Remarks by OpenAI's CFO have heightened investor concerns about massive AI projects. Following concerns about expenses, the company's CEO, Altman, posted an urgent message before the US stock market closed on Thursday to "put out the fire," emphasizing that the company would not seek government funding for its data centers. They provided guarantees and tried to convince the market that the company had "strong" revenue-generating capabilities .

Altman said on Thursday that the AI startup is expected to generate over $20 billion in annualized revenue this year and plans to increase sales to hundreds of billions of dollars by 2030 .

In recent months, OpenAI has signed infrastructure deals worth over $1.4 trillion to build data centers to meet growing demand. This staggering figure has raised questions among investors and industry insiders: Where will OpenAI raise this money?

“We are working to build the infrastructure for an AI- driven future economy, and given all the prospects we see in our research projects, now is the time to ramp up our investments and really scale up the technology,” Altman wrote in a post on X. “Large infrastructure projects take a considerable amount of time to build, so we must start now.”

OpenAI was founded in 2015 as a non-profit research lab and launched its chatbot in 2022. Following ChatGPT, it has become one of the world's fastest-growing business entities. The startup is currently valued at $500 billion, although it has not yet achieved profitability.

In September of this year, OpenAI CFO Sarah Friar stated that OpenAI's revenue is expected to reach $13 billion this year.

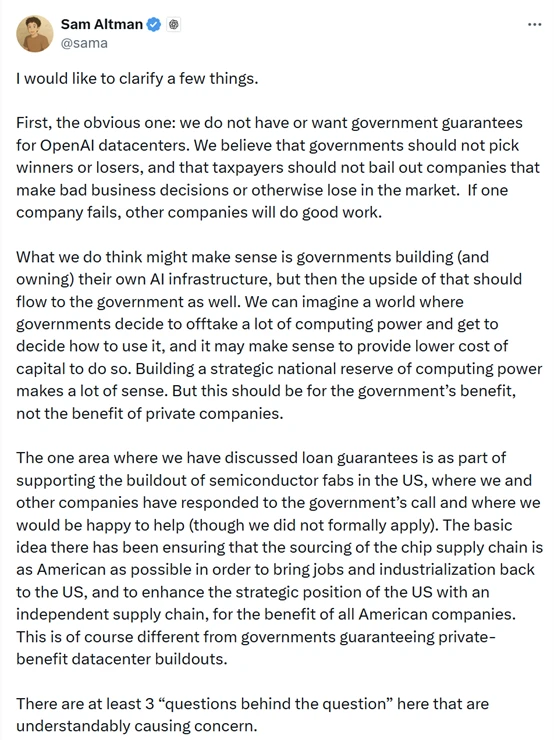

Friar's comments at an event this Wednesday regarding seeking government guarantees for AI investments have sparked controversy and concern. During the event, she stated that OpenAI is seeking to build a system backed by banks... An ecosystem comprised of private equity funds and federal government "backing" or "guarantees" helps companies finance their massive chip investments .

Later Wednesday, she clarified her remarks in a LinkedIn post, stating that OpenAI has not sought government backstops for its infrastructure commitments. She explained that using the word "backstop" was misleading. Her point was that America's technological strength will come from building genuine industrial capacity, which requires both the private sector and the government to fulfill their respective responsibilities.

Altman said on Thursday that OpenAI "has not and does not want the government to guarantee its data centers ." He stated that taxpayers should not bail out companies that make bad decisions, adding, "If we make a mistake, the responsibility lies with us."

“This is the bet we are taking, and from our perspective, we are very confident about it,” Altman wrote. “But of course, we could also make a mistake, and if that happens, it will be the market—not the government—that will solve it.”

He further explained that the company's CFO meant that the US government should establish a "national strategic computing power reserve," sign numerous computing power procurement agreements, and that this should serve the public interest, rather than help a private company profit.

Clearly, Altman's clarification failed to quell market concerns. Influenced by the OpenAI CFO's comments and signs of a deteriorating US job market, US tech stocks fell across the board on Thursday, with the Nasdaq dropping nearly 2%.

(Article source: CLS)