Grid equipment on Friday (December 12) Concept stocks surged, with Zhongneng Electric among them. Optical cables China XD Electric Co., Ltd. hit the 20% daily limit. Hualing Cable Many stocks hit their daily limit.

Nvidia A "Power Shortage Conference" will be held.

According to Jiemian News, Nvidia plans to hold a closed-door summit next week at its headquarters in Santa Clara, California. The core topic of the meeting will be discussing and addressing potential obstacles to artificial intelligence. The development of " data center" The problem of "electricity shortage".

This summit will bring together executives from startups focused on the power and electrical engineering sector. Notably, attendees include several companies that have already received equity investment from Nvidia .

Analysts believe this is a strong signal that energy shortages are genuinely impacting companies that use Nvidia chips to build AI infrastructure. These companies' data centers are filled with Nvidia's power-hungry AI server chips, and power supply constraints could "hinder the development of artificial intelligence ."

AIDC energy storage Market: Expected upside potential of 20 times in 5 years

Recently, GGII (Gaogong Industry Research Institute) released the "2025 China AIDC Energy Storage Industry Development Blue Book," which analyzed that the global AIDC energy storage market is experiencing explosive growth, and it is expected that by 2030, AIDC energy storage lithium batteries will... Shipments will exceed 300 GWh, which is 20 times the 15 GWh expected in 2025.

The energy solutions sector related to AIDC continues to attract increasing attention. From an industry trend perspective, grid upgrades and the wave of overseas expansion provide long-term support. Global energy transition and the growth of AI computing power are driving grid systems towards greater intelligence and resilience. Domestic ultra-high voltage (UHV) power transmission... As the construction of the main power grid continues to advance, overseas markets, especially in Europe and the United States, are experiencing a wave of upgrades and procurement of power equipment such as transformers to address shortcomings in power grid infrastructure and accommodate more renewable energy. This presents a historic opportunity for leading domestic power equipment companies with technological advantages and overseas expansion capabilities, and the entire industry chain is expected to continue to benefit.

At the same time, due to limitations in power plant construction cycles and grid transmission capacity, the US power sector... Shortage for SOFC (Solid Oxide Fuel Cell) This development brings new opportunities. According to McKinsey and Bloom Energy forecasts, the US will need approximately 55GW of new data center capacity between 2025 and 2030, but traditional power grid construction cannot keep pace. In contrast, a 50MW SOFC power system can be delivered in as little as 90 days, far shorter than gas-fired power systems. With a cycle of over 3 years, the engine directly addresses the pain point of "rapid deployment" in data centers.

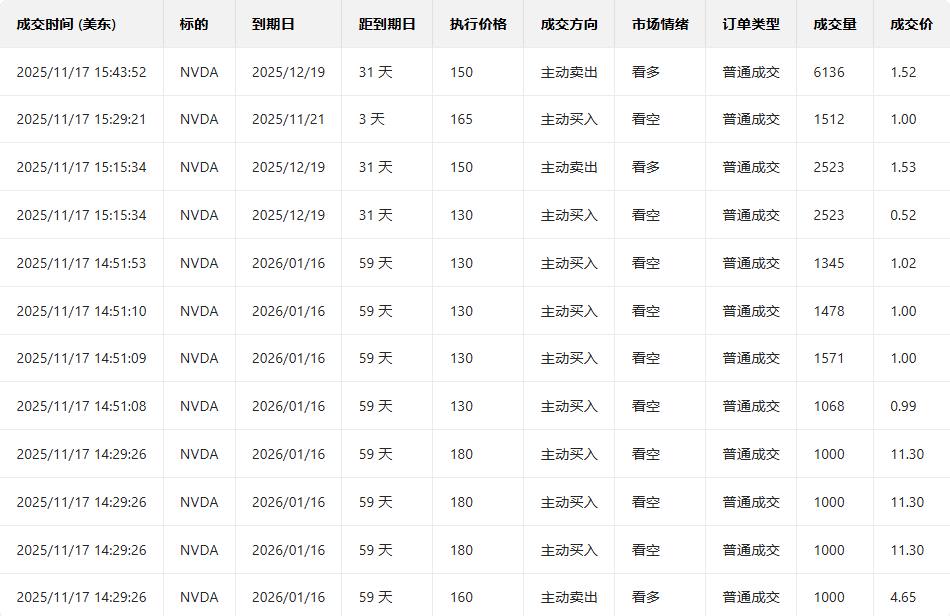

Major funds: These stocks have been snapped up since November

Eastmoney According to Choice data, since November this year, major funds have been net buyers of several power equipment concept stocks, including Taiyong Changzheng. The company ranked first with a net purchase of 440 million yuan by major investors; Hualing Cable ranked second with a net purchase of over 400 million yuan by major investors.

Chinese Super League Holdings Sifang Co. , Ltd. Luokai Co. , Ltd. Tongguang Cable , Caneng Power Fengfan Co. , Ltd. The net purchase amount of individual stocks by major investors ranged from 380 million yuan to 100 million yuan.

Hanlan Cable Xineng Taishan Golden Dragon Feather Shunna Shares Hangzhou Kelin Sun Cable Beijing Career Hangzhou Electric Power Co. , Ltd. The net purchase amount by major investors for individual stocks ranged from 99 million yuan to 47 million yuan.

Institutions: Demand for power equipment may remain high.

According to various institutions, with AI driving up US electricity demand, there is a need for power system upgrades and expansions, and demand for related power equipment is expected to remain high, potentially accelerating the industry's development.

Tianfeng Securities According to IEA data, global electricity demand is projected to grow at a high average annual rate in 2025-2026, primarily driven by industrial demand, air conditioning, data centers, and electrification. Strong demand for overseas power grid construction, particularly in the US and Europe, is fueling a supply-demand mismatch in transformers, leading to continued price increases. From January to August 2025, China's transformer exports increased by 51.42% year-on-year, demonstrating robust overseas market demand. Furthermore, the increasing trend of cross-border power grid interconnection presents new opportunities for Chinese power equipment companies to expand into international markets.

Huaxi Securities It is pointed out that with the development of new energy... Large-scale grid integration will significantly increase the demand for supporting power grid construction, while also raising the requirements for grid coordination and operation capabilities. It is expected that there will be ample room for investment in the distribution network side, and leading suppliers of integrated primary and secondary distribution equipment will continue to benefit. Meanwhile, with AI driving US electricity demand, there is a need for power system upgrades and expansions, and the demand for related power equipment is also expected to remain high, potentially accelerating the industry's development.

Hualong Securities Looking ahead to 2026, the new energy industry is expected to continue its positive trend. The National Energy Administration has set the tone for increasing the development of offshore wind power during the 15th Five-Year Plan period, and the spillover of high-value overseas orders is expected to open up export space for China's wind power. High growth in overseas demand coupled with the growth in domestic power grid investment is expected to drive a surge in power equipment production, and the power grid equipment sector is expected to maintain high prosperity.

(Article source: Eastmoney Research Center)