I. Overview of US Stock Index Options

Trading volume in the US stock index options market has declined slightly, while the put/call ratio has increased, indicating that bullish forces have somewhat withdrawn.

The volume distribution of S&P 500 index options expiring today shows a divergence between call and put order distributions, with put orders peaking at 6700 points and call orders peaking at 6800 points.

Nasdaq contracts expiring today 100 Index Options Trading Volume Distribution: Call single peak at 26,000, Put single peak at 25,400.

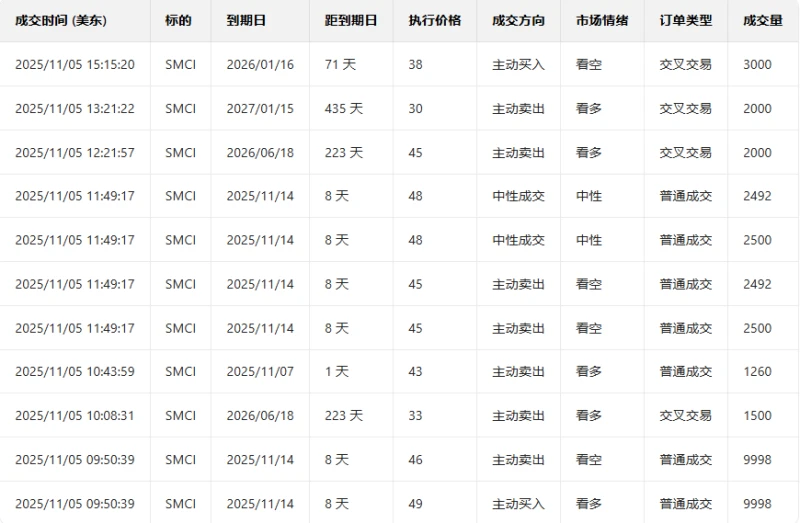

II. US Stock Options Trading Volume Ranking

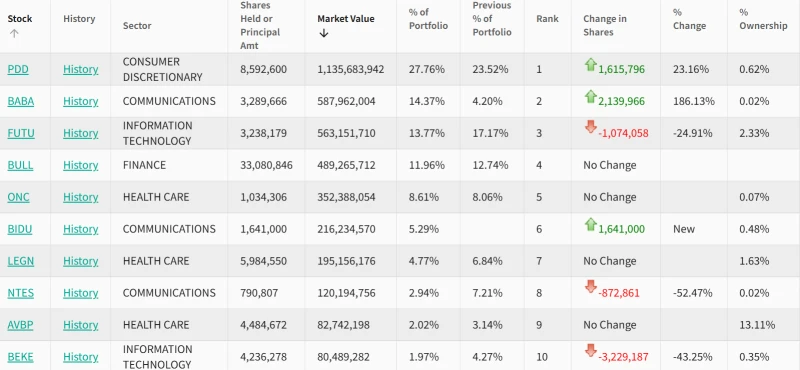

1. Rivian Automotive rose 23.36% in the previous trading day. The put/call ratio declined slightly the day before, while trading volume increased significantly.

Looking at the call orders expiring this Friday, the highest increase was over 7 times.

Just before the market closed, options bulls were riding high.

In terms of news, Rivian reported a 78% year-over-year revenue increase to $1.56 billion, exceeding market expectations of $1.5 billion. Deliveries grew 32% to 13,200 vehicles, and gross profit turned positive to $24 million, a significant milestone for the previously loss-making startup. Although the company's loss per share was still higher than expected, investors chose to ignore this and focus instead on operational progress and the reaffirmed 2025 delivery forecast.

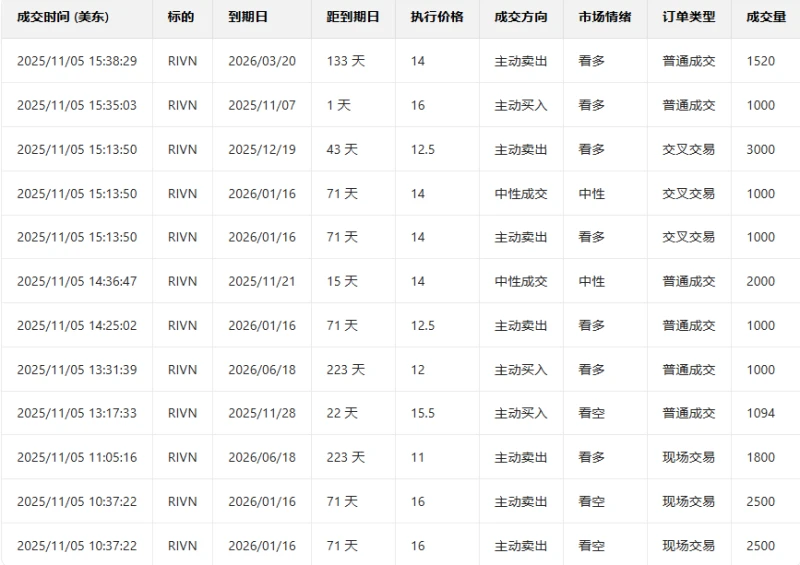

2. Microcomputer The stock fell 11.33% in the previous trading day. The put/call ratio declined the day before, while trading volume increased, indicating that some bulls were exiting the market.

Looking at the call orders expiring this Friday, many have seen their prices more than double.

In the lead-up to the market close, the battle between long and short positions in options trading was intense.

Top 10 US Stock Options Trading Volume Ranking

Top 10 US Stocks by Implied Volatility (Underlying Asset Market Cap > $10 Billion, Options Trading Volume > $100,000)

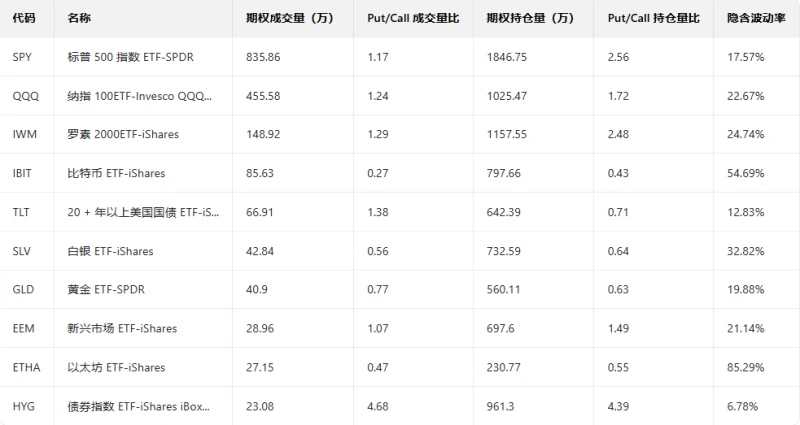

III. Top Ten US Stock ETF Options Trading Volume Ranking

Top 10 US Stock ETFs by Implied Volatility (Based on: Market Cap > $10 billion)

(Article source: Hafu Securities) )