With the ongoing US government shutdown causing a continuous "disruption" in official economic data, investors have recently turned to job postings from the private sector in an attempt to glean insights into the state of the US labor market.

On Thursday, investors finally found some indicators to refer to—but most were clearly uneasy about the data they saw.

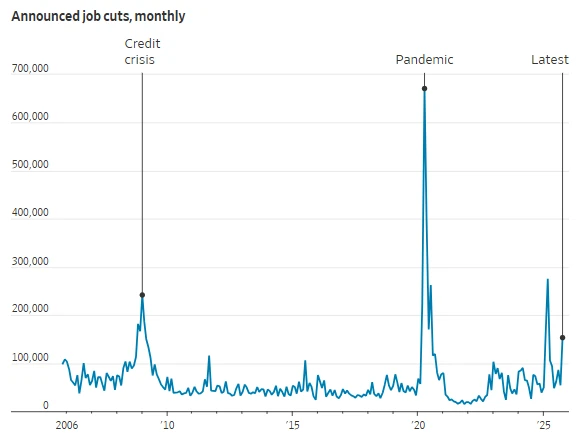

A recent report from Challenger, Gray & Christmas, a company that focuses on publishing monthly hiring and layoff updates, shows that U.S. employers announced 153,074 layoffs in October, a surge of 175% year-over-year and a 183% increase compared to September. This is the highest number of layoffs in October since 2003.

The consulting firm says this means that U.S. employers have announced a total of 1.0995 million layoffs this year, a 65% increase from the first 10 months of last year. Challenger says this is the highest number of layoffs announced in the same period since 2020, when the number of layoffs caused by the COVID-19 pandemic was almost double that now.

Some on Wall Street attributed Thursday's renewed sell-off in U.S. stocks to the data, which also fueled a rebound in the bond market, causing the 10-year U.S. Treasury yield to fall back to around 4%—bond yields move inversely to prices, with yields falling when prices rise.

According to FactSet data, this sell-off caused the S&P 500 to fall more than 1% in Thursday's trading. Following Tuesday's worst single-day performance in nearly a month, the latest decline puts the index on track for its worst weekly performance since October 10. Currently, the index is about 2.9% below its all-time closing high reached in late October.

Implications of employment data for overvalued stock markets

Many analysts say that the significant divergence between technology stocks and other sectors has been a major focus of market attention during this three-year bull market.

Some argue that if these concentrated bets begin to falter, as they did during the tariff turmoil in April, investors chasing this small group of soaring tech stocks could suffer heavy losses.

Meanwhile, another view supporting the market is that as long as American families have jobs, the rally can easily continue.

But just as investors missed the official nonfarm payroll data from the Labor Department for the second consecutive month, Thursday's Challenger, Gray & Christmas data undoubtedly added another item to a recent string of disappointing labor market figures. This also appears to have exacerbated market concerns about overvalued stocks, speculative bubbles, and artificial intelligence. Long-term concerns about the sustainability of the sector.

M&T Bank According to Luke Tilley, chief economist at Wilmington Trust, both the Challenger report and the October ADP data released earlier this week show an increasing trend of corporate layoffs—since April, companies with fewer than 50 employees have laid off more than 130,000 people.

“Small businesses are laying off workers in large numbers since the tariffs were implemented, ” Tilley pointed out. Although small businesses provide about one-third of all jobs in the U.S., these layoffs have often gone unnoticed—unlike large publicly traded companies. “And the current economic outlook is fraught with uncertainty, which will lead to increased market volatility,” Tilley said.

Comparison of hiring and layoffs

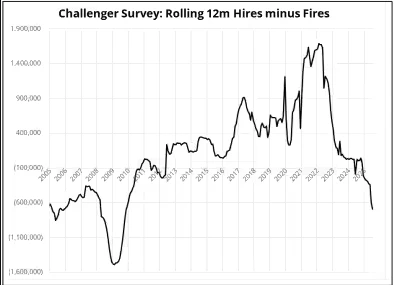

In addition to the layoff data released on Thursday, the Challenger report also included hiring data. Spectra Markets analyst Brent Donnelly created charts using data analysis to compare the number of new hires with the number of layoffs over the past 12-month rolling period. In his commentary published on Thursday, he noted that the gap between unemployment and new hiring has reached its highest level in approximately 15 years.

“If you believe in the ‘jobs doomsday’ theory, this chart is a prophecy of an impending flood,” Donnelly stated in the report.

Of course, the Challenger data also has its flaws. Donnelly points out that the data is not seasonally adjusted and is far more volatile than the official nonfarm payroll report released by the Labor Department. "I trust the nonfarm payroll data more—but the problem now is that we don't have that official data," he added.

Andy Challenger, chief revenue officer at Challenger, Gray & Christmas, pointed out that the accelerated layoffs in October may be due to a combination of factors: some industries began to downsize after the pandemic hiring boom, when many companies had previously scrambled to stockpile labor.

However, the widespread adoption of AI applications, weak consumer and corporate spending, and austerity measures triggered by rising costs may also have contributed to the situation. A Challenger report shows that the technology, retail, and service sectors remain the most concentrated areas for layoffs. Among them, the technology industry announced 33,300 layoffs in October, almost six times the number in September, making it the sector most affected by AI integration and automation.

“It is becoming more difficult for laid-off employees to find new jobs quickly, which could further exacerbate the loosening of the labor market,” Challenger noted in a press release that published the latest data on Thursday morning.

Employment data from other private sectors also confirms the increasingly severe labor market situation. A Revelio Labs employment report showed a loss of 9,000 jobs in October, with the company citing "job losses in the government sector as the main driver," but also noting layoffs in sectors such as retail and manufacturing.

Wednesday's ADP private sector employment data also drew industry attention. The data showed 42,000 new jobs were added last month, exceeding economists' expectations. However, as Tilley of M&T Bank pointed out, signs of weakness still emerge beneath the surface of the data.

“Whether it’s due to fundamentally weak final demand and rising costs from tariffs, or the increasing prevalence of new technologies like AI, businesses and business leaders seem to think that they no longer need as many employees,” noted Gregory Daco, chief economist at EY-Parthenon. “I think that’s the reality for the future.”

(Article source: CLS)