On November 15th, Beijing time, HHLR Advisors, a fund management platform under Hillhouse Capital that focuses on secondary market investment, released its US stock holdings report as of the end of the third quarter of 2025.

Data shows that at the end of the third quarter, HHLR Advisors held a total of 33 stocks with a total market value of $4.1 billion, an increase of $990 million (nearly 7 billion yuan) from the second quarter, representing a growth rate of 32%.

HHLR Advisors' holdings of Chinese concept stocks account for over 90% of its portfolio, continuing to be a core holding, highlighting its long-term optimism about high-quality Chinese assets.

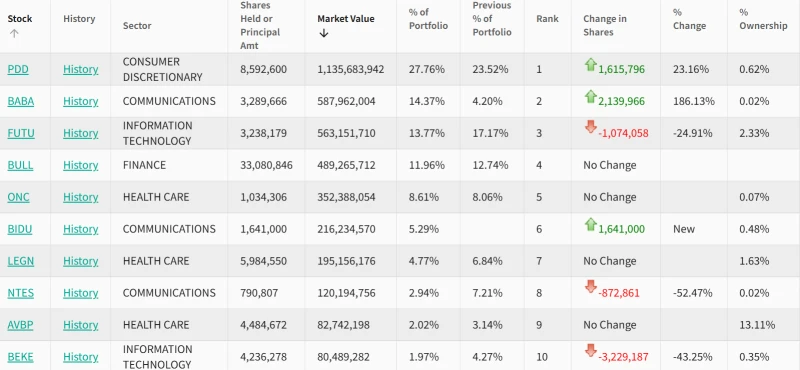

Hillhouse Capital's Top 10 Holdings

Pinduoduo was among HHLR Advisors' top ten holdings in the third quarter. It remains the largest holding, with its share price rising 39% year-to-date. Other major holdings of HHLR Advisors have also performed exceptionally well this year, with Futu's share price rising by 125% and BeiGene's... Reaching 99%, Alibaba It also reached 92%.

It is worth noting that Baidu in the third quarter Baidu appeared on HHLR Advisors' new addition list and jumped to become their sixth largest holding. Fueled by the accelerated commercialization of its AI strategy and breakthroughs in its self-developed chips, Baidu's stock price rose by 54% in the third quarter.

In terms of portfolio changes, HHLR Advisors increased its holdings in Alibaba and Pinduoduo in the third quarter, with these two companies seeing share price increases of 58% and 27%, respectively. HHLR Advisors also increased its holdings in Futu and Yatsen Global , which have seen significant gains this year. NetEase They reduced their holdings to lock in profits in a timely manner.

It should be noted that Form 13-F only requires funds to disclose their long positions in U.S. stocks, so it cannot fully reflect the overall picture of the fund's operations.

(Article source: CLS)