $72 trillion) with the US Gross Domestic Product (GDP), it visually demonstrates that the US stock market is now more than twice the size of the economy —even though US GDP recorded its fastest growth in nearly two years.

Barclays Stefano Pascale, a member of the derivatives strategist team, stated bluntly in a report: " The current ratio clearly points to overvaluation of stocks, confirming market concerns about 'bubble behavior.' " They emphasized that even with the limitations of the metric, it is wise for investors to view this record "market capitalization/GDP" ratio as the latest warning sign of extreme market frenzy.

US Stocks Focus

With the vote on Musk's compensation package imminent, Tesla is entering a high-risk phase.

Tesla will hold its annual shareholder meeting on November 6th (Eastern Time). At that time, shareholders will vote on a difficult choice proposed by the board: either support a compensation package of up to $1 trillion for Musk, or accept the risk of his potential departure—which could cause the company's stock price to plummet.

It's worth noting that Musk held a potentially decisive tool in Thursday's vote—his own 15% stake. Additionally, approximately 40% of the shares were held by retail investors who have consistently remained loyal to him, while the remaining 45% were held by Vanguard Group and BlackRock. Hutchison Whampoa Institutional investors, such as banks , hold the shares. This percentage should be sufficient for the compensation plan to be approved at the shareholders' meeting.

AI-driven upgrade cycle drives demand for high-end smartphones, Qualcomm Delivered better-than-expected results

In its fourth fiscal quarter ending September 28, Qualcomm reported sales of $11.27 billion, exceeding market expectations of $10.79 billion; adjusted earnings per share were $3, exceeding market expectations of $2.88.

Meanwhile, Qualcomm projects first-quarter sales and adjusted earnings per share of $12.2 billion and $3.40, respectively, exceeding market expectations of $11.62 billion and $3.31. Qualcomm CEO Cristiano Amon stated that the current positive performance is primarily driven by the surge in consumers upgrading from mid-range smartphones to high-end devices to run AI applications.

The market is clearly diverging between basic, low-end models and high-profit, high-end models, the latter having historically been Qualcomm's main source of profit. As of press time, Qualcomm's stock was down more than 2% in pre-market trading on Thursday.

Google Cloud's high growth has only just begun! Morgan Stanley: Conservative estimates suggest growth could exceed 50% next year.

Morgan Stanley believes that by breaking down Google Cloud’s revenue structure, even under relatively conservative assumptions, Google Cloud’s revenue growth rate in 2026 is very likely to exceed 50%, a prediction that is about 15% higher than the market’s general expectation.

In a report dated November 5, Morgan Stanley stated that the general market consensus may have significantly underestimated the growth potential of Google Cloud.

By analyzing Google Cloud's revenue structure—specifically, the synergistic growth of its "Backlog" and "On-demand" businesses—Morgan Stanley believes that even under relatively conservative assumptions, Google Cloud's revenue growth rate in 2026 is highly likely to exceed 50%. Continued outperformance of the cloud business will be a key catalyst driving the company's valuation multiple expansion and its AI-driven stock price outperforming the market.

Wall Street sharply raises its forecast for flash memory giant SanDisk. Regarding the target price, Bank of America stated that "during a storage supercycle, the price-to-book ratio should be at least 3-4 times."

AI Data Center Demand is driving a revaluation of the memory industry, with several Wall Street investment banks significantly raising their target prices for flash memory giant SanDisk .

Bank of America Merrill Lynch's latest research report significantly raised its target price from $125 to $230 and maintained its buy rating. Bank of America analysts believe that in the AI-driven storage supercycle, the NAND supplier's price-to-book ratio should be revalued to 3-4 times.

Bank of America Merrill Lynch raised its fiscal 2026 EPS forecast for SanDisk from $6.93 to $8.00 (a 15.4% increase), and its revenue forecast from $8.91 billion to $9.17 billion (a 2.9% increase). The bank expects SanDisk's revenue to grow at a CAGR of 16% from fiscal 2025 to 2028, with EPS increasing more than fivefold during the same period. Analysts point out that the rapid growth in data center demand is significantly driving up NAND flash memory pricing, while the high gross margins of enterprise-grade SSDs (solid-state drives) will be the main profit driver. SanDisk's stock price has surged more than 500% in the past three months, making it one of the 12 best-performing stocks in the US market during that period.

(Article source: Hafu Securities) )